- Israel and Iran continued to bomb each other today, a scenario that used to be regarded as potentially disastrous for asset markets. But while the price of oil has risen as a result of the conflict, the rise has been moderate, and stock investors have been taking it easy. The U.S. dollar, however, has reached historically low levels of enthusiasm among institutional investors, according to Bank of America.

The Stoxx Europe 600 was down 0.9% in early trading, but that was the only drama on global asset markets so far today. The VIX volatility index is in retreat after the S&P 500 put in a solid performance yesterday. S&P 500 futures were off only 0.7% this morning, premarket.

In Japan, stocks rose, but in China they were flat.

The major surprise this week seems to be the relaxed, almost upbeat attitude of investors toward the Israel-Iran conflict. U.S. stocks have been up over the last five trading sessions as traders await the U.S. Federal Reserve’s interest rate decision tomorrow. Fed Chair Jerome Powell is expected to keep rates the same—it will be any change in his commentary that moves the markets.

Why are stocks shrugging off the bombing? The institutional bulls are back, according to Bank of America’s most recent survey of global fund managers. The survey calls on 222 panellists who have $587 billion under management. “The Bottom Line: investor sentiment recovers to pre–Liberation Day ‘Goldilocks bull’ levels as trade war & recession fears abate,” BofA’s Michael Hartnett and his team told clients in a note seen by Fortune.

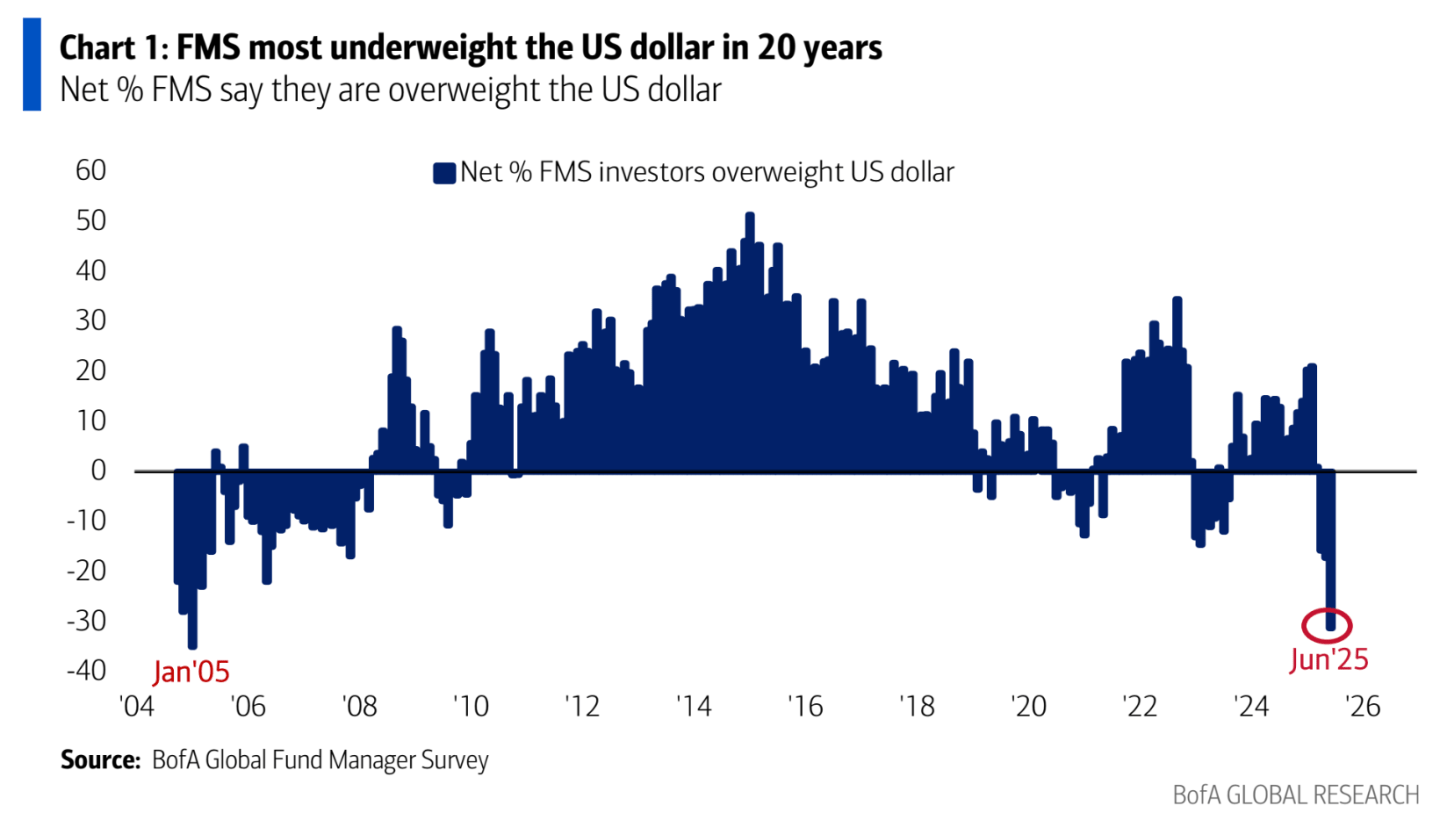

Nonetheless, there’s still one asset that investors hate right now, and that’s the U.S. dollar. The dollar has lost nearly 10% of its value against foreign currencies this year, according to the DXY index. Investors are now the most underweight in the dollar in 20 years, according to BofA. “[The] biggest summer pain trade is long the buck,” Hartnett et al. said.

Antonio Ruggiero of Convera also noted feebleness of the dollar: “Surging oil prices—up as much as 12% on Friday amid escalating geopolitical tensions in the Middle East—have further exposed the dollar’s fading safe-haven appeal. A clear divergence is taking shape: oil rallies, yet the dollar fails to follow. This underscores how sentiment toward the U.S. economy is acting as a stronger drag than what has historically been a dollar-positive force—higher oil prices, especially in periods of geopolitical risk. The result? Renewed selling pressure as confidence in U.S. assets continues to erode,” he told clients.

“The dollar’s only meaningful support for now remains a hawkish Fed, now back in full alert mode—leaving those softer CPI prints in a distance past. Whether tariff-induced or driven by surging oil prices looming inflationary pressures put the Fed in a tougher position to deliver the rate cuts sought by the Trump administration—reinforcing the case for policy to remain steady for now.”

Here’s a snapshot of the action prior to the opening bell in New York:

- S&P 500 futures were off 0.7% this morning. The index itself closed up 0.94% yesterday.

- The Stoxx Europe 600 sunk 0.9% in early trading.

- Japan’s Nikkei 225 rose 0.59%.

- South Korea’s Kospi was flat.

- China’s SSE Composite was also flat.

- The Nasdaq Composite rose 1.5% yesterday propelled by various tech stocks.

- Coinbase was up 7.7%.

- Reddit was up 6.8%.

- Palantir was up nearly 3%.