Good morning. Companies are actively seeking on-demand, interim C-suite leaders as disruption and uncertainty continue.

I had a conversation with Sunny Ackerman, global managing partner for on-demand talent at Heidrick & Struggles, who shared with me an eye-opening statistic—the demand for interim leaders from the firm’s clients has soared 310% since 2020. And C-suite roles account for the majority of interim placements (53% year over year). That’s one of the findings discussed in “The 2025 High-End Independent Talent Report” released by Heidrick & Struggles and Business Talent Group (BTG).

Amid C-suite turnover, interim executives allow companies to tap into a high-end, experienced talent pool, Ackerman told me. For example, CFO turnover at Fortune 500 companies is up 33% year over year, based on data from Jan. 1 through April 6, according to Heidrick & Struggles.

However, Ackerman said the need for interim talent isn’t solely turnover, referring to when an executive leaves a company or takes on a new role. It’s also when an organization needs “critical talent at a critical time,” she said.

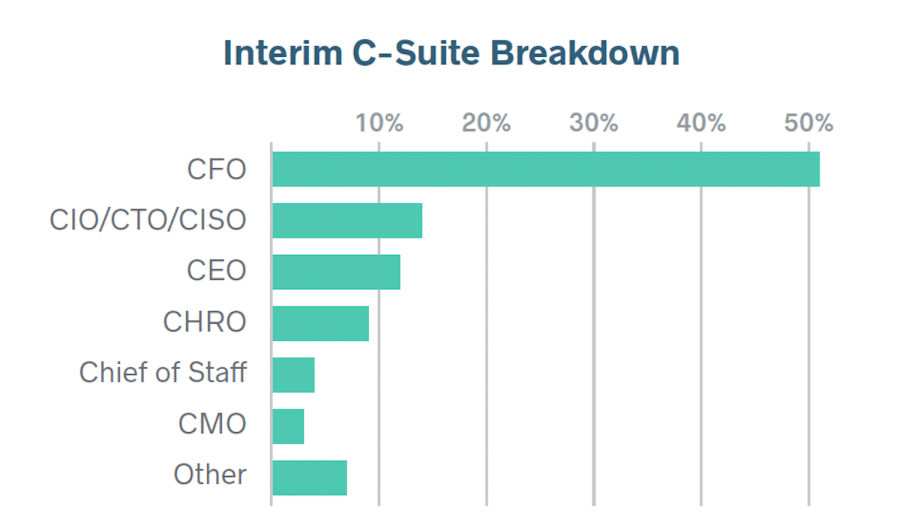

The analysis found that interim CFOs make up half (51%) of all interim leadership requests within the C-suite. “The type of requests that we’re seeing are really underscoring that kind of critical role that finance leaders play,” Ackerman explained. Companies want executives with financial expertise who can quickly evaluate and take hold of financial controls, auditing, or financial planning and analysis. “CFOs and their teams are really at the forefront of helping organizations stabilize and optimize the company,” she said.

The chart below indicates the percentage of interim requests for various C-suite leaders. The report provides an annual analysis of BTG’s proprietary data of large- and mid-market companies in U.S. and European markets.

Ackerman noted that companies are also expanding their use of interim leadership beyond the top tier. “Roles at the SVP and VP level made up about 33% of the requests,” she said. Meanwhile, demand below VP has risen 23% year over year, she added. For companies, this expansion into a variety of areas is really about maintaining stability during these times, Ackerman said.

Interim executives stay at a company typically anywhere between six to nine months to drive certain types of transformations, she said. For example, demand for experts in AI and machine learning grew 46% year over year.

Health care and life sciences, industrials, and consumer markets are BTG’s top three client industries for interim talent. Health care companies are streamlining operations, either driving reorganization or cost reduction, or they are planning operational restructuring, Ackerman said. Meanwhile, in industrials, there’s a need for interim executives to manage some of the volatility, especially for companies that import or export products, she said.

Is there a trend that stands out to Ackerman compared to last year’s findings? “Companies are tapping into business strategy and tech experts to assess AI opportunities. I found that it is starting to actually accelerate quite a bit.”

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Anuj Dhruv was appointed as EVP and CFO of Weatherford International plc (Nasdaq: WFRD), an energy services company. Dhruv brings more than two decades of diverse experience. Most recently, he served as VP of finance and strategy for the Global Olefins and Polyolefins segment at LyondellBasell.

Daniel Wolf was appointed CFO of Theradaptive, a clinical-stage biotechnology company. Wolf brings more than two decades of leadership experience. Wolf most recently served as SVP, chief strategy and M&A officer at Baxter International. Before that, he spent over 12 years at Medtronic, where he held a variety of leadership positions.

Big Deal

The EV giant Tesla reported its Q1 earnings after the bell on Tuesday. Automotive sales fell 20% over the same period last year to $14 billion. And despite a strong 12-month gain in its industrial and residential battery storage franchise, overall revenues fell 9%, Fortune reported. Net income for the quarter was $409 million, down 71% year over year, far below analyst estimates.

“Starting early next month, in May, my time allocation to DOGE [Department of Government Efficiency] will drop significantly,” Tesla CEO Elon Musk said on Tuesday’s earnings call. Musk said he will be “allocating far more of my time to Tesla.” He will spend a day or two per week working at DOGE. Tesla investors have been pleading for Musk to turn his focus back to the electric vehicle maker and the company’s projects.

The Q1 statement announced that Tesla would launch the long-awaited, affordable, apparently all-new Model Y by mid-2025. And the company plans to launch a “pilot” robotaxi service in its hometown of Austin in June. In after-hours trading on Tuesday, Tesla gained 3.5% following a 4.6% jump during the day.

“We have near-term challenges in our business due to tariffs and brand image,” Tesla CFO Vaibhav Taneja said on the earnings call. “We think our strategy of providing the best product at a competitive price is going to be a winner, and this is the reason we’re still focused on bringing cheaper models to market soon. The start of production is still planned for June.”

Going deeper

“The Economic Impact of Tariffs,” a new article in Wharton’s business journal, discusses an analysis derived from the Penn Wharton Budget Model. Sweeping tariffs would raise new revenue, but they would also depress GDP, wages, and Treasury bond demand and prices, according to the findings.

Overheard

“It will come down substantially but it won’t be zero.”

—President Donald Trump told reporters in the White House on Tuesday referring to the U.S. tariff rate on Chinese imports which is currently at 145%.