Good morning. Did you hear the joke about the tariffs?

Yeah, me neither.

Today’s tech news below. —Andrew Nusca

Want to send thoughts or suggestions to Fortune Tech? Drop a line here.

White House imposes 104% tariff on Chinese imports

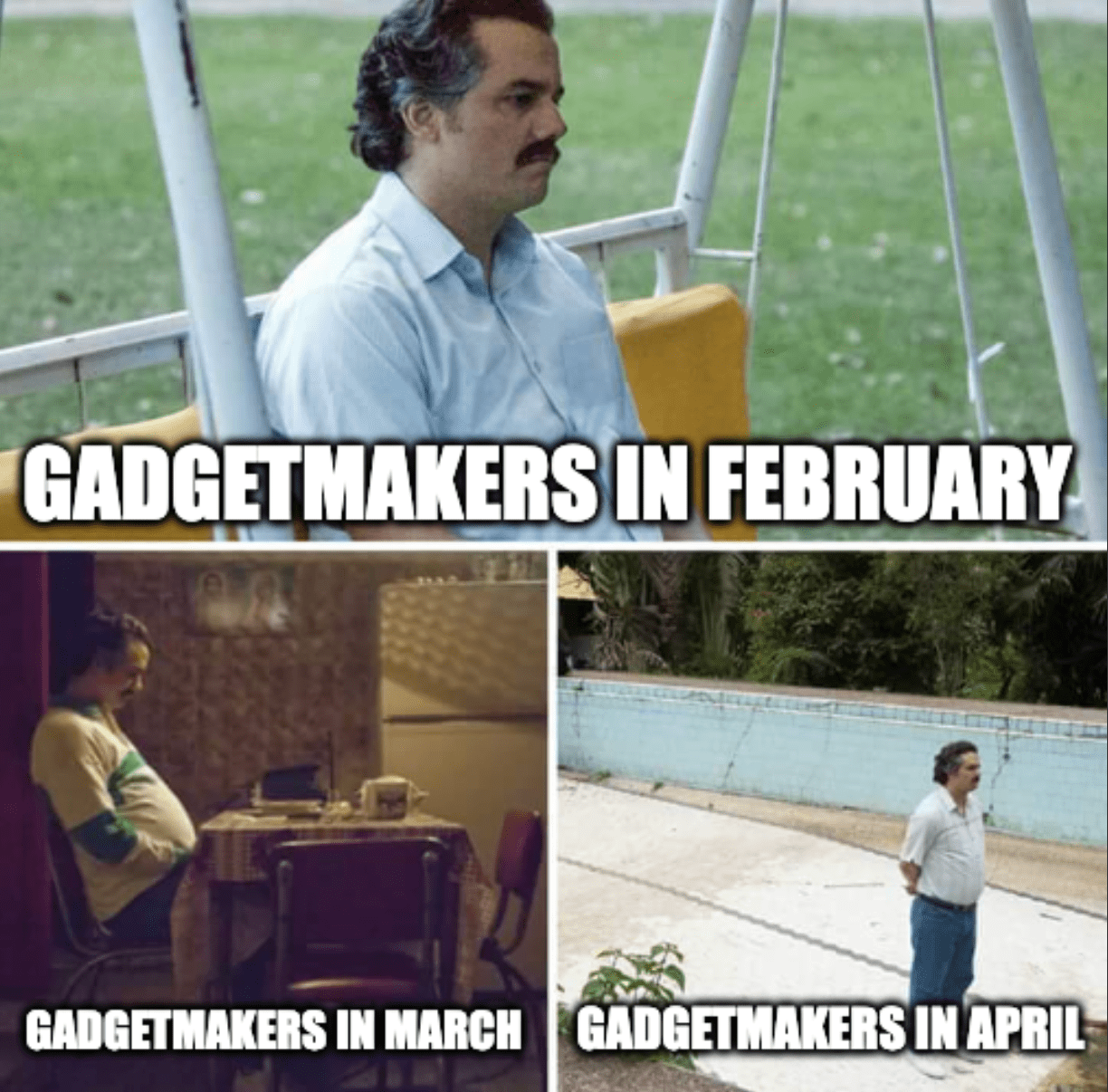

The Trump administration first moved to increase tariffs on imported goods from China by 10% in February. An additional 10% came in March.

China tariffs were set to increase by another 34% beginning today. Now those levies have increased by 84%, bringing the grand total on Chinese imports to 104%—far and away the largest duty on another nation’s goods.

