The Biden administration is canceling student loans for another 206,000 borrowers as part of a new repayment plan that offers a faster route to forgiveness.

The Education Department announced the latest round of cancellations Friday in an update on the progress of its SAVE Plan. More people are becoming eligible for student loan cancellation as they hit 10 years of payments, a new finish line for some loans that’s a decade sooner than what borrowers faced in the past.

Casting a shadow over the cancellations, however, are two new lawsuits challenging the plan’s legality. Two groups of Republican-led states, fronted by Kansas and Missouri, recently filed federal suits arguing that the Biden administration overstepped its authority in creating the repayment option.

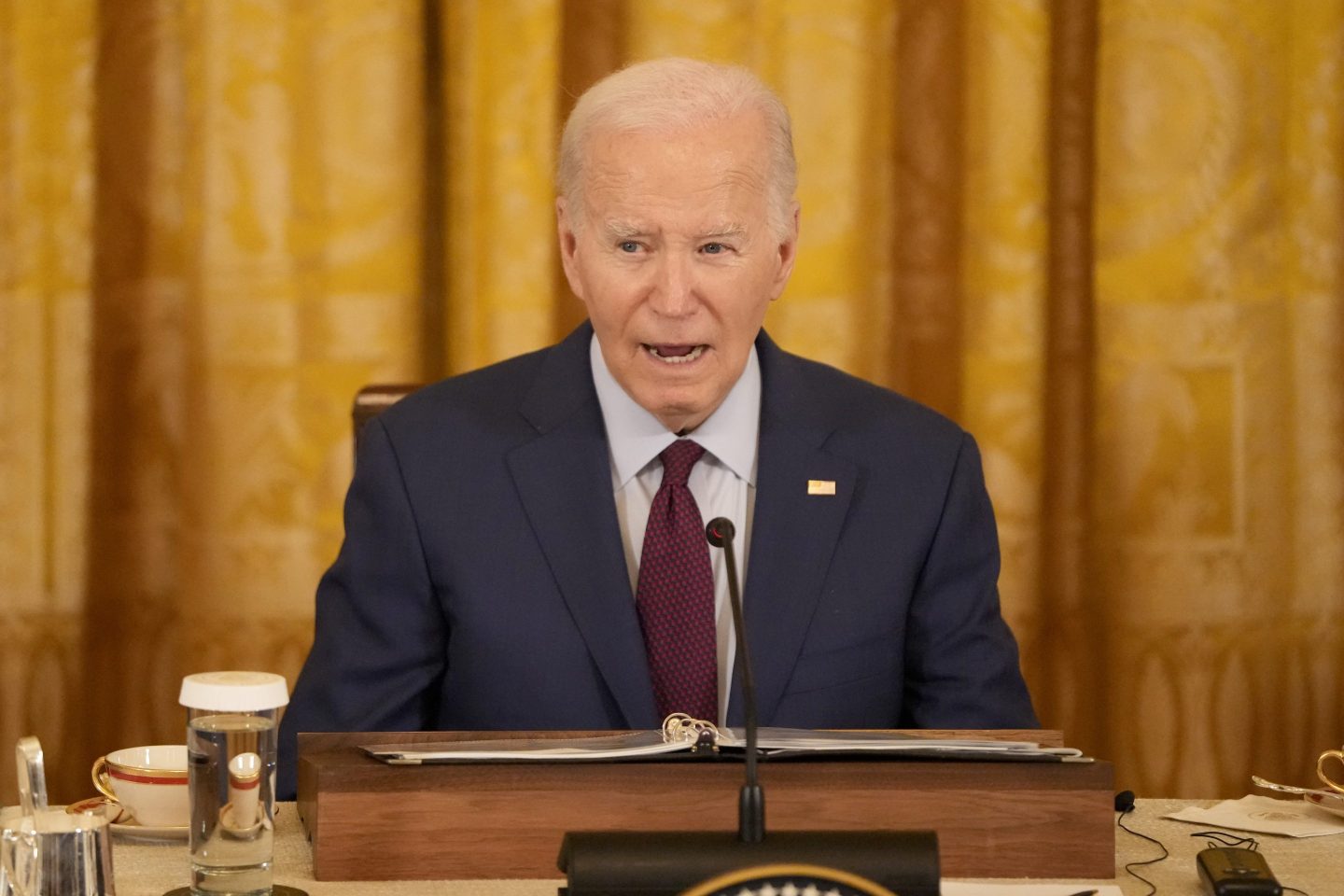

“From day one of my Administration, I promised to fight to ensure higher education is a ticket to the middle class, not a barrier to opportunity,” President Joe Biden said in a statement. “I will never stop working to cancel student debt — no matter how many times Republican elected officials try to stop us.”

