Honeywell says that 20% of the company’s software code is written by GitHub Copilot and other AI-assistant coding tools. But, does that mean that the industrial giant’s embrace of AI has corresponded with a 20% reduction in that team’s workforce?

No, according to Suresh Venkatarayalu, the chief technology officer and president of the company’s software-focused division, Honeywell Connected Enterprise. “What has changed is the type of developer skill sets,” said Venkatarayalu at the Fortune Brainstorm Tech conference held last week in Park City, Utah.

With less time needed to write code, Honeywell’s software developers can perform more complex work, including spending more time in the field with customers to solve their system integration needs.

For decades, the industrial sector has been embracing automation technologies that have made it easier to move goods across the factory floor, perform quality control inspections, and monitor machinery to predict when a fix may be in order before any breakdowns occur. Workers have also gotten more access to AI-enabled tools, helping recommend when supplies need reordering, predict demand from customers, and help handle repetitive back-office tasks.

AI represents yet another new way to rethink manufacturing automation. Many are still early in their adoption journey, with only 29% using AI or machine learning at the factory or network level, and just one out of four having deployed generative AI at that scale, according to a survey of 600 executives from large manufacturing companies by consultancy Deloitte.

Jaime Mineart, SVP and CTO of construction and mining equipment manufacturer Caterpillar, joined Venkatarayalu during the panel discussion and shared leaders need to change how their workers engage with technology. That might include classes in prompt engineering, so they know how to get the most out of large language models, specialized training in how to work alongside robots, or lessons on how to glean insights from the data streaming from a more connected manufacturing ecosystem.

“It’s huge change management,” Mineart said. The biggest challenges that they will need to solve will be related to both labor capability and labor availability, she added.

Venkatarayalu sees things slightly differently. In the U.S. and other developed markets, he believes that there is a labor shortage. But in higher growth regions, the problem is more focused on the skills gap.

“The only way to offset the labor shortage and a skills shortage is to augment with something, and that something is AI,” said Venkatarayalu.

A survey conducted by the National Association of Manufacturers last year found that nearly 60% of manufacturers report that their inability to attract and retain employees is their top challenge. A separate study by Deloitte and The Manufacturing Institute last year showed that 1.9 million U.S. manufacturing jobs could go unfilled over a decade if the talent woes aren’t addressed.

Meanwhile, the median tenure of a manufacturing worker has slipped from 5.9 years in 2014 to 4.9 years in 2024, according to the Bureau of Labor Statistics.

Mineart said automation and AI can help move workers away from less safe, duller, and more repetitive tasks. “Those are jobs that robots, robotics, and technology can really do very, very well, alongside that human capability and that human creativity to get more productivity and safer work sites,” she said.

Caterpillar and Honeywell share some similarities in that they are both over a century old and are on the Fortune 500 (Caterpillar at 64, Honeywell at 119). But their AI journeys are evolving in different ways.

Honeywell, which is in the process of splitting itself into three different companies, has launched new generative AI features for customers including an AI assistant to automate tasks for operators and production workers and has inked partnerships with Google, Chevron, and Qualcomm to collaborate more on AI innovation.

Caterpillar’s revenue is getting a boost from the data center boom that’s leading to stronger sales of the company’s generators. It has also pledged $100 million over the next five years to upskill workers on evolving technologies, including AI.

“When you think about bringing manufacturing back into the United States, we have to reimagine how we are going to do that,” said Mineart.

John Kell

Send thoughts or suggestions to CIO Intelligence here.

NEWS PACKETS

Momentum continues to build for quantum. While the most promising advancements for quantum computing look to be at least a few years away, excitement for the developing field is accelerating as seen by a Wall Street Journal report last week that quantum computing startup PsiQuantum raised $1 billion from investors including BlackRock and Nvidia’s venture-capital arm to bring the company’s total valuation to $7 billion. There’s been quite a bit of funding action in the space in recent weeks, with Honeywell’s quantum computing company, Quantinuum, and Europe’s IQM Quantum Computers both disclosing funding rounds earlier this month. WSJ also separately reported on IBM’s efforts to lead in the space, which includes a partnership with chip maker AMD to develop “quantum-centric supercomputers.”

