Good morning. Surge pricing, when prices fluctuate to adjust to demand, can boost a company’s margins—but also has the potential to alienate customers. The tactic, heavily used by rideshare companies, is referred to as Primetime by Lyft. But the company’s CEO David Risher plans to “open up a can of whoop ass on Primetime.”

Risher made that proclamation during the company’s Q2 earnings call on Wednesday. Not your standard quarterly call conversation. But he was making a point about surge pricing.

“Many of you have probably experienced it at one time or another, and I’m willing to bet you didn’t care for it one bit,” he said on the call. “It’s probably rideshare’s most hated feature.”

The average Primetime amount included on each Lyft ride in Q2 declined by 25% versus the first quarter, Risher said. The markets with the sharpest declines in Primetime in Q2, like Baltimore, Orlando, and Phoenix are the markets where conversion rates—the percentage of ride intents that converted to actual rides taken—are improving the most, he said.

Lyft CFO Erin Brewer said the 25% dip in Primetime has significance. “It means we continue to perfect our ability to help drivers know when and where they can choose to drive,” Brewer said on the call. “That’s great for drivers and for riders and also for the long-term health of our platform.”

The company is piloting a new feature called Price Lock, which lets a rider purchase a monthly subscription that caps the price per specific route at a specific time. However, Risher noted that Primetime “won’t ever completely go away,” as it’s an important way to “match supply and demand when demand spikes quickly.” But Price Lock, priced at under $5 per month, can seemingly “chip away” at how often it occurs, he said. Lyft’s crusade against surge pricing comes on the heels of recent scrutiny of the practice by lawmakers.

For Q2, Lyft reported revenue of $1.4 billion, an increase of 41% year-over-year, which topped expectations. The company reached an all-time high for active riders—23.7 million, up 10% year-over-year. Gross bookings were $4.02 billion, up 17%, but missed expectations by about 1%. For Q3, Lyft issued guidance for gross bookings of $4 billion to $4.1 billion. Wedbush Securities analysts adjusted the 12-month price target on Lyft to $12 from $19, maintaining a neutral rating, noting that Lyft reported “disappointing Q3 guidance” and “mixed results relative to Uber.”

Lyft’s competitor Uber reported Q2 earnings on Tuesday. Gross bookings reached $40 billion for the quarter, an increase of 19% year over year, and about 1% above Wall Street estimates. Gross bookings and adjusted EBITDA guidance for Q3 was relatively in line with Street estimates, according to Wedbush, which gave Uber an outperform rating.

It will be interesting to see if Uber will address surge pricing, as Lyft currently seems to be taking the lead on making changes in that area.

Have a good weekend.

Sheryl Estrada

sheryl.estrada@fortune.com

The following sections of CFO Daily were curated by Greg McKenna

Leaderboard

Some notable moves this week:

Thomas Michael Youngmark was appointed CFO of Trace Minerals, a Utah-based nutrition supplement company. Youngmark has more than 15 years of experience as a financial executive and has worked at consumer brands like Vital Proteins, Beam Suntory and PepsiCo.

Anurag Maheshwari was appointed CFO of industrial behemoth 3M (NYSE: MMM), effective Sept. 1. Maheshwari will succeed former CFO Monish Patolawala, who was in the role for four years before being announced as the new CFO of Chicago-based food processing giant ADM on Thursday.

David Johnson was appointed CFO of Corteva (NYSE: CTVA), a fertilizer and agriculture company, effective Sept. 16. Johnson will succeed current CEO Dave Anderson, who will serve in an advisory role until his retirement in the first quarter of 2025, the company said. Johnson arrives from Atkore, an electrical equipment manufacturer, where he also served as CFO.

Andrew Casey was appointed CFO of Amplitude (Nasdaq: AMPL), a digital analytics software developer. Casey succeeds Christopher Harms, who left the company in May.

J. Kevin Vann was promoted to CFO of Helmerich & Payne (NYSE: HP), an oil and gas drilling rig contractor, effective immediately. He succeeds Mark W. Smith, who is retiring from the position.

Tiffany Mason was appointed CFO of global tax preparation company H&R Block (NYSE: HRB), effective immediately. She succeeds CFO Tony Bowen, who announced his retirement in February and will remain with the company until September.

Adrian Ding was promoted to acting CFO of Yum China (NYSE: YUMC), a Fortune 500 fast-food company whose brands include Kentucky Fried Chicken and Pizza Hut, effective Sept. 30. He succeeds current CFO Andy Yeung, who intends to resign for personal reasons after nearly five years in the role, the company said.

Francesca Weissman was promoted to CFO of Edgewell Personal Care (NYSE: EPC), which manufactures shave, sun, skin and feminine products, effective Dec. 1. She will succeed Dan Sullivan, who has been appointed COO and will continue to serve as CFO until Weissman assumes the role.

Jeff Gonzales was promoted to CFO of Ares Commercial Real Estate Corporation (NYSE: ACRE), effective Aug. 30. He will succeed Tae-Sik Yoon, who has been appointed chief operating officer after serving 12 years as CFO.

