Good morning. As a Department of Justice investigation of Archer-Daniels-Midland continues, the agricultural giant and its CFO have agreed to part ways.

In January, I reported that CFO and SVP Vikram Luthar, in the role since 2022, had been placed on administrative leave—Ismael Roig was named interim CFO—amid an investigation of accounting issues tied to ADM’s nutrition segment, which produces ingredients for both human and animal food. The inquiry was sparked by a voluntary document request from the Securities and Exchange Commission.

And now with Luthar, according to an April 19 SEC filing by ADM, agreeing to resign as CFO effective Sept. 30, I contacted the company to see what its plans were regarding a permanent finance chief.

“ADM has initiated a formal selection process to identify the company’s next CFO,” the company told me in an email. “Vikram Luthar is transitioning to a non-executive position, until the end of September, to support transitional efforts as needed. We appreciate Vikram’s many years of service to ADM, and wish him the best in the future.” The company didn’t comment on the ongoing investigation.

Luthar, who joined ADM in 2004 and has held several financial leadership roles, will receive his annual cash performance incentive award of $743,419 for 2023 and the shares earned for his 2021 performance share unit award, according to the filing. This is based on the “company performance metrics that applied to other executive officers,” the document states. He’ll also receive his paid base salary during the transition period. And if Luthar remains as an employee through July 1, he’ll be eligible to receive a prorated 2024 cash performance incentive payment.

Following ADM’s announcement of an internal investigation, the company received document requests from the DOJ. The agency directed grand jury subpoenas to “certain current and former company employees,” according to a 10-K filing. ADM’s internal investigation found “a material weakness” in its internal control over financial reporting related to its accounting practices and procedures for intersegment sales, according to the company.

“There is a larger problem at ADM as this scandal didn’t begin and end with Mr. Luthar,” said Shawn Cole, president and founding partner of Cowen Partners, a C-suite-focused executive search firm.

Roig has served in various finance and operational leadership roles at ADM for two decades, and as a member of the firm’s executive council for 10 years.

“My bet is on the internal candidate, as a qualified outside hire will be difficult to attract without significant financial incentives to retain—even then the willing candidate pool will be small,” Cole told me.

Last month, Roig, during his first earnings call as interim CFO, said the priorities for cash deployment in 2024 would remain focused around the shareholders. The company repurchased almost $1.6 billion in shares in Q4 2023 and “nearly $330 million of shares so far in Q1” as part of a plan to “actualize $2 billion of additional share repurchases” this year.

And Although Roig may a front-runner, Cole said many of those same shareholders benefitting from the buybacks may prefer an outside hire for the full-time CFO spot, someone with “a clean resume, spotless reputation, a Big Four 4 auditor, significant internal controls, and financial reporting experience. This is a financial reporting trust issue, and the entire accounting and finance function should be under scrutiny.”

Sheryl Estrada

sheryl.estrada@fortune.com

María Soledad Davila Calero curated the Leaderboard and Overheard sections of today’s newsletter.

Upcoming event: Fortune‘s Future of Finance event in New York City will take place on May 16. It’s going to be a unique opportunity to explore with top players how technology is set to transform finance. You can learn more about it and apply to attend; email FutureFinance@Fortune.com with inquiries.

Leaderboard

Daniel Hopgood was named EVP and CFO at the precision technology manufacturer Nordson Corporation (Nasdaq: NDSN), effective May 20. Hopgood succeeds Joseph Kelley, who moved to the role of EVP and Industrial Precision Solutions segment leader. Before joining Nordson, Hopgood worked at Eaton Corp., where he served as SVP of finance, and most recently as controller and chief accounting officer.

Paul Todgham was named CFO at the hiring platform Greenhouse. Todgham has over 20 years of experience, most recently as CFO at Cognex Corp. He also spent six years at Levi Strauss & Company, where he held a range of senior leadership positions, including leading finance for the company's global supply chain, distribution, merchandising, planning, design, and marketing teams.

