Good morning. Intuit, a fintech company, is experiencing a boost to its bottom line with AI.

For more than a decade, the company has operated an AI-driven expert platform strategy, Sandeep Aujla, EVP and CFO at Intuit, told me. Intuit continually practices cleaning up data, powering its AI engines—and “staying humble,” Aujla said. He added that the firm doesn’t have the attitude that “our LLMs [large language models] are the best,” he said. “LLMs are going to be the fastest depreciating assets out there,” he added.

However, Intuit (No. 297 in the Fortune 500), which offers products like TurboTax, Credit Karma, and QuickBooks, has made big gains in leveraging AI for customer-facing applications and for use within the company. Investments in AI are on track to deliver nearly $90 million in annualized efficiencies in its fiscal year 2025, Aujla said. “That was slightly ahead of what we had expected for this year,” he said.

Expert training, workforce operations, and data entry are all areas that got a boost with agentic AI. For instance, the Intuit Assist tool is using AI agents to deliver “done-for-you experiences,” which has contributed to a 20% reduction in the contact rate for TurboTax product support year to date, he said.

Aujla offered an example. When you’re filing your tax returns using the tool, and have sold stocks, bonds, or other securities during the year, you will need a 1099-B supplemental form. The AI agent will ask you to download the form and share it. “AI will then go through the supplemental form and automatically connect what the right tax bases would be,” Aujla explained. That’s saving people multiple hours of work, he said. “I remember when I was doing my taxes myself, and what I would dread was that,” Aujla said. “And it would literally take about three hours.”

“Through over 200 partnerships, we’re able to automate 90% of the data that comes into a tax filing,” he added. That’s up from 68% last year. And essentially TurboTax users can have a bespoke experience on the platform, he said.

A goal for Turbo Tax is to reduce that customer support time because “we get paid by the return, and we pay our experts by the hour,” he said. “So if I can automate 90% of their tasks, that’s money to the bottom line.”

Internally, including in the finance organization, the company is using AI knowledge engineering and machine learning to automate tasks, like data entry, he said.

Intuit reported on Feb. 25 earnings for its second fiscal quarter that ended Jan. 31. The company reached $3.96 billion in revenue for the quarter, an increase of 17% year over year, which surpassed analyst estimates. Credit Karma revenue was up 36% year over year. And its Global Business Solutions Group revenue was up 19%. Amid the ongoing U.S. tax season, AI-enhanced offerings are giving the company a boost.

Does Aujla have advice for increasing efficiency using AI? “Focus on driving productivity for everyone you serve, and be willing to experiment again and again,” he said.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Simon McWilliams was appointed CFO at Tether Holdings, a stablecoin issuer, as the company takes a step toward a full financial audit. McWilliams has over 20 years of experience leading large investment management firms and will spearhead Tether’s commitment to transparency and regulatory readiness, according to the company. Giancarlo Devasini will transition from CFO to chairman of the group.

Travis Lan was promoted to senior executive vice president and CFO of Valley National Bank, a company of Valley National Bancorp (Nasdaq: VLY). Since joining Valley in 2020, Lan has contributed to the bank’s strategic growth and recent balance sheet transformation. He joined Valley from the investment banking department of Keefe, Bruyette & Woods where he specialized in M&A and capital advisory for community and regional banks.