Big Deal

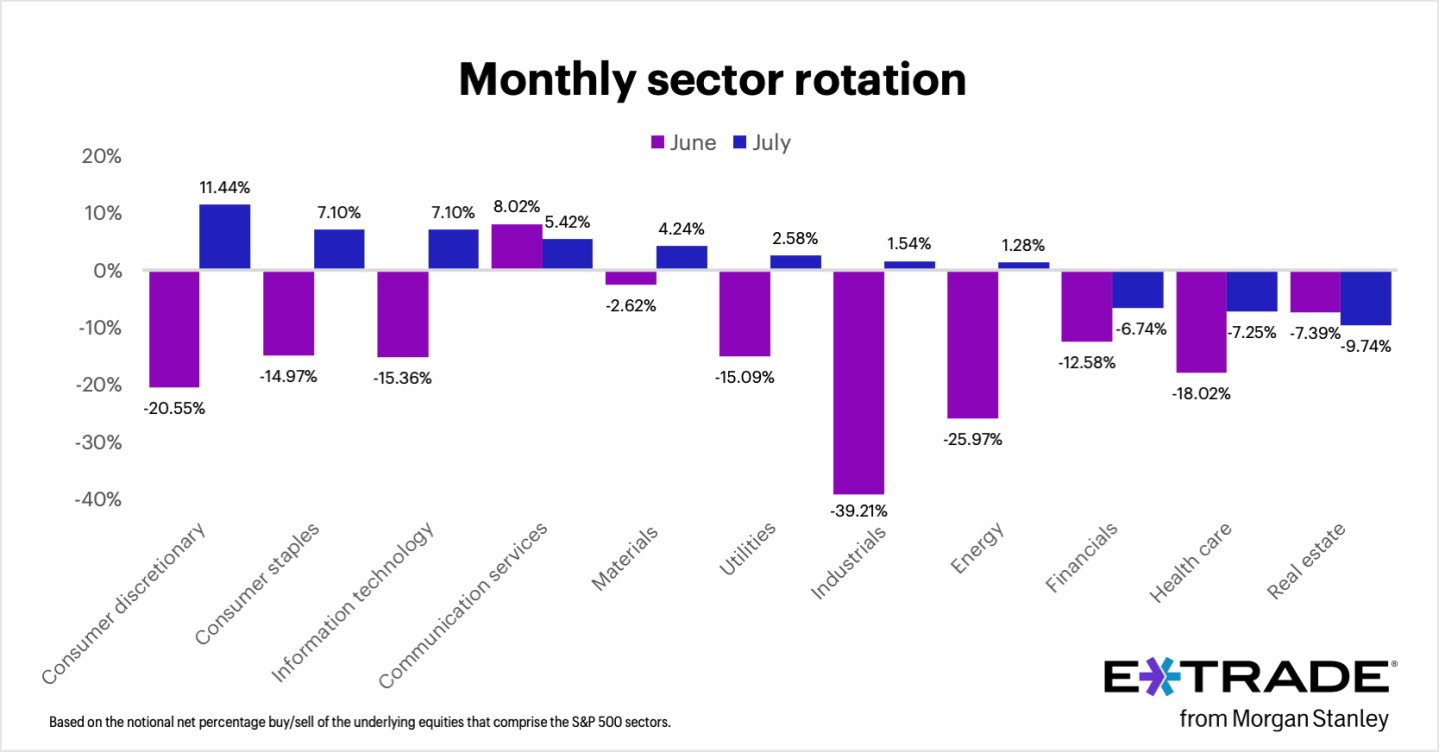

Traders took advantage of the stock market broadening out in July, according to monthly sector data released by E*Trade, which measured net buys and sells on its platform. The company reported net buying activity in eight of 11 sectors, led by consumer discretionary, consumer staples and information technology.

Investors continued to demonstrate risk-on appetite for Big Tech names like Nvidia, Amazon and Tesla, E*Trade managing director Chris Larkin said in a statement. They were bearish, he added, on areas that could be most affected by shifting interest rates, including real estate and financials.

Going deeper

Here are a few Fortune weekend reads:

“Half of boomers and Gen X are poised to run out of money in retirement—but millennials are in a better spot, says report,” by Alicia Adamczyk

“The Fed’s Powell said his 2% inflation target was non-negotiable. Jamie Dimon is skeptical it’s even possible,” by Eleanor Pringle

“Top economist: More people are looking for a job, but not because they were laid off,” by Paolo Confino

“Paul Polman: It’s time to stand with Bangladesh—and my friend Muhammad Yunus,” by Paul Polman

Overheard

“Rates are going to go up, they’re going to go down. The bigger structural issue is the lack of inventory. That’s not going away.”

— Sam Khater, chief economist at Freddie Mac, told the Wall Street Journal in an interview about mortgage rates falling to their lowest level in more than a year.