The extra 50%, announced Tuesday and in effect from midnight Eastern Time, is a retaliation to China’s own retaliatory tariffs of 34% on U.S. goods, which took effect yesterday.

The White House called China’s move a “mistake.” The Chinese Commerce Ministry called the U.S. response “a mistake upon a mistake.”

Hanging in the balance: The consumer electronics, household appliances, furniture, clothing, and toys that China is known the world over for manufacturing.

The White House maintains that the levies will help the U.S. eliminate trade deficits and recapture a manufacturing base lost over generations of globalization. Economists maintain that trade deficits are impossible to eliminate and that the administration’s approach is highly flawed.

Who will blink first? So far, the answer is Wall Street. “The global economy is being taken down,” hedge fund manager (and Uber shareholder) Bill Ackman wrote on social media, “because of bad math.” —AN

With Ai2, Google Cloud moves deeper into open source AI

Google has entered a partnership with the Allen Institute of Artificial Intelligence that will see the nonprofit AI lab offering its open source AI models through Google’s Cloud Platform.

Seattle-based Ai2, as it’s known, has developed some of the most capable and open large language models (called OLMo) and a family of multi-modal models (called Molmo).

Its most powerful model, called OLMo 2 32B and released in March, outperforms OpenAI’s GPT-4o mini model while using fewer computing resources to train than competing “open weight” models.

Open weight models are so named because their code and core numeric values are made publicly available, but not the exact data “recipe” for how they were trained.

Google’s tie-up with Ai2 represents a further push by the tech giant into open source AI at a time when many large businesses and government organizations are attracted to open weight models because of the control it gives them over both data security and cost.

The demand for open weight models has only accelerated since January, when the Chinese AI startup DeepSeek released its R1 model, which excels at reasoning tasks and was less expensive than competing models.

Google’s most prominent AI models, called Gemini, are proprietary. These “closed models” are essentially the opposite of the sort Ai2 is offering.

But Google has also dipped a toe in the open model world with its Gemma family. Last month’s Gemma 3 release was essentially the company’s answer to DeepSeek. —Jeremy Kahn

U.S. scraps crypto unit, further loosening digital asset oversight

The U.S. Department of Justice notified staff on Monday evening that the agency was disbanding a unit dedicated to crypto-related investigations.

“The Department of Justice is not a digital assets regulator,” wrote U.S. Deputy Attorney General Todd Blanche in a four-page memo reviewed by Fortune.

Blanche wrote that NCET, or the National Cryptocurrency Enforcement Team, is disbanded “effective immediately” as part of the agency’s efforts to comply with Trump’s January executive order on digital assets, which aimed to “establish regulatory clarity” for the industry.

Established in 2021 under President Joe Biden, NCET was a joint task force composed of prosecutors from the DOJ’s money laundering and cybercrime units as well as attorneys from other district offices.

The task force collaborated on some of the DOJ’s biggest crypto cases.

Those included Tornado Cash, a crypto mixer that scrambled crypto funds to obscure ownership, and the case of Avraham Eisenberg, a hacker who exploited a crypto trading protocol for more than $100 million.

The unit also led investigations into North Korean actors who helped launder proceeds from crypto hacks.

As part of the Monday memo, Blanche directed DOJ employees to focus on “prosecuting individuals who victimize digital asset investors” and not pursue cases against crypto exchanges, mixers like Tornado Cash, and “offline wallets.” —Ben Weiss

More tech

—DOGE using AI to monitor federal workers “for hostility to President Donald Trump and his agenda.”

—Amazon’s Haul gets a glow-up. The Temu competitor broadens product selection to take advantage of the U.S.-China trade war.

—U.S. Treasury bureau hacked. More than 150,000 compromised emails between 2023 and 2025 at the Office of the Comptroller of the Currency (OCC).

—R.I.P. Hollywood in China. Billion-dollar dreams deferred, thanks to nationalism.

—Finally, an Instagram iPad app. Meta is reportedly at work on the missing platform to take advantage of TikTok’s U.S. distractions.

—TSMC could face $1 billion U.S. fine stemming from the discovery of its chip in a Huawei AI processor.

—Ripple buys Hidden Road for $1.25 billion. The deal for the prime brokerage firm is one of crypto’s biggest to date.

—Samsung beats Q1 estimates. Strong Galaxy S25 and memory chip sales lead to a 6.6 trillion won ($4.45 billion) operating profit quarter.

—An extinct animal, revived. Colossal Biosciences “de-extincts” the dire wolf.