Good morning. As the demand for CFOs increases, the job continues to become more complex. Finance chiefs are shaping business strategy amid volatile markets, for example.

The new economic environment rife with tariffs could remain uncertain for some time. U.S. Federal Reserve Chair Jerome Powell warned that the Trump administration’s sweeping tariffs would likely push inflation higher. “It is now becoming clear that tariff increases will be significantly larger than expected, and the same is likely to be true of economic effects, which will include higher inflation and slower growth,” Powell said in a speech Friday before business journalists in Arlington, Va.

CFOs are looking beyond short-term concerns in a way they haven’t in previous years, and have high expectations for technology, McKinsey finds. Finance leaders are increasingly citing strategic planning and sustained resource allocation as top finance priorities, according to the firm.

During my recent conversations with the CFOs of tech companies Workday, Toast and Adobe, I asked for their perspectives on balancing near-term operational needs with in-depth strategic planning. Here’s what they had to say.

Zane Rowe, CFO at Workday

“We’re always trying to be tactical, as well as strategic and nimble. We conduct scenario planning to understand what could be happening across the globe and put out an annual plan with targets. But we’re flexible as to how we achieve those targets—as the dynamics change, whether it’s geopolitical, foreign exchange or other variables that every business must navigate. I encourage leaders throughout the organization to be thoughtful, nimble, and continue to execute both in the short term and long term. Our mindset can’t just be around the next two, three or four years, it must be well into the future to build a durable business.”

Elena Gomez, president and CFO at Toast

“We run a long-range plan process and manage day-to-day against key KPIs. We always scenario plan—what are the risks and opportunities in the business? And how then does that shape our decision-making? I spend time with my CEO on a regular cadence to say, ‘Here’s what I see as risks for the business, and here’s where I think the opportunities are.’ We also discuss where we can go faster now to support long-term growth. If you think about our international and retail opportunities, the investment right now feels very short-term, but they’re in service of our long-term ambitions. That’s just an example of taking an idea today that will ultimately drive revenue over time.”

Dan Durn, CFO and EVP of finance, technology, security and operations at Adobe

“I talk to my peers at other companies, and I would say the error bar on 2025 and how it plays out is greater today in the minds of my peers than it was a quarter or two ago. What that tells me is we’re just in an elevated environment of uncertainty. What I learned a long time ago is, in an uncertain environment, focus on the things you can control, stay agile and respond to the things that you can’t. Keep a long-term perspective when you make decisions. Keep a long-term perspective on driving value for your employees, customers and investors.”

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Alberto Toni was appointed CFO of Guess?, Inc. (NYSE: GES), effective following the filing of the Company’s next Quarterly Report, which is expected to be filed by mid-June. Toni will succeed interim CFO Dennis Secor, who will remain with the company as EVP through Sept. 12. Toni is currently group managing director and CFO of Flos B&B Italia Group S.p.A., an international design company, where he has served as CFO since May 2023. Before that, he served as CFO of Bata SA, a global retail footwear company.

Peter J. Weiler was appointed CFO of Edesa Biotech, Inc. (Nasdaq: EDSA), a clinical-stage biopharmaceutical company, effective May 1. Weiler will succeed Stephen Lemieux, who will be stepping down on May 1. Since August 2018, Weiler has served as president of Exzell Pharma, Inc. Before that, he served as VP of business development at Biosyent Inc. Weiler also served in various roles at Cipher Pharmaceuticals Inc., including VP of business development.

Big Deal

“Generative AI adoption in the enterprise,” is a report released by Writer, an AI company. Optimism around AI is increasing with 88% of employees and 97% of executives surveyed saying they've benefitted from generative AI.

However, 72% of C-suite leaders say their company has faced at least one challenge on their journey to AI. And, nearly two out of three C-suite executives report that generative AI adoption has sparked division within their organizations, according to the report.

