Good morning. The on-again, off-again tariff scenario has the attention of corporate leaders.

President Donald Trump imposed 25% fees on all goods imported from Canada and Mexico on Tuesday. But on Thursday, Trump postponed until April 2 tariffs on all products covered under the U.S.-Mexico-Canada (USMC) trade agreement. That is also the date when reciprocal tariffs are expected to go into effect. On Tuesday, tariffs on imports from China increased from 10% to 20%.

Tariffs are certainly a hot topic on earnings calls. John Butters, VP and senior earnings analyst at FactSet shared with me the findings of his analysis. A search of S&P 500 earnings call transcripts from Dec. 15 through March 5 found that the terms “tariff” and “tariffs” were mentioned by 255 companies. The previous high was 185 in Q2 2018, Butters said.

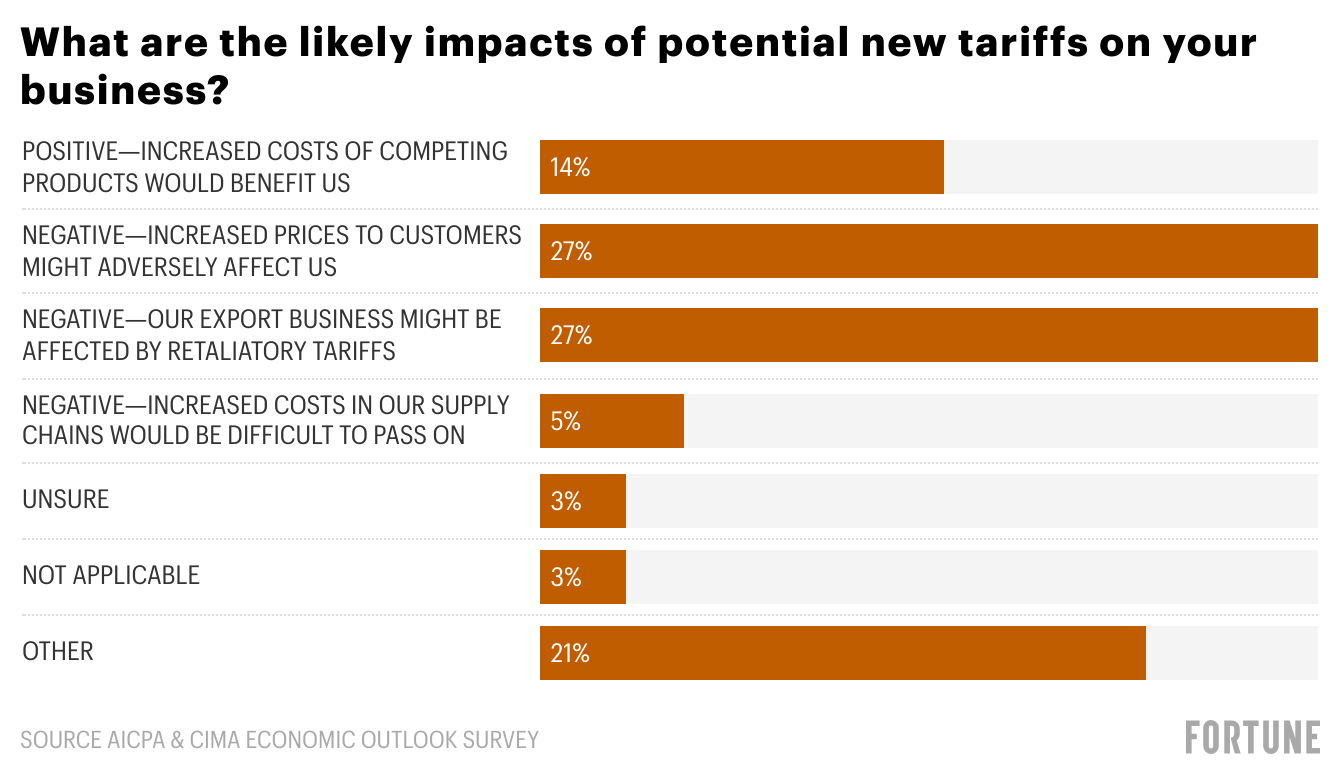

To get a better idea of how the C-suite feels about tariffs, I spoke with Tom Hood, EVP of business growth and engagement at the Association of International Certified Professional Accountants (AICPA). We talked about the findings of the new AICPA & CIMA Economic Outlook Survey.

The survey found that 59% percent of respondents think tariffs would have a negative effect on their businesses, and 85% said uncertainty surrounding the subject had influenced their business planning to some degree—18% described that impact as significant. The data is based on a survey of 305 CPAs and chartered global management accountants of which the majority are CFOs at private and public companies. The survey ended on Feb. 26.

Another key finding is executives’ optimism about the U.S. economy has declined from a more than three-year high of 67% seen in last quarter’s survey to 47% in Q1. Hood sees this more as a moderation of sentiment rather than a turn towards pessimism.

