Good morning. The drugstore chain Rite Aid has a new CEO—its finance chief who is a longtime executive at the company.

Rite Aid announced on Tuesday that it has emerged from federal bankruptcy protection and will operate as a private company. The new chief executive Matt Schroeder, CFO since 2019, joined Rite Aid in 2000 as VP of financial accounting. He succeeds Jeffrey S. Stein, who stepped down as CEO and chief restructuring officer in connection with the company’s emergence from Chapter 11.

Rite Aid informed me via email on Wednesday afternoon that it has appointed Steve Bixler as acting chief financial officer. Bixler has served as chief accounting officer since January 2023 but has been with Rite Aid since 2001. He has over 22 years of experience in process management, financial leadership and process improvements, particularly in inventory and revenue accounting, according to the company.

“Thanks to the dedication of the entire organization, we are beginning our next phase as a transformed company,” Schroeder said in a statement. During his tenure at Rite Aid, he has served in various leadership positions such as the role of SVP, chief accounting officer and treasurer. Schroeder’s span of responsibility also included providing “key decision-making to support” across the company in areas such as store and pharmacy operations, according to the company. Before joining Rite Aid, he worked for Arthur Andersen LLP.

Schroeder has a deep understanding of the business and is “an excellent fit for the company,” Bruce Bodaken, chair of Rite Aid’s board of directors during its Chapter 11 process, said in a statement.

Rite Aid is the latest large corporation to elevate its finance chief to chief executive. “The broad mandates of modern CFOs have given rise to historically high rates of CEOs who were once CFOs,” Clem Johnson, president of executive search firm Crist Kolder Associates, said in a statement regarding the firm’s mid-year Volatility Report. The findings are based on data from 671 Fortune 500 and S&P 500 companies. Although the percentage of CFOs promoted to CEOs in the first half of 2024 has dipped slightly (7.1%) compared to the same time last year (8.4%), it’s “trending upward overall,” according to Johnson. Across the data set, the total population of sitting CEOs who were once CFOs is almost 12%, he said.

Rite Aid has posted annual losses for several years in part due to slumping sales. It also faced controversy regarding opioid-related lawsuits. Since 2021, it has moved down 39 spots in the Fortune 500 landing at No. 171 in 2024.

The company responded to these headwinds by cutting costs and closing stores, but it was not enough to stave off bankruptcy. Going through Chapter 11, however, will help “significantly reduce the company’s debt” while helping to “resolve litigation claims in an equitable manner,” Rite Aid said in October.

Through its financial restructuring process, Rite Aid has eliminated approximately $2 billion of total debt, the company announced. Additionally, it has received approximately $2.5 billion in exit financing to support the business going forward. Ownership of the company transitioned to “certain Rite Aid creditors” and all of the company’s existing common shares were canceled—a common event in bankruptcy that was set out in the company’s plan of reorganization.

Founded in 1962, Rite Aid made its first public offering and started trading on the American Stock Exchange in 1968. It then moved to the New York Stock Exchange in 1970.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Andy Childs was named Interim CFO at Pineapple Energy Inc. (Nasdaq: PEGY) a provider of sustainable solar energy. Childs succeeds Eric Ingvaldson who, as previously announced, resigned from the position of CFO, effective Aug. 30. Childs brings nearly 25 years of accounting, finance, and operational experience across multiple industries. Before joining Pineapple, Childs was with Conduit Capital Partners, an investment group.