With the latest action, the Education Department has now approved cancellation for about 360,000 borrowers through the new repayment plan, totaling $4.8 billion.

The SAVE Plan is an updated version of a federal repayment plan that has been offered for decades, but with more generous terms.

Congress created the first income-driven repayment option in the 1990s for people struggling to afford payments on standard plans. It capped monthly payments to a percentage of their incomes and canceled any unpaid debt after 25 years. Similar plans were added later, offering cancellation in as little as 20 years.

Arguing that today’s borrowers need even more help, the Biden administration merged most of those plans into a single repayment option with more lenient terms.

The SAVE (Saving on a Valuable Education) Plan allows more borrowers to pay nothing until their income rise above certain limits. It also lowers payments more than past plans, eliminates interest growth and cancels unpaid debt in as little as 10 years.

Biden announced the plan in 2022 alongside his broader proposal for a one-time cancellation of up to $20,000 for more than 40 million people. While the one-time cancellation was struck down by the Supreme Court, the SAVE Plan moved forward and initially escaped legal scrutiny.

The repayment plan opened for enrollment last fall, with certain provisions scheduled to be phased in later this year. The faster path to cancellation was among those slated to start this summer, but the Biden administration fast-tracked that benefit early this year, announcing forgiveness for 153,000 borrowers who had hit 10 years of payments.

Almost 8 million Americans have enrolled in the plan, including 4.5 million who pay nothing because they have lower incomes.

In a call with reporters, Education Secretary Miguel Cardona said the plan provides relief and prevents borrowers from falling behind on their loans.

“Now they have some money back in their pockets, instead of a bill that too often competed with basic needs like groceries and health care,” he said.

Under the plan, borrowers who originally borrowed $12,000 or less are eligible for forgiveness after 10 years. Those who took out more than $12,000 can get cancellation but on a longer timeline. For each $1,000 borrowed beyond $12,000, it adds an additional year of payments on top of 10 years.

The Biden administration says it’s designed to help those who need it most. Counterintuitively, those with smaller student loan balances tend to struggle more. It’s driven by millions of Americans who take out student loans but don’t finish degrees, leaving them with the downside of debt without the upside of a higher income.

In two separate lawsuits, Republican attorneys general in 18 states are pushing to have the plan tossed and to halt any further cancellation. They say the SAVE Plan goes beyond Biden’s authority and makes it harder for states to recruit employees. They say the plan undermines a separate cancellation program that encourages careers in public service.

It’s unclear what the suits could mean for loans that have already been canceled. A court document filed by Kansas’ attorney general says it’s “unrealistic to think that any loan forgiveness that occurs during this litigation will ever be clawed back.”

The lawsuits don’t directly address the question, and the attorneys general didn’t immediately respond to an Associated Press request.

The Education Department says Congress gave the agency power to define the terms of income-driven payment plans in 1993, and that authority has been used in the past.

Along with the repayment plan, Biden is trying again at a one-time student loan cancellation. In a visit to Wisconsin on Monday, he highlighted a proposal to reduce or cancel loans for more than 30 million borrowers in five categories.

It aims to help borrowers with larges sums of unpaid interest, those with older loans, those who attended low-value programs, and those who face other hardships preventing them from repaying student loans. It would also cancel loans for people who are eligible for other forgiveness programs but haven’t applied.

The Biden administration says it will accelerate parts of the proposal, with plans to start waiving unpaid interest for millions of borrowers starting this fall. Conservative opponents have threatened to challenge that plan, too.

On Friday the administration also said it’s canceling loans for 65,000 borrowers who are enrolled in older income-driven repayment plans and hit the finish line for forgiveness. It also announced cancellation for another 5,000 borrowers through the Public Service Loan Forgiveness program.

Through a variety of programs, the Biden administration says it has now provided loan relief to 4.3 million people, totaling $153 billion.

___

The Associated Press’ education coverage receives financial support from multiple private foundations. AP is solely responsible for all content. Find AP’s standards for working with philanthropies, a list of supporters and funded coverage areas at AP.org.