Good morning. Financial services companies are highly regulated but that doesn’t mean they’re not embracing AI. And that requires doubling down on security while still focusing on innovation, according to experts.

Cybercrime has become highly sophisticated and very profitable for perpetrators, Rajat Taneja, president of technology at Visa, said during a panel session at Fortune’s Brainstorm AI conference this week in San Francisco.

Visa, a Fortune 500 company, has spent more than $3 billion in the last decade to create an AI and data infrastructure geared for the future, Taneja said. It had to do so in a trustworthy and secure manner, with fraud prevention, payment security and cybersecurity at the heart of it for protection against constant attacks.

Visa began leaning into AI over 30 years ago, and currently manages about a billion transactions a day, Taneja said. “We went from good old fashioned AI to deep learning to neural networks to all the predictive AI to now leaning into generative AI,” he explained.

That’s why Taneja believes the use cases for AI can go beyond just cyber and fraud protection. For Visa, that means using AI to reinvent and rethink commerce—a change that will be as monumental as the arrival of e-commerce, he said.

“Now comes the opportunity to move from the hunt-and-peck era of shopping,” he said. That means consumers are still searching for products themselves and trying to figure out what to buy. We’re heading toward “the self-driving commerce era,” where AI takes away some of the mundane aspects of shopping, he explained.

The speed and breadth of AI implementation at financial services companies will vary, Pegah Ebrahimi, cofounder and managing partner of FPV Ventures, said during the panel session. Ebrahimi is a former CIO and COO at Morgan Stanley.

She posed a question to consider when creating AI-use cases: “Can you pick low-hanging fruit where you can drive a ton of efficiency, versus trying to go for the moon and trying to go for something that has a really high risk?”

Many companies are starting to go in this direction, she said. You can watch the panel session here.

Have a good weekend.

Sheryl Estrada

sheryl.estrada@fortune.com

The following sections of CFO Daily were curated by Greg McKenna.

Leaderboard

Some notable moves this week:

Jérémie Papin was appointed CFO of Nissan Motor Co., Ltd., effective Jan. 1. Papin succeeds Stephen Ma, who was appointed chairperson of the management committee for China. Papin is currently chairperson of the management committee for the Americas. Before that, he gained many years of experience in finance, strategy, and business development within Nissan and the Alliance.

Michael DeVeau was appointed EVP and CFO of International Flavors & Fragrances Inc. (NYSE: IFF), effective Jan. 1. DeVeau will succeed current CFO and business transformation officer Glenn Richter, who is retiring.

Michael Holt was appointed CFO at Morningstar, Inc. (Nasdaq: MORN), a global provider of independent investment insights, effective Jan. 1. The company previously announced that Jason Dubinsky would step down at the end of the year.

Laura Russell was appointed SVP, CFO, and treasurer at Rogers Corporation (NYSE: ROG), effective Dec. 10. Russell joined Rogers in September 2023 as VP of finance and served in that capacity until her appointment as interim CFO in August 2024.

Lanny Baker was promoted to CFO of Etsy (Nasdaq: ETSY), an e-commerce company that focuses on handmade or vintage items and craft supplies, effective the first week of January. He will succeed Rachel Glaser, who announced her decision to retire in July.

Tara C. Henderson was appointed CFO of Red Roof, an economy hotel chain. A U.S. Navy veteran, she brings over 20 years of financial leadership experience across a diverse range of industries, including manufacturing, logistics, supply chain management, and transportation, the company said.

Tani Girton, EVP, CFO, and principal accounting officer at Bank of Marin Bancorp (Nasdaq: BMRC), a wholly owned subsidiary of Bank of Marin, will retire effective Jan. 31. Dave Bonaccorso, who currently serves as the bank’s treasurer, has been named her successor.

Ranojoy “RJ” Hazra was appointed CFO at HireRight, a provider of global background screening services and workforce solutions. Hazra joins HireRight with more than 15 years of executive leadership experience in the finance and technology sectors.

Big Deal

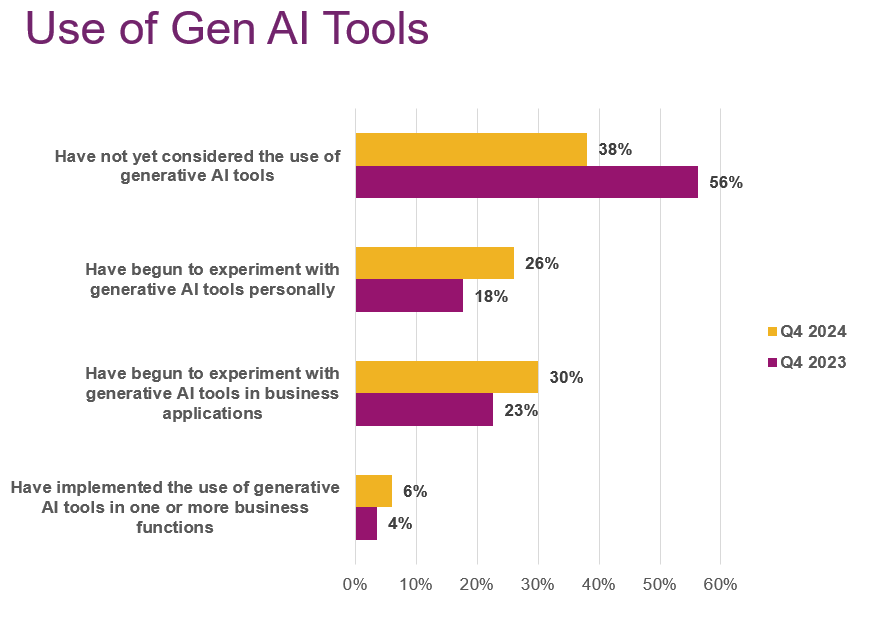

A majority of business executives are investigating how their organizations can employ GenAI, but its use in essential activities remains rare, according to a new report from the Association of International Certified Professional Accountants. The association’s quarterly economic outlook survey included 273 responses from CEOs, CFOs, controllers, and other member CPAs who hold executive and senior management roles.

Only 38% of those polled said they had not yet contemplated the use of GenAI, down from 56% last year, while the portion of respondents experimenting with the technology in their business rose from 23% to 30% in that span. Just 6% of respondents said they arefully using GenAI in key operations, however, a mark that stood at 4% last year.

“The data suggests we’re right on the cusp of broad adoption of Gen AI,” said Tom Hood, the association’s EVP for business engagement and growth. “We’re rapidly moving from the contemplation to experimentation phase. This technology has seen faster take-up rates than other adoption cycles, so we expect implementation to move quickly as well.”

Going deeper

Here are four Fortune weekend reads:

“Justworks doesn’t regret whiffing on a 2022 IPO—and has no plans to go public next year either,” by Luisa Beltran

“Exclusive: This 31-year-old Google alum raised $75 million for a frontier tech fund backed by Marc Andreessen and a cofounder of OpenAI,” by Emma Hinchliffe

“With General Motors pulling the plug on Cruise, every American automaker except Tesla has called it quits on robotaxis,” by Jessica Mathews

“Crypto giants Binance and Circle team up to take on Tether,” by Jeff John Roberts

Overheard

“There are not just billions of questions that people come to Google for, but billions of questions that people don’t even ask. And they don’t ask because it’s too hard. They don’t ask because they’re not confident they can get that answer.”

— Liz Reid, Google’s vice president of search, said on stage at Fortune’s Brainstorm AI conference in San Francisco about why she believes the search engine can successfully coexist with artificial intelligence.