Big Deal

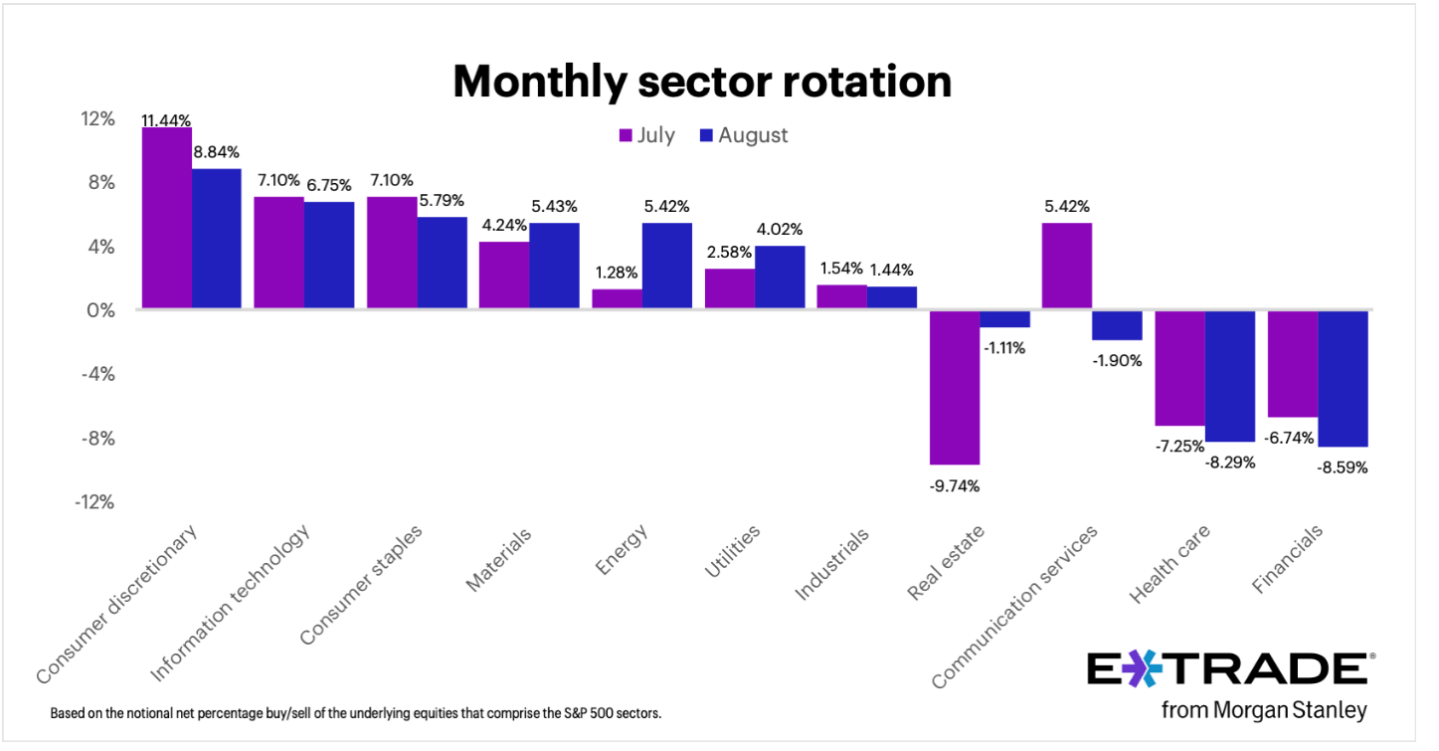

Morgan Stanley’s E-Trade released data from its monthly sector rotation study. The results are based on the trading platform’s customer notional net percentage buy/sell behavior for stocks that comprise the S&P 500 sectors.

In August, there was net buying in seven out of the 11 sectors. Consumer staples remained in the top three, fueled by interest in Costco Wholesale Corporation (NASDAQ: COST) amid news of membership fee increases, Chris Larkin, managing director of trading and investing at E-Trade from Morgan Stanley, said in a statement. Conversely, financials saw a net sell-off on the platform “with the possibility of rate cuts on the horizon and the traditionally defensive sector, health care, continued to lose interest,” according to Larkin.

Going deeper

“An Analysis of Generative Artificial Intelligence and International Trade” is a new white paper released by the World Economic Forum. Generative AI could contribute an estimated $4.4 trillion annually to the global economy, according to the organization. The white paper explores how this emerging technology is set to transform global trade by streamlining supply chains, enhancing productivity, and creating new opportunities for cross-border transactions. It also examines both the potential benefits and the challenges of generative AI.

Overheard

“We will be fully electric probably in 50% of the market way before 2030, but in the other 50%, it’s going to take a lot longer.”

—Volvo CEO Jim Rowan told Fortune in an interview during Volvo Cars’ 90/90 event in Gothenburg, Sweden, where it showcased its new hybrid XC90 and its electric EX90.