Government regulation of business is dominating the headlines these days, with the Department of Justice and dozens of states trying to break up music promoter Live Nation, a blizzard of recent actions seeking to rein in Big Tech players like Apple and Amazon, and of course, the recently signed legislation to force ByteDance to sell TikTok.

Many founders and investors sound like broken records as they grouse about the heavy hand of government regulation. But there are some interesting exceptions.

I recently checked in with a couple of prominent tech investors about the state of affairs, particularly as it relates to TikTok. After writing a series of articles about the hidden ties between TikTok and its Chinese corporate parent, I was curious to hear their takes.

My first stop was Bradley Tusk, who has made a career, and hundreds of millions, from assisting and investing in companies subject to heavy government regulation. His Tusk Ventures’ investments include rideshare giant Uber, sports betting platform FanDuel, and renter’s insurance behemoth Lemonade. He lists companies subject to the most government scrutiny—like Google, Walmart, and AT&T—as clients of Tusk Strategies. He even almost opened his own casino. And yet, Tusk, while acknowledging the seeming hypocrisy, says he is supportive of the TikTok ban.

“You have a situation where our biggest competitor [China] controls a piece of propaganda that’s in every single kid’s pocket,” says Tusk. “It’s just so overwhelmingly logical to get rid of it that it transcends parties and special interests and ideology and everything else.”

That said, Tusk believes that all social platforms are detrimental to children’s mental health and that Section 230 should be repealed. If tech companies weren’t shielded from liability by Section 230, Tusk argues, “the financial incentives would change and that would lead to better content moderation.”

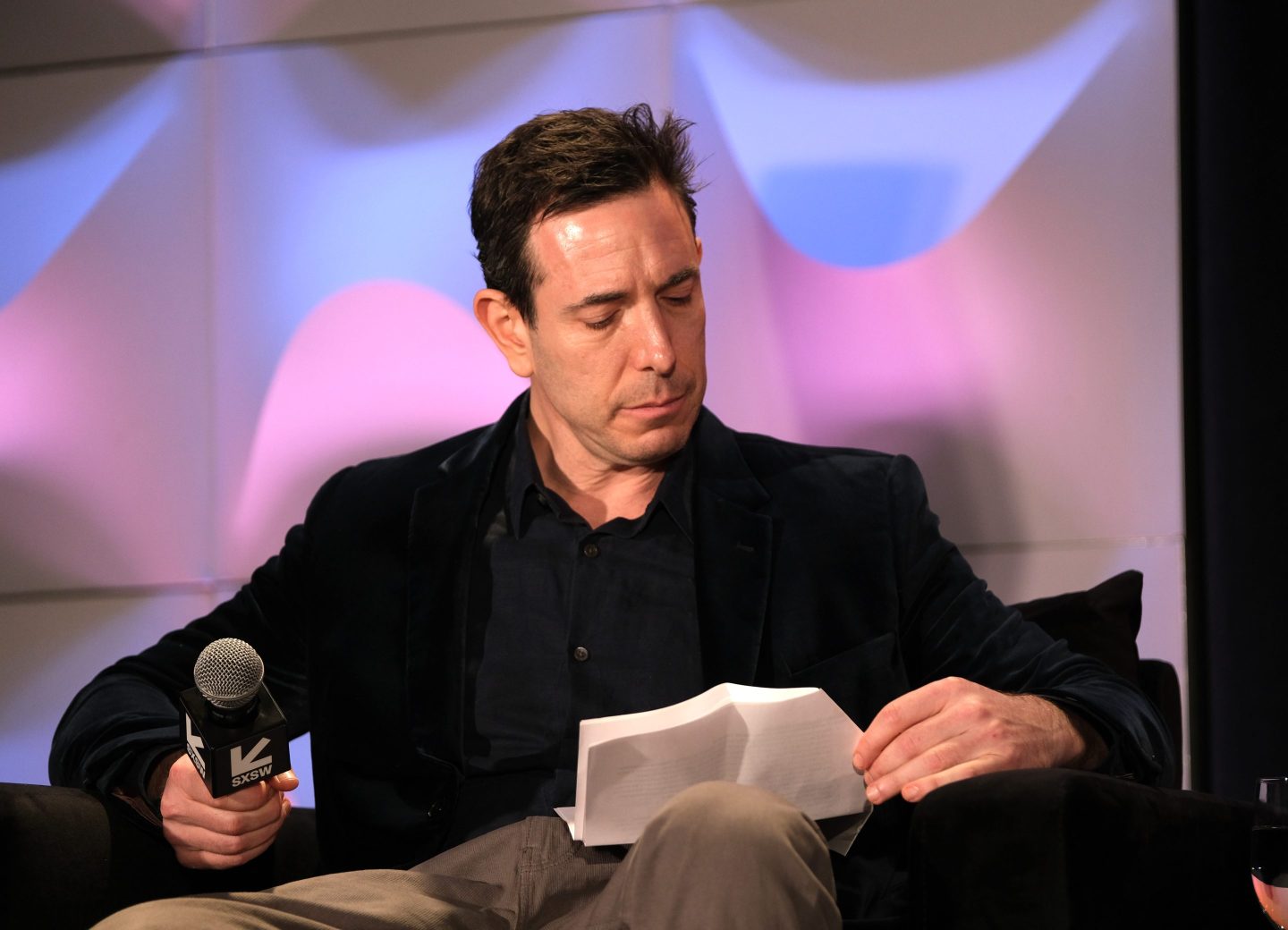

David Ulevitch, a general partner at Andreessen Horowitz who co-leads the firm’s $600 million defense tech American Dynamism program, feels the same as Tusk when it comes to TikTok. “When we have a situation where so many Americans are being influenced by an adversary of the United States, a ban makes a lot of sense,” he told Fortune.

