The venture industry is filled with localized celebrities. These are figures probably known by every startup and investor within 5,000 miles of Menlo Park, but who don’t have the name recognition of the VCs that have broken through into the (relative) mainstream, like Marc Andreessen or Tim Draper.

David Haber is one of those venture celebrities, though the term would probably make him cringe. He’s the type of person who comes up every time I ask about the top VCs operating in New York—someone who has been described to me as a “connector,” whose superpower is knowing and linking the right people, and ideas, together. (That he also happens to work as a general partner helping oversee enterprise software at arguably the most powerful venture firm of the moment, a16z, doesn’t hurt.)

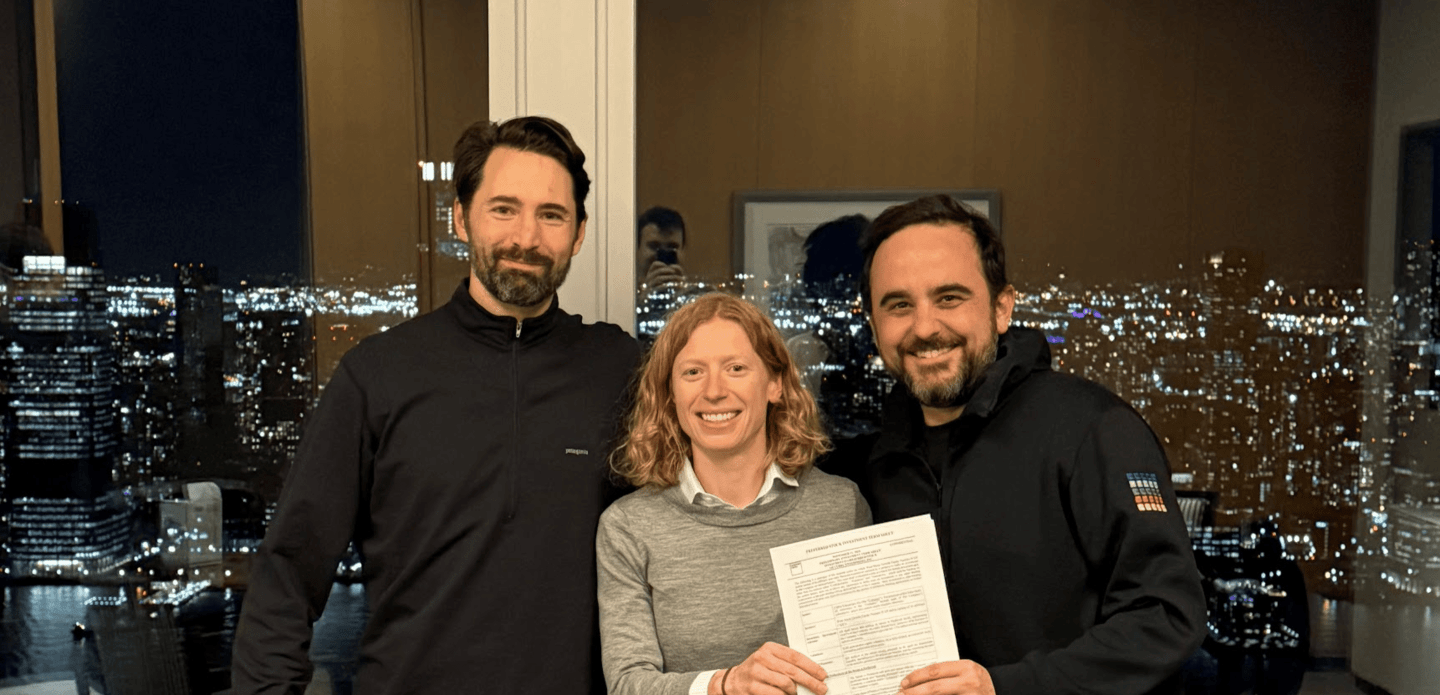

I met with David last week in a16z’s New York offices, which he helped open in 2022. The venture juggernaut has two floors of a SoHo office building, with books written by partners, like Chris Dixon’s Read Write Own, lining the walls. It’s soon expanding to two more floors, perhaps spurred by an expected influx of employees following the close of the firm’s London office, announced on Friday.