Inflation also remained the top concern for executives, followed by issues related to staffing—employee and benefit costs, availability of skilled personnel, and staff turnover.

The CFOs Hood talks with are working with their teams on scenario planning and agile strategic solutions, he said. “And they’re not overreacting to the news cycle,” he added.

Hood pointed out that 57% of respondents expect their businesses to expand over the next 12 months, which is the same percentage as last quarter.

“I think everyone is still anticipating tax cuts and regulatory reform,” he said. “Those are the two big pieces we know that CFOs like and have been looking forward to.”

Have a good weekend.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Fortune 500 Power Moves

Cathy R. Smith was appointed CFO of Starbucks Corporation (No. 116). Smith, currently CFO at retailer Nordstrom Inc., will succeed Rachel Ruggeri who is leaving the company. Ruggeri’s separation from the company is “without cause,” Starbucks said in an SEC filing. Smith will join Starbucks in the next month. Before her CFO role at Nordstrom, she was the finance chief and chief administrative officer at health insurer Bright Health Group which has since rebranded as NeueHealth Inc. Smith also previously served as CFO of retailers Target Corp., Walmart International, and GameStop Corp.

Stewart Glendinning was appointed CFO of Dollar Tree Inc. (No. 143), effective March 30. Glendinning joined Dollar Tree earlier this year in a senior role focused on enterprise-wide transformation initiatives, including areas within the company’s finance organization. Before joining Dollar Tree, he served as CEO of Express, Inc., and held global CFO roles at Tyson Foods and Molson Coors Brewing Company. Glendinning will succeed Jeff Davis, who previously announced plans to step down.

Every Friday morning, the weekly Fortune 500 Power Moves column tracks Fortune 500 company C-suite shifts—see the most recent edition.

More notable moves this week:

Melissa Hahn was promoted to CFO of Ames Watson, a private equity holding company. Hahn joined Ames Watson in 2023 as VP of finance. She previously held roles at Campbell's Company, Deloitte, and Grant Thornton.

Travis Lan was promoted to senior executive vice president and CFO of Valley National Bank, a company of Valley National Bancorp (Nasdaq: VLY). In 2020, he joined Valley from the investment banking department of Keefe, Bruyette & Woods where he specialized in M&A and capital advisory.

Simon McWilliams was appointed CFO at Tether Holdings, a stablecoin issuer, as the company takes a step toward a full financial audit. McWilliams has over 20 years of experience leading large investment management firms. Giancarlo Devasini will transition from CFO to chairman of the group.

Mark Okerstrom was appointed CFO of Fortive Corporation (NYSE: FTV), an industrial technology company, effective March 24. Okerstrom will succeed Chuck E. McLaughlin who is retiring. Over the course of more than 13 years at Expedia Group, Inc. Okerstrom held a variety of senior executive roles including SVP of corporate development, CFO, EVP of operations and ultimately president and CEO.

Brett Parker was appointed CFO and COO of the combined Legends and ASM Global business. Before joining Legends, Parker held several senior positions, including executive vice chairman, president, and CFO of Lucky Strike Entertainment, previously known as Bowlero Corp.

Jennifer Phipps was promoted CFO of BrightSpring Health Services, Inc. (Nasdaq: BTSG), a pharmacy and health services provider, effective March 4. Phipps will succeed Jim Mattingly. Phipps currently serves as chief accounting officer and principal accounting officer, as well as CFO of BrightSpring’s Home Health and Hospice segment.

Big Deal

New S&P Global Market Intelligence data finds global private equity and venture capital deal value reached $37.93 billion in February, up 26.6% from January. Deal value fell 28% year over year from $52.64 billion in February 2024. The number of deals fell by roughly 12.7% during the same period, according to the report.

During the first two months of 2025, investment value decreased about 20% to $67.89 and the number of deals was down to 1,670 from 1,788, Market Intelligence data showed.

The largest private equity transaction in February was Blackstone Inc.’s $5.65 billion purchase of U.S. marina operator Safe Harbor Marinas LLC from Sun Communities Inc. through the firm’s Blackstone Infrastructure Partners LP fund, according to the report.

Going deeper

Here are four Fortune weekend reads:

“The top power players at Elon Musk’s Department of Government Efficiency (DOGE)” by Luisa Beltran

“The architect of Trump’s first tax cuts says the plan to scoop out overtime pay and Social Security from taxes is ‘very expensive’ but tips are feasible” by Greg McKenna

“Visa is going all in on popular ‘tap to phone’ payment options” by Alicia Adamczyk

“3 things driving the global sleep deficit—which is turning into a health crisis and costing companies” by Beth Greenfield

Overheard

“When you give up the need to impress people all the time, and let them impress you, you get promoted from…smart…to…wise.”

—Bill Hoogterp writes in his latest Fortune “Ask a CEO coach” advice column. This week, Hoogterp offers advice to an executive in the finance sector who feels stuck. Hoogterp is a bestselling author, an entrepreneur, and one of the top executive coaches in the world. He has advised dozens of Fortune 500 CEOs.