- Berkshire Hathaway has fully exited its stake in Chinese EV-maker BYD, ending a 17-year investment that began in 2008. The sale, part of a broader portfolio reduction, comes after BYD’s profits slowed and Mexico’s recent tariff hike on Chinese vehicles.

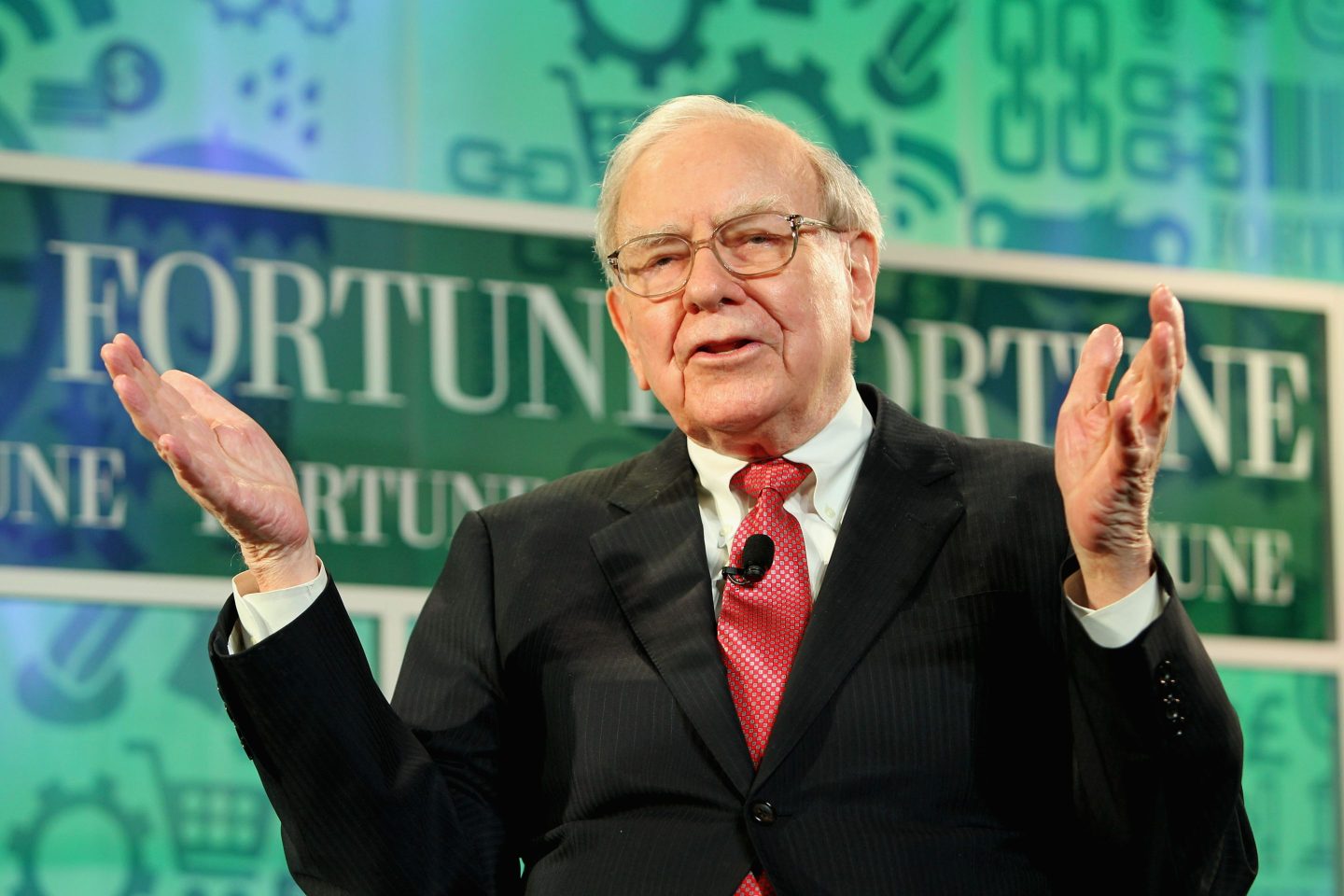

For the majority of the past two decades, Chinese EV-maker BYD has been able to hang its hat on the fact that famed investor Warren Buffett held a stake in its business. That’s no longer the case, according to a recent filing from Berkshire Hathaway.

Berkshire’s stake in the Tesla rival dates back to 2008, when it wrote in its annual report it owned a 10% stake in an “amazing Chinese company” named BYD, which was building the vehicle of “the future … a new plug-in electric car.”

