- UBS chief economist Paul Donovan said Democrats are buying now to beat the tariff increases. A separate survey released by the University of Michigan found inflation expectations have jumped significantly as tariff fears loom.

Americans, and especially Democrats, are “front-loading” their spending as tariff trepidation spurs purchases to get ahead of expected price hikes, according to UBS chief economist Paul Donovan.

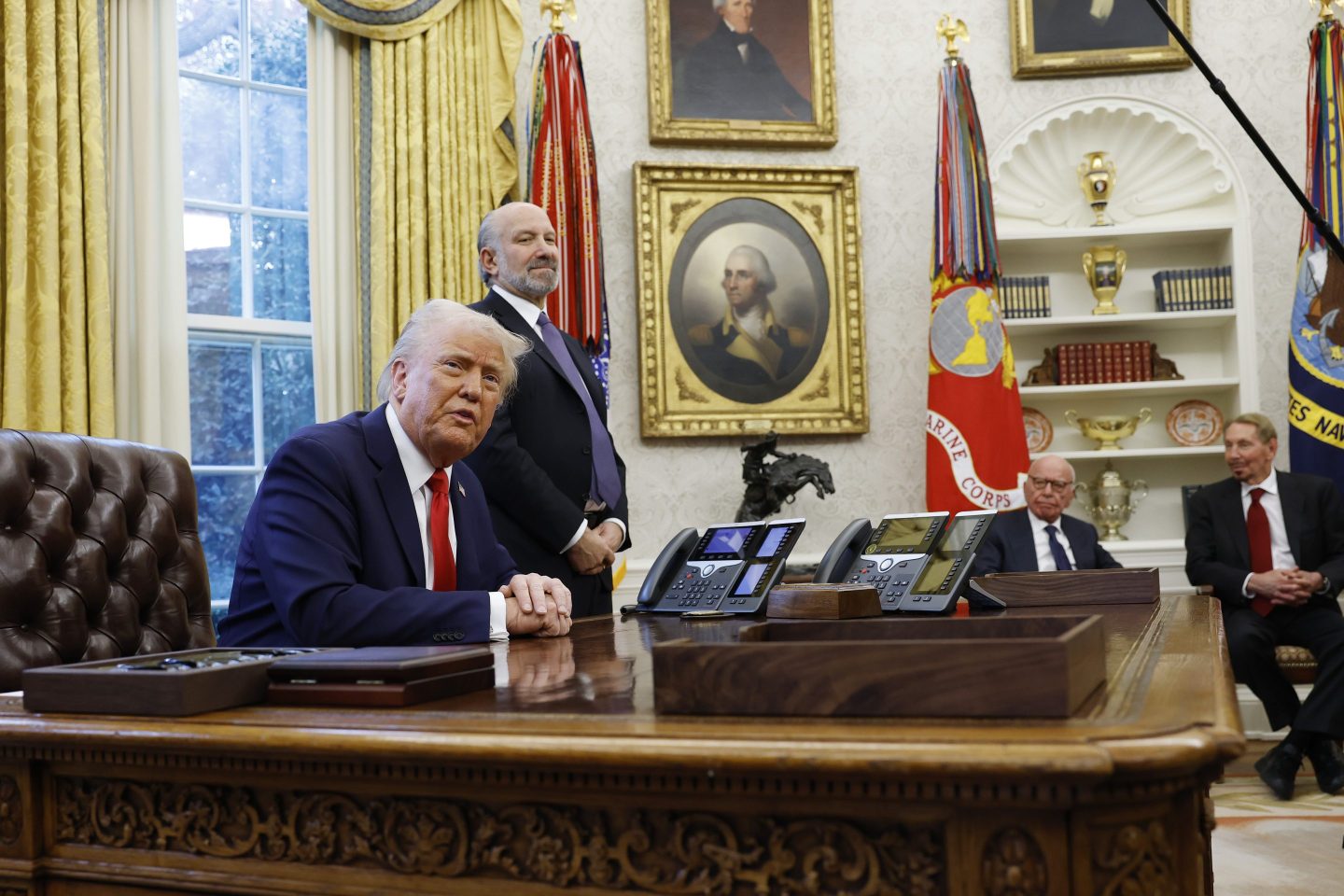

President Donald Trump announced Feb. 1 that he would impose tariffs on Mexico, Canada and China, effective Feb. 4. Although tariffs on Mexico and Canada have been postponed for 30 days, the China tariffs went into effect and consumers are scrambling to buy before prices spike.

“Sentiment and consumer spending data suggests Democrats (in particular) in the US seem to have been fearful that trade taxes mean higher prices, and have rushed to buy in advance,” Donovan said in a note on Friday. “The pattern of consumer durable goods buying suggests ‘front-loading’ consumption, but ‘buy now’ also implies ‘don’t buy later’ and may slow future demand.”

Tariff concerns and their impacts on prices are on the forefront of consumers’ minds when it comes to purchasing decisions.

According to the latest survey from the University of Michigan, consumer sentiment dropped 5% across every political divide in February, hitting the lowest level since July 2024.

Survey director Joanne Hsu cited a 12% slide in buying conditions for durables, “in part due to a perception that it may be too late to avoid the negative impact of tariff policy.”

Additionally, year-ahead inflation expectations rose considerably for the second consecutive month, jumping from 3.3% in January to 4.3% this month, the highest reading since November 2023, when it was 4.5%.

Hsu noted that this is only the fifth time in the last 14 years there’s been such a large one-month rise in year-ahead inflation expectations.

In addition to tariffs, UBS said Trump’s crackdown on immigration may also have inflationary effects.

“If agricultural workers fear ICE agents and a Fox News crew raiding their farm, they may not show up for work,” Donovan wrote. “Fewer workers and disrupted work schedules push up food prices. That leads to fear of inflation for consumers, changing their behavior.”