Ulevitch, who led a16z’s Series B investment in defense giant Anduril, thinks the negative mental health repercussions that stem from social media use may be beneficial to countries like China and Russia. “If you can make an entire population of people feel really depressed or feel really bad about themselves, that has consequences—that may be an objective of a foreign adversary.”

With an election approaching, the comments show how investor attitudes towards regulation and tech policy aren’t as clear cut as they might once have seemed.

What about regulation outside of tech? I asked Tusk, who recently wrote a book called Vote With Your Phone: Why Mobile Voting Is Our Final Shot at Saving Democracy, about the LiveNation lawsuit. “Absolutely the right move,” he said. “When you have a company that has so much market dominance and is so hated universally by consumers, it’s definitely the right move,” Tusk wrote in a text.

He followed up moments later to note that he has equity in LiveNation rival StubHub. “But I’d have the same view here either way,” he added.

Term Sheet is off Monday, May. 27 for Memorial Day. We’ll be back in your inboxes Tuesday, May 28.

Alexandra Sternlicht

Twitter: @iamsternlicht

Email: alexandra.sternlicht@fortune.com

Submit a deal for the Term Sheet newsletter here.

Joe Abrams curated the deals section of today’s newsletter.

VENTURE DEALS

- Syre, a Stockholm, Sweden-based developer of textile recycling technology, raised $100 million in Series A funding. TPG Rise Climate led the round and was joined by H&M Group, Giant Ventures, IMAS Foundation, and others.

- Grey Wolf Therapeutics, an Abingdon, U.K.-based developer of therapeutics for immunologically-driven diseases, raised $50 million in Series B funding. ICG Life Sciences led the round and was joined by Pfizer Ventures, Andrea Partners, Canaan, Earlybird Venture Capital, Oxford Science Enterprises, and British Patient Capital.

- Lumos, a San Francisco-based platform designed to centralize access to app and identity management for IT and security teams, raised $35 million in Series B funding. Scale Venture Partners led the round and was joined by Andreessen Horowitz, Harpoon Ventures, Neo, and others.

- Orca AI, a London, U.K.-based developer of AI-powered autonomous navigation technology for ships and fleets, raised $23 million in funding. OCV Partners and Mizmaa Ventures led the round and was joined by Ankona Capital Partners, Santa Barbara Venture Partners, Playfair Capital, and others.

- Radar Therapeutics, a Berkeley, Calif.-based developer of precision therapeutics, raised $13.4 million in seed funding. NfX Bio led the round and was joined by Eli Lilly and Company, Biovision Ventures, KdT Ventures, PearVC, BEVC, and others.

- Remark, a New York City-based platform that connects shoppers with product experts and product commentary, raised $10.3 million in funding from Spero Ventures, Stripe, Shine Capital, Neo, Sugar Capital, Visible Ventures, and others.

- Plume Network, a San Francisco-based modular L2 blockchain specifically for tokenized real-world assets like sneakers, cash, and artwork, raised $10 million in seed funding. Haun Ventures led the round and was joined by Galaxy Ventures, Superscrypt, A Capital, SV Angel, Portal Ventures, Reciprocal Ventures, and others.

- Welbe, a Mexico City, Mexico-based occupational health management platform for large companies, raised $7 million in Series A funding. Volpe Capital and the International Finance Corporation led the round and was joined by NAZCA, Kortex, GreenRock, Marathon, and Parceiro Ventures.

- Bootloader Studio, a Singapore and Ho Chi Minh City, Vietnam-based developer of AI designed to be capable of reading and responding to human emotion, raised $5 million in seed funding led by Antler Elevate.

- Viable, a London, U.K.-based company developing technology designed to streamline financial operations for e-commerce businesses, raised £2.4 million ($3.1 million) in seed funding from Episode 1, Haatch, Portfolio Ventures, and angel investors.

PRIVATE EQUITY

- Merck KGaA agreed to acquire Mirus Bio, a Madison, Wisc.-based provider of transfection products for the biopharmaceutical and research industries, from Gamma Biosciences, backed by KKR, for $600 million in cash.

- KPS Capital agreed to acquire a 49.7% stake in Primient, a Schaumburg, Ill.-based producer of food and industrial ingredients made from plant-based, renewable resources, from Tate & Lyle for $350 million.

- Goldman Sachs Alternatives acquired Xpress Wellness, an Oklahoma City, Okla.-based operator of two primarily-urgent care focused providers of health care services, from Latticework Capital Management. Financial terms were not disclosed.

- OnBoard, a subsidiary of Passageways and backed by JMI Equity, acquired Govenda, a Pittsburgh, Pa.-based AI tool for board management. Financial terms were not disclosed.

- PestCo Holdings, a portfolio company of Thompson Street Capital Partners, acquired Enviro-Safe Pest Control, a Perrineville, N.J.-based provider of commercial pest control services. Financial terms were not disclosed.

EXITS

- Intermediate Capital Group acquired a partial stake in Law Business Research, a London, U.K.-based information services company for the legal, intellectual property, and compliance, from Levine Leichtman Capital Partners. Levine Leichtman Capital Partners will remain minority shareholders. Financial terms were not disclosed.

IPOS

- Bowhead Specialty Holdings, a New York City-based property and casualty insurance company, raised $128 million in an offering of 7.5 million shares priced at $17 on the New York Stock Exchange. The company posted $283 million in revenue for the year ending December 31, 2023.