Good morning. As CEO of EV maker Tesla, Elon Musk is the face of the company. His image and influence are a big part of the brand—so much so that President Trump on Monday pledged to buy a Tesla to help defend “Elon’s baby” at a time when its share price is plummeting and protests continue at Tesla dealerships.

However, investors are starting to examine what they’ve long ignored: “Tesla’s bedrock value minus the ‘Musk premium,’” according to Fortune’s Shawn Tully. In his new piece, Tully set out to answer the question: What would Tesla be worth without Elon Musk? He explores the company’s worth on its own by separating out what he referred to as the “Musk Magic Premium, the extra market cap awarded for the ‘forthcoming’ ventures Musk has failed to deliver but that still rally hordes of believers.”

Tesla has been facing some headwinds. Its stock price reached a high of $488 on Dec. 18 but has now relinquished essentially all its gains from President Trump’s election, when it doubled in value over the span of just six weeks, becoming more valuable than all carmakers combined. Shares have been down heavily since the start of this year. Tesla shares sank over 15% on Monday, closing at $222.15.

Investors have braced for a stock dump. And during this vulnerable time for stock sentiment, Tesla published an SEC filing informing investors that CFO Vaibhav Taneja sold another $718,000 in shares on March 6, which brought his total over the past 90 days to over $8 million, Fortune reported.

In 2024, Tesla sales fell by 1%, its first annual decline in 12 years. The slump isn’t solely a reflection of less consumer demand but also an increase in market competition and political dynamics.

In Tully’s report, he writes that investors reckoned that Musk’s newfound status as the highest-profile member of the Trump economic team in heading the Department of Government Efficiency would somehow restore the buzz around Tesla.

“Musk appeared to be performing a never-before-seen coup in taming the federal bureaucracy,” he writes. “His early wins at the White House reminded folks and funds of the supposedly enduring Musk magic, and renewed belief in his epic vision for the EV giant.”

In his analysis of Telsa’s worth, Tully used conventional guideposts to reach an accurate valuation based on the products and services Tesla currently produces and sells, “sans the wonders Musk is predicting.”

“To establish repeatable, durable numbers for earnings, I eliminated special items, notably the $589 million write-up for the Bitcoin trove on Tesla’s books allowed by new accounting rules, and the almost $6 billion tax benefit in Q4 of 2023,” Tully writes. “I also removed estimated after-tax income from the sale of regulatory credits to competing manufacturers, a sideline that Musk acknowledges will disappear, though the rate of decline remains uncertain.”

To find out the results of his analysis, you can read the complete article here.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Steve Rosen was appointed CFO of the beauty brand Stila Cosmetics. Rosen has over 30 years of experience in the cosmetics industry. He most recently served as CFO for ZO Skin Health, a Blackstone Private Equity portfolio company. Before that, Rosen spent 22 years at Estee Lauder in various finance and M&A roles for brands such as Crème de la Mer, Jo Malone, Aramis, Designer Fragrances, and BECCA Cosmetics.

Brad E. Schwartz was appointed EVP and CFO of First National Corporation (Nasdaq: FXNC) and First Bank (the “Bank”), effective March 31. Schwartz is the retired president and COO of TowneBank and was formerly CEO, CFO, and COO of Monarch Bank before its acquisition by TowneBank. He also served as CFO of two other Virginia community banks.