Big Deal

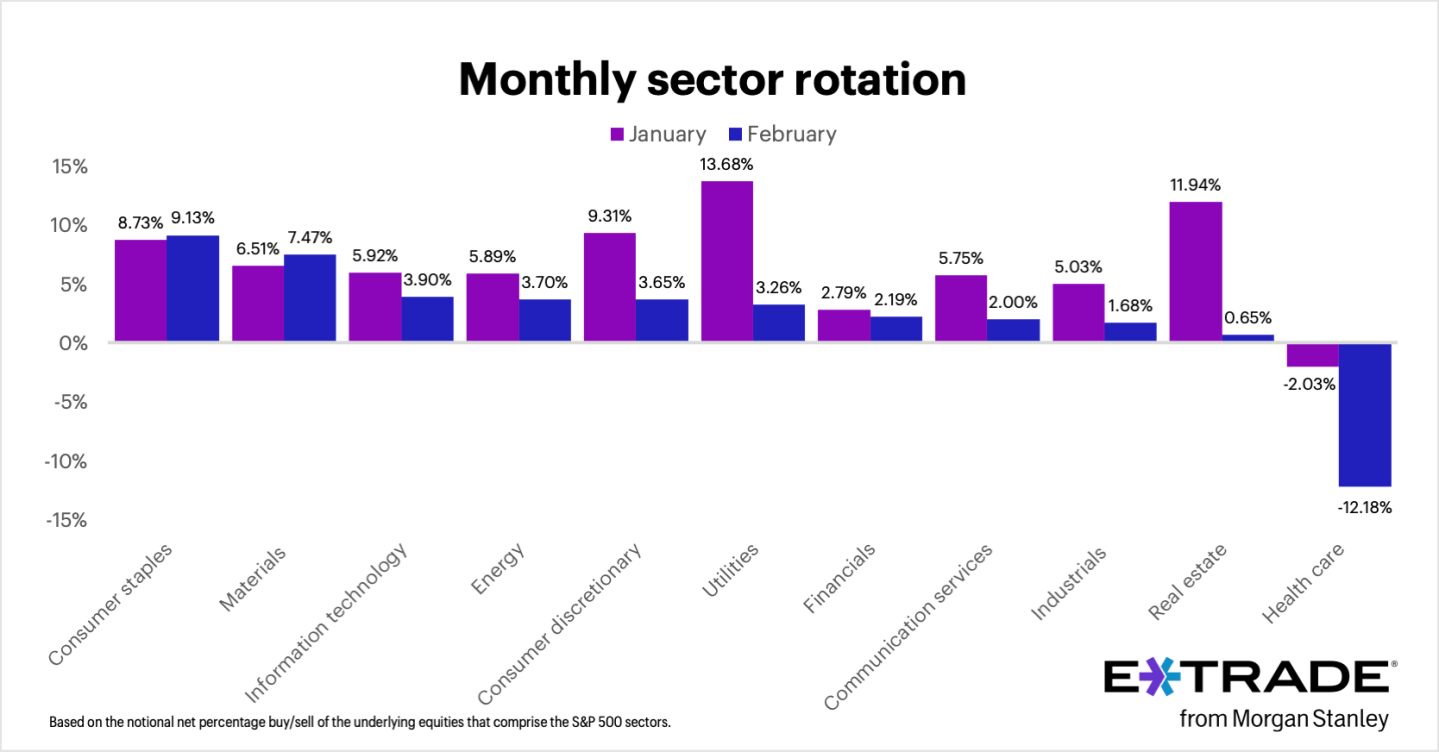

E*TRADE from Morgan Stanley’s monthly analysis finds the three most-bought sectors on the platform in February were consumer staples (+9.13%), materials (+7.47%), and information technology (+3.90%). The data is based on the net percentage buy/sell behavior of stocks on the platform that comprise the S&P 500 sectors.

“Clients were net buyers in 10 of 11 S&P sectors, with some of the buying appearing to be defensive in nature, and some possible cases of ‘buying the dip,’” Chris Larkin, managing director of trading and investing at E*TRADE, said in a statement. “For the second month in a row, clients were net sellers of health care, although it’s worth noting there may have been an element of profit taking since at least one of the most actively sold stocks had a double-digit percentage gain and ended the month at a record high.”

Going deeper

“Tariffs, layoffs, and immigration—the triple threat to economic growth that has Wall Street worrying about the U.S. economy” is a new Fortune report by Greg McKenna.

“Markets hate uncertainty, the saying goes, and investors are desperately awaiting clarity on President Trump’s plans for taxing imports as the Street debates whether the president’s economic agenda will slow growth, reignite inflation, do both—or result in none of the above,” McKenna writes. “Traders got more bad news on Monday, as the Federal Reserve Bank of Atlanta’s GDPNow tracker signaled a 2.8% contraction for the first quarter of 2025.”

Overheard

“Leadership isn’t just about personal achievement—it’s about paving the way for those who come next.”

—Wetteny Joseph, EVP and CFO of global animal health firm Zoetis, a Fortune 500 company, wrote in a LinkedIn post on Feb. 28.