Automation is more popular than augmentation for Anthropic’s Claude. Anthropic, the AI startup whose CEO warned that the technology could wipe out 50% of entry-level white-collar jobs in five years, published a broad report this week that found that 77% of enterprises’ usage of Claude AI software was focused on automation, with just 12% for augmentation (which includes improved collaboration and learning). Peter McCrory, head of economics at Anthropic, told Bloomberg that it wasn’t clear whether the increase in automation was due to “new model capabilities that are expanding the set of things that get automated, or if it’s people being more comfortable with large language models and becoming more willing to delegate certain tasks to Claude.”

As OpenAI spends big, questions begin to swirl on the startup’s monetization strategy. Wall Street cheered the news of Oracle’s $300 billion cloud deal last week, an OpenAI halo that’s also lifting the valuations of key investor Microsoft, AI chip maker Nvidia, and Broadcom, the latter seeing a stock pop after it was reported that OpenAI placed a $10 billion order for its custom AI chips. The thesis of all this investment is that enterprises and individual customers will spend on AI at exponentially higher rates than they are today, to justify the hundreds of billions of dollars that OpenAI is putting into AI infrastructure. That’s not necessarily a guarantee, with studies and surveys beginning to call into question the success of generative AI pilots and very few paying individual customers. While nearly two billion individuals use AI, only 3% of them are paying for premium services, which includes ChatGPT, according to a study by Menlo Ventures.