Haber is clean-cut with a calm, measured demeanor. Though he only graduated from Harvard 15 years ago, it seems like he’s already had four careers, working as an investor at the Boston-based Spark Capital (where he helped source a seed round into Plaid) before starting a fintech venture of his own, the financing startup Bond Street, which he sold to Goldman Sachs. He then worked to help the bank build out its more tech-focused offerings, including the online platform Marcus. (He described his time in banking after running a startup as “recovery,” which is probably the only time a stint at Goldman has been characterized that way.)

While Haber’s 360-degree profile is enviable for any VC, his trajectory is more common to New York, especially for those in fintech, with Wall Street right around the corner. He was interested in finance at a time when the financial crisis pushed young graduates out of traditional paths, trawling New York tech meetups for interesting people back when you could come across the Plaid founder or the Venmo head of engineering at a random happy hour.

When he began working at Goldman, that skill helped him stand out to the new chief strategy officer, Stephanie Cohen, who asked Haber to help her get connected to the tech ecosystem. At the same time, he learned how an organization of 45,000 employees operates, watching how division heads work together. “It was an interesting bird’s eye view into a big company from within the inner sanctum,” he told me.

It also helped inform his view of financial technology, specifically B2B software. The line between fintech and traditional finance is increasingly blurred, especially as institutions like Goldman Sachs and J.P. Morgan create, or adopt, software first championed by their challengers. On the consumer fintech front, Haber said that we already have our scaled winners—companies like Robinhood, Ramp, and Brex—that will be difficult to challenge.

Now, Haber said, he’s biased toward companies that lead with software (as opposed to a financial product) that can help businesses solve workflow challenges. As he transitioned into his role at a16z, which he joined in 2021, he also leaned into his connecter role between the startup ecosystem and large, incumbent institutions. “That was a unique way to add value from New York City,” he told me.

At Andreessen, Haber’s portfolio has expanded beyond fintech to other types of software (powered, of course, by AI) that help solve those workflow issues, which he describes as a “massive kind of opportunity” to go after. Haber has championed the idea of the “messy inbox problem,” where AI can sit at the top of the funnel for work to capture and organize unstructured data—and eventually displace existing legacy software (or people). One example, which Allie wrote about last week, is Eve, the legal software platform that announced a $47 million Series A led by a16z and helps replace paralegal functions like client intake.

Throughout our conversation, I was curious how Haber has adapted to a16z’s new role in the VC-supercharged Washington, where his boss has ascended from venture celebrity to president whisperer. Everything Haber talked about was so determinedly apolitical and technical, it seemed easy to forget that Andreessen recently appeared on the Joe Rogan podcast to decry Biden-era debanking.

“It’s not a huge topic of conversation,” Haber told me, adding that board meetings with portfolio companies instead focus on questions like team size and customer happiness. “People obviously value the brand and the megaphone that the firm has.”

Ask Andy…“Ask Andy” is back! In this week’s column, Bonobos cofounder Andy Dunn tackles the age-old conundrum: Should I bootstrap my startup? He advises that if founders decide to take on backers, they should ask two crucial questions about their potential investors, including whether entrepreneurs love working with them. Read the whole column here.

You should fill out this survey…Our 17th annual confidence survey with Semaphore is underway! You should fill it out because it’ll take less than four minutes and your thoughts matter. Some preliminary results of one of the most interesting survey questions: Does Elon Musk have an undue influence on American domestic and foreign policy? Right now, almost 80% of you say yes. Click here to take the survey.

Leo Schwartz

X: @leomschwartz

Email: leo.schwartz@fortune.com

Submit a deal for the Term Sheet newsletter here.

Nina Ajemian curated the deals section of today’s newsletter. Subscribe here.

VENTURE DEALS

- ShopMy, a New York City-based creator marketing and partnerships platform, raised $77.5 million in Series B funding. Bessemer Venture Partners and Bain Capital Ventures led the round and were joined by Menlo Ventures, existing investors Inspired Capital and AlleyCorp, and others.

- Tive, a Boston-based shipment monitoring technology company, raised $40 million in Series C funding. World Innovation Lab and Sageview Capital led the round and were joined by AVP, RRE Ventures, Two Sigma Ventures, and others.