Big deal

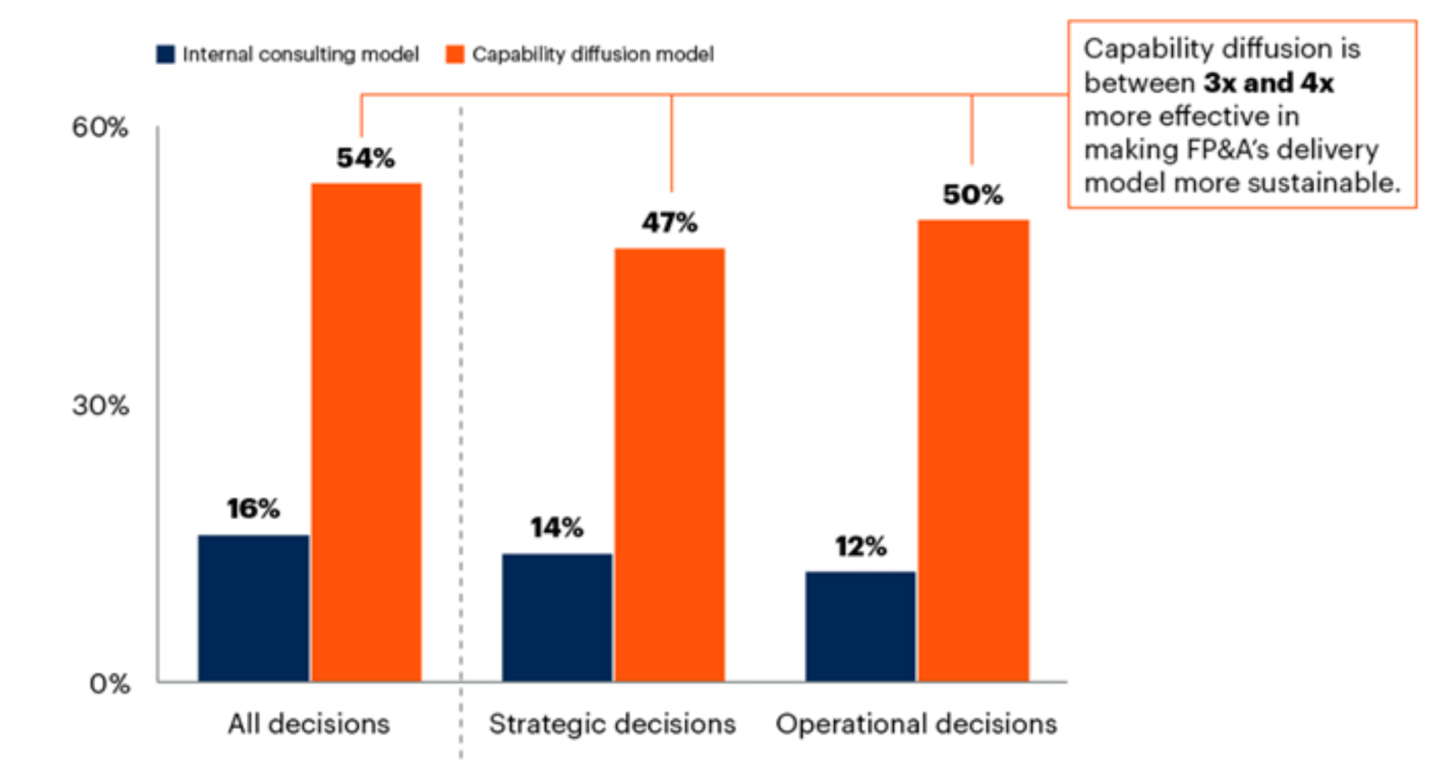

Financial planning and analysis (FP&A) teams are in demand for decision support in times of economic uncertainty. A Gartner survey of 273 FP&A managers and finance business partners and 102 senior decision makers found that only 15% of FP&A leaders reported having a sustainable delivery model.

The most common scenario in FP&A functions is an “internal consulting model,” which uses automation to free staff capacity, according to Gartner. This provides FP&A teams more time to spend on activities such as finance business partnering.

However, leading FP&A organizations have discovered a scalable way for FP&A to deliver value-added insights to the company by using a “capability diffusion model,” according to the report. In this model, technology is the “default channel” for providing decision support. That means using FP&A decision support that is embedded into technology tools and in-person business partnering is the exception. Gartner finds that the capability diffusion model is more sustainable for FP&A teams to keep up with demand.

Going deeper

The Federal Trade Commission (FTC) issued a final rule on Tuesday banning noncompetes nationwide. “Noncompetes are a widespread and often exploitative practice imposing contractual conditions that prevent workers from taking a new job or starting a new business. Noncompetes often force workers to either stay in a job they want to leave or bear other significant harms and costs,” the FTC said in a statement. An estimated 30 million workers—nearly one in five Americans—are subject to a noncompete, according to the federal agency.

Overheard

“It took us some time to find our footing, but more than four months into this transition, I think we’re back on track and I expect to continue improving on our execution throughout the year.”

—Spotify CEO Daniel Ek said during the company’s Q1 earnings call. Ek recognized that reducing headcount by 1,500 people, which amounted to 17% of Spotify’s workforce, had a bigger impact than they originally thought.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.