But according to a 10-Q form for Berkshire’s energy arm filed for the period ending June 30, 2025, the Buffett-led company has reduced its stake to zero.

The filing, seen by Fortune, reads that in December 2024, Berkshire held a stake in BYD worth $415m. Beside it, as of June 30, that stake had been reduced to zero.

The BYD sale comes as part of a reduction in the energy giant’s investment portfolio as a whole, which has reduced to $950m from $1.3 billion six months prior. That being said, there was one area where Buffett and his team are buying: Treasury bills. Holdings of this asset increased from nothing to $39 million during the window from December to June.

BYD’s share price slipped on the news. The company’s Hong Kong dollar-denominated shares (more liquid than their Chinese yuan counterparts) were down 3.35% in trading today, sitting at 109 HKD compared to their 2025 peak of 155 HKD, which it hit back in May per Bloomberg.

The backing from one of America’s most famed investors had been a feather in the cap of BYD, even more so because Berkshire has thus far resisted in investing in its main rival, Elon Musk’s Tesla.

Despite that investment now being walked back, Li Yunfei, a general manager at BYD, praised Buffett and his company. Writing on Chinese social media site Weibo, Li wrote: “In August 2022, Berkshire began to reduce its holdings of the company shares it bought in 2008, and its shareholding was below 5% in June last year.”

“Stock investment, if you buy, you can sell, which is a normal thing! Thanks to Munger and Buffett for their recognition of BYD! Thank you for your investment, help and companionship in the past 17 years! Like all long-termism!”

BYD did not respond to Fortune’s request for comment, but directed other media outlets to the statement from Li.

Why sell?

As Li points out, both buying and selling is a standard practice in stock investment. One reason for Berkshire selling could simply be that the company feels BYD’s share price has hit its ceiling. After all, when Berkshire invested back in 2008 the price of was between 3 and 8 HKD per CNBC records.

Therefore Berkshire has already seen a massive return on its initial investment, especially having sold in the early half of 2025 when stock prices were relatively elevated.

But the 10-Q did also shed some light on Berkshire’s potential motivation. It reads: “BHE [Berkshire Hathaway Energy] and Other’s earnings decreased $317 million for the second quarter and $65 million for the first six months of 2025 compared to 2024.

“The changes included an unfavorable comparative change of $257 million in the second quarter and $62 million for the first six months of 2025 and lower net interest and dividend income of $44 million for the second quarter and $58 million for the first six months of 2025, each related to the Company’s investment in BYD Company Limited, lower federal income tax credits … and unfavorable consolidated income tax adjustments, partially offset by lower interest expense and higher federal income tax credits recognized on a consolidated basis for the first six months of 2025.”

Profits at BYD are also shrinking. In its half-year results for 2025, the company reported net profits attributable to shareholders of its parent company of 15.5 billion yuan, having previously reported Q1 net profits attributable to shareholders of 9.15 billion. The discrepancy between the two is some 6.35 billion yuan for the second quarter—approximately 30% down from a year prior, per data from LSEG.

In its half-year report, BYD wrote it was operating in an “intense market game [of] increased price competition, and frequent occurrence of excessive marketing, which had exerted an adverse periodic impact on the development of the industry.”

This high-stakes game is a dynamic Buffett is well aware of. At Berkshire Hathaway’s 2023 annual conference, Buffett said: “Charlie [Munger] and I for long have felt that the auto industry is just too tough … It’s just a business where you’ve got a lot of worldwide competitors, they’re not going to go away. And it looks like there are winners at any given time, but it doesn’t get you a permanent place.”

On top of the shifting profit picture, BYD is also navigating its new tariff-era environment. Bizarrely, Trump’s trade policy agenda has actually given BYD an edge because it doesn’t sell passenger vehicles in the U.S., unlike some of its other E.V. competitors reliant on the American market.

But it does sell a range of vehicles in Mexico, which had been a region earmarked for significant growth. However, earlier this month the country announced a plan to increase tariffs on Chinese cars by 50%, a move which some analysts saw as “placating” Mexico’s neighbors to the north—and potentially closing a loophole in President Trump’s rumbling trade war with China.

Beijing addressed the issue head on, saying earlier this month: “China advocates a universally-beneficial and inclusive economic globalization, opposes all forms of unilateralism, protectionism and discriminatory and exclusive measures, and firmly rejects moves that are taken under coercion to constrain China or undermine China’s legitimate rights and interests under any pretext.”

Foreign ministry spokesperson Lin Jian added in the briefing: “China attaches great importance to its relations with Mexico and hopes that Mexico will work with China to jointly advance world economic recovery and the development of global trade.”