- Allara Health, a New York City-based women’s hormonal healthcare virtual platform, raised $26 million in Series B funding. Index Ventures led the round and was joined by existing investor GV.

- Ati Motors, a Bengaluru, India-based autonomous AI-powered robot manufacturer, raised $20 million in Series B funding. Walden Catalyst Ventures and NGP Capital led the round and were joined by existing investors True Ventures, Exfinity Venture Partners, Athera Venture Partners, and Blume Ventures.

- Optable, a Montreal-based identity management platform for advertising, raised $20 million in Series A acceleration funding. TELUS Global Ventures led the round and was joined by existing investors Hearst Ventures, Brightspark Ventures, Desjardins Capital, and others.

- Basetwo, a Toronto-based AI-powered manufacturing platform, raised $11.5 million in Series A funding. AVP led the round and was joined by existing investors Glasswing Ventures, Deloitte Ventures, Global Brain Ventures, angel investors, and others.

- Lanai, a Palo Alto-based AI incorporation platform for enterprises, raised $10 million in seed funding. Juxtapose led the round and was joined by Lux Capital, F7 Ventures, and BAG.

- Teal Health, a San Francisco-based at-home cervical cancer screening developer, raised $10 million in funding. Emerson Collective and Forerunner led the round and were joined by Serena Ventures and Metrodora.

- Foyer, a New York City-based homeownership savings platform, raised $6.2 million in seed funding. Alpaca VC and Hometeam Ventures led the round and were joined by Animo Ventures, Resilience VC, Accion Venture Lab, and others.

- Applied Labs, a New York City-based AI agents developer, raised $4.2 million in seed funding. Abstract led the round and was joined by Point72 Ventures, Outlander, Tetra, and angel investors.

- MarkeTeam.ai, a Tel Aviv-based AI marketing agents developer, raised $3 million in seed funding. Ocean Azul Partners led the round and was joined by Clive Sirkin, Dion Joannou, Mitch Mayers, Tony Weisman, and others.

- CapeZero, a Brooklyn-based financial platform for clean energy developers, raised $2.6 million in seed funding. Powerhouse Ventures led the round and was joined by Climactic, Avesta Fund, Virta Ventures, and Stepchange.

PRIVATE EQUITY

- Waste Eliminator, backed by Allied Industrial Partners, acquired FC Sanitation, a Toccoa, Ga.-based waste pickup services provider. Financial terms were not disclosed.

IPOS

- Ascentage Pharma, a Suzhou, China-based cancer, hepatitis B, and age-related diseases therapies developer, raised $126.4 million in an offering of 7.3 million American depositary shares priced at $17.25 on the Nasdaq. The company posted $124 million in sales for the year ending June 30, 2024. Edward Ming Guo and Takeda Pharmaceutical back the company.

- Aardvark Therapeutics, a San Diego-based metabolic diseases therapies developer, filed to go public on the Nasdaq. Decheng Capital and Vickers Venture Partners, and Jane Wu Lee back the company.

- Aurion Biotech, a Seattle-based vision loss therapies developer, filed to go public on the NYSE. The company posted $1 million in revenue for the year ending Sept. 30, 2024. Alcon Research, Deerfield, KKR, and Petrichor back the company.

- One Power, a Findlay, Ohio-based industrial power systems company, filed to go public on the NYSE. The company posted $6 million in revenue for the year ending Sept. 30, 2024. Craig A. Stoller and Ruth Stoller back the company.

FUNDS + FUNDS OF FUNDS

- Madrona, a Seattle-based venture capital firm, raised $770 million collectively for its 10th early fund and fourth acceleration fund focused on early-stage tech companies.

PEOPLE

- Bessemer Venture Partners, a San Francisco-based venture capital firm, promoted Janelle Teng to partner.

- Rackhouse Venture Capital, a San Francisco-based venture capital firm, added Brendan Baker as a partner. Previously, he was at Ridge Ventures.

- Rev1 Ventures, a Columbus-based venture capital firm, promoted Kristy Campbell to president and COO.

- Upfront Ventures, a Los Angeles-based venture capital firm, added Alex Marley as an investor. Previously, he was at Lux Capital.