Big Deal

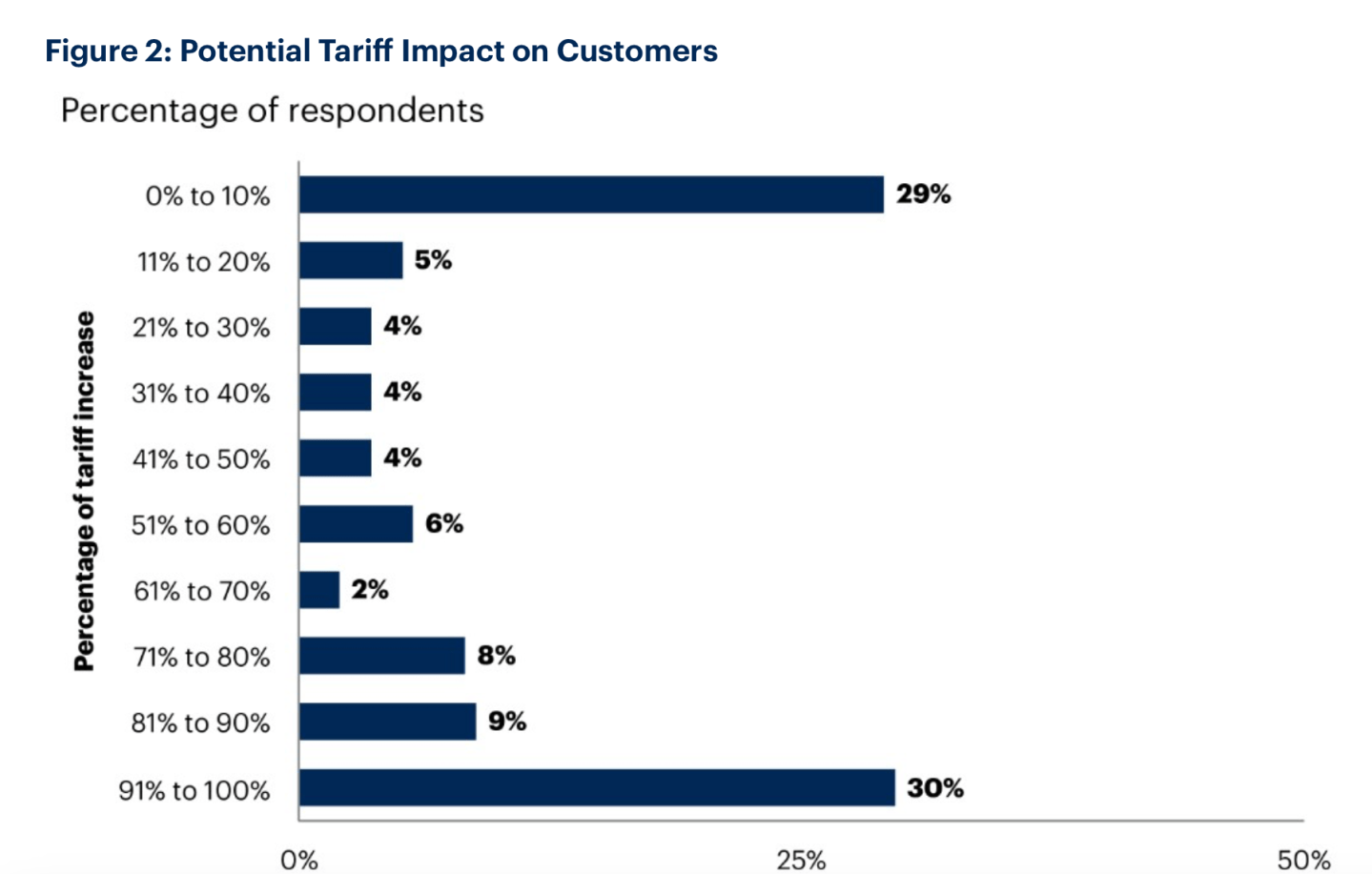

A new survey by Gartner, Inc. gauges the response of CFOs to new tariffs. About 59% of CFOs expect their organizations to absorb less than 10% of tariff impact in their cost base. And 41% of CFOs expect to absorb on average 49% of tariff increase within their cost base.

Regarding the potential impact on customers, 30% of respondents are planning to pass 91%-100% of tariff costs. And 29% intend to pass on 10% or less to consumers, according to the report. The findings are based on a poll of 192 CFOs and finance leaders from a cross-industry group of organizations with global operations.

“CFOs are exploring various strategies to minimize the short-term impact of tariffs, including revisiting Harmonized Tariff Schedule classifications, leveraging tariff exemptions and free trade areas, and optimizing transactional structures to lower the dutiable value of imports,” Alexander Bant, chief of research in the Gartner Finance practice, said in a statement. “Despite these efforts, 45% of CFOs have no immediate plans for tax and duty compliance adjustments, potentially overlooking quick wins.”

Going deeper

“Making reinvention real with gen AI,” is a new report by Accenture. It’s based on an analysis of over 2,000 gen AI projects delivered to clients, along with surveys of more than 3,000 C-level executives.

With over 83% of C-suite executives indicating gen AI exceeds their initial expectations, the findings signal a growing confidence in its capabilities. However, many still struggle as only 36% of surveyed executives say they have scaled gen AI solutions, and just 13% report creating significant enterprise- level value. Challenges around data readiness, process redesign and a lack of C-level sponsorship continue to hinder progress.

Another finding is three times more gen AI budgets are spent on technology than on people. Technology anchors any transformation, but it’s the alignment of people, processes and technology that drives reinvention, according to Accenture.

The research found that organizations excelling in gen AI transformation invest in broad AI upskilling, adopt dynamic workforce models, and enable human and AI agent collaboration.

Overheard

“An era of deregulation is both an imperative and an opportunity for organizations to look at the risks they face with fresh scrutiny. It’s also a chance to reassess risk management and oversight.”

—Richard Chambers, the CEO of Richard F. Chambers & Associates, a global advisory firm for internal audit professionals, writes in a new Fortune opinion piece.