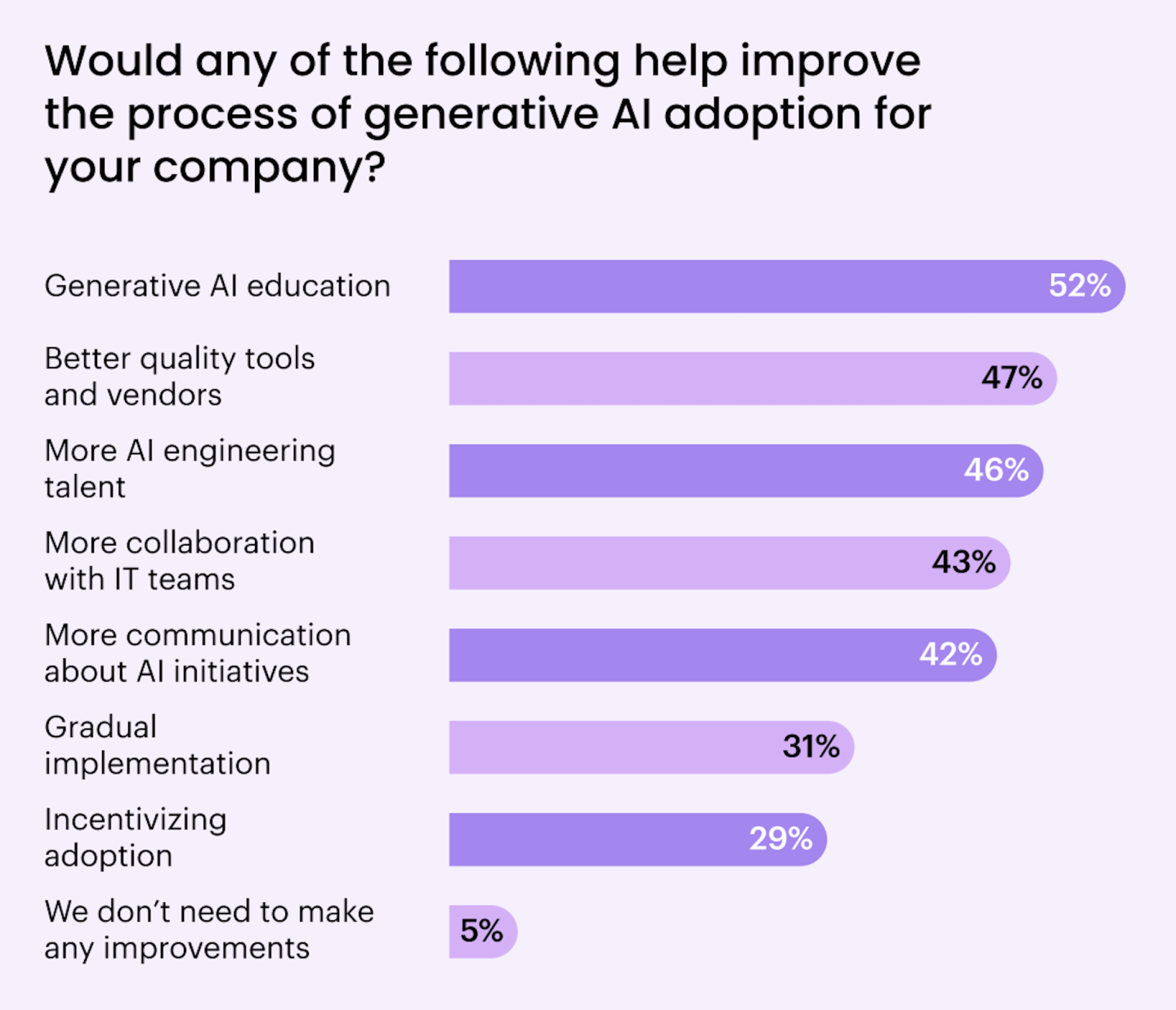

Almost all (95%) of C-suite leaders admit their company needs to improve the generative AI process. More than half of respondents (52%) said they think generative AI education within the company would be helpful.

The findings are based on a survey of 1,600 knowledge workers actively using AI in the workplace, including 800 C-suite executives and 800 employees across the U.S.

Going deeper

“Asian markets go into a 2008-style freefall, after Trump calls his tariffs needed ‘medicine’ for the U.S.” is a new Fortune report by Nicholas Gordon. “Hong Kong’s benchmark Hang Seng Index fell by 13.2%, its worst decline since 1997 and close to wiping out its gains for 2025,” Gordon writes. “Tencent, China’s most valuable company, dropped by 12.5%. PC manufacturer Lenovo fell by over 22.9%, the largest drop by a Global 500 company based in the Asia-Pacific region.”

Overheard

“Every company, every great AI unicorn, any company I’ve ever worked for was never the overnight success that it appears in the press release. It’s always a 10-year journey.”

—Vimeo’s new CEO, Philip Moyer, told Fortune in an interview.