ADOPTION CURVE

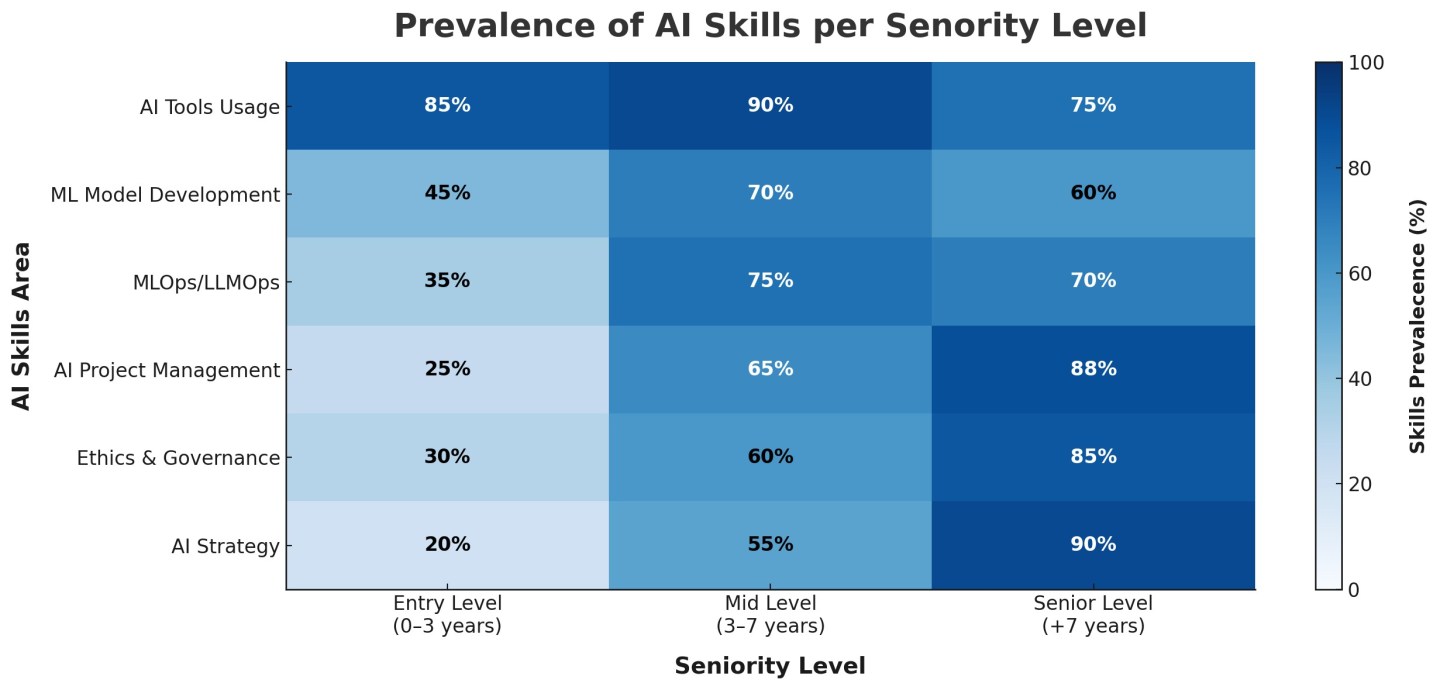

AI skills are becoming a job requirement A report on the Group of 7 nations found that 78% of all tech roles now include at least some AI skills and that seven of the 10 fastest-growing tech roles are related to AI. The highest in-demand roles that saw the largest year-over-over growth are AI risk and governance specialist (234%), NLP engineer (186%), AL/ML engineer (145%), AI business consultant (134%), and AI infrastructure engineer (124%), according to a study published by the AI Workforce Consortium, a group of ten large employers that includes Google, Intel, Cisco, Microsoft, and SAP.

Beyond merely hiring new talent for those roles, AI Workforce Consortium is also advocating for more upskilling, saying that tech skills like prompt engineering, conversational AI, and generative AI require “immediate” intervention to cater to the job market demand.

“I think there has been a gap, for quite some time, between higher education and corporations,” Fran Katsoudas, Cisco's chief people, policy and purpose officer, tells Fortune. Those gaps were initially focused on soft skills, including learning how to collaborate on a project or respectfully disagree. Now, corporations will need to take that same college-to-work skills gap playbook and apply it to AI.

“Part of the challenge is when companies think about training or education, we make it very individualized,” adds Katsoudas. “Enterprise education has to be more team- and roll-based.”

JOBS RADAR

Hiring:

- Jefferson Center for Mental Health is seeking a CIO, based in Wheat Ridge, Colorado. Posted salary range: $184.1K-$222.5K/year.

- Jeffer Mangels Butler & Mitchell is seeking a CTO, based in Los Angeles. Posted salary range: $280K-$320K/year.

- DriveWealth is seeking a chief information security officer, based in New York City. Posted salary range: $300K-$400K/year.

- Managed Health Care Associates is seeking a SVP of technology, based in Parsippany, New Jersey. Posted salary range: $211.3K-$316.9K/year.

Hired:

- State Farm Mutual Automotive Insurance appointed Joe Park as EVP and chief digital and information officer. He will officially join the auto and home insurance company in October after most recently serving as chief digital and technology officer at KFC and Taco Bell restaurant operator Yum Brands. Park will oversee tech, data, and innovation at State Farm, which includes several thousand associates.

- Mural named Omar Ayub as its new CTO, joining the digital collaboration software provider to accelerate its AI vision. Ayub has held various leadership positions, including as VP of engineering, data and product for fintech unicorn Zepz, CTO for remittance company Sendwave, and an engineering lead for credit-card company Capital One.

- Visiting Media announced the appointment of Eric Sniff as CTO, a newly established role to embed AI and oversee innovation for the sales software provider. Sniff held various technology leadership roles at software providers including as senior director of data engineering for Contentstack and VP of engineering for Lytics.

- Qualstar announced the appointment of Jeff Sengpiehl to the newly created role of CTO, effective immediately. Sengpiehl joins the data storage and power supplies manufacturer after most recently serving as CTO and chief technologist at broadcast and media production technology provider Key Code Media. He also held leadership roles at Panavision and ABC.

- CyberArk appointed Omer Grossman, who has served as CIO since late 2022, to the newly created role of chief trust officer and announced that Ariel Pisetzky will succeed Grossman as CIO. Pisetzky joins the identity security provider after most recently serving as VP of IT and cyber at digital ad provider Taboola.