Good morning. Just before 1:30 a.m. on Tuesday, a 948-foot Singapore-flagged container ship leaving the Port of Baltimore struck the Francis Scott Key Bridge, which collapsed in several places and plunged into the Patapsco River. At least eight people fell into the river and two survived. But, tragically, six construction workers are missing and presumed dead, and the search for them will resume this morning.

The container ship, Dali, was chartered by Danish shipping giant Maersk, but owned by Grace Ocean and operated by Synergy Group. “We are deeply concerned by this incident and are closely monitoring the situation,” Maersk said in a statement on Tuesday. “We are omitting Baltimore on all our services for the foreseeable future, until it is deemed safe for passage through this area.”

The vessel reportedly lost control, but it isn’t the first time Dali was involved in a major accident. It also isn’t the first time CFOs suddenly have been confronted with a major supply chain disruption.

The Port of Baltimore—closed until further notice—is busiest in the U.S. for car shipments, and in 2023 handled more than 750,000 vehicles, according to data from the Maryland Port Administration, Reuters reported. The port handles imports and exports for major automakers such as General Motors.

I reached out to GM, and a spokesperson said in an emailed statement: “Our thoughts are with those who were affected and the Baltimore community. We expect the situation to have minimal impact to our operations. We are working to re-route any vehicle shipments to other ports as recovery work continues.”

Although Ford manufactures most of its vehicles in the U.S., the company’s CFO, John Lawler, said his firm’s supply chain could be affected.

“First and foremost, our thoughts are with those impacted in the city of Baltimore,” Lawler said in an interview with Bloomberg on Tuesday. “It’s a large port with a lot of flow through it, so it’s going to have an impact. It’s just that, at this point, we’ll have to understand what that will mean for us, specifically.”

Ford will have to divert parts to other ports—on the East Coast or elsewhere in the U.S.—Lawler said.

“It will probably lengthen the supply chain a bit,” he added. “I would say that we have experience now in understanding supply chain disruptions, so we’ll just put that experience to work and figure out the best solution.”

Whether it’s a global pandemic or extreme weather or geopolitics, CFOs are playing bigger roles in helping to navigate supply chain issues. And, according to a recent report by Deloitte, maintaining stakeholder trust is essential.

“When companies face catastrophic events,” the report notes, “confidence in suppliers’ capability, reliability, humanity, and transparency become critical.”

Do you have a story about overcoming a supply chain issue that could help other readers of CFO Daily? Send me an email and maybe we’ll include them in a future newsletter.

Sheryl Estrada

sheryl.estrada@fortune.com

María Soledad Davila Calero curated the Leaderboard and Overheard sections of today’s newsletter.

Leaderboard

Jeffrey DiGiovanni was named CFO at Innovative Solutions & Support (Nasdaq: ISSC), a flight guidance and cockpit display manufacturer. DiGiovanni's appointment is effective April 8, when he will replace interim CFO Relland M. Winand. Before ISSC, DiGiovanni served as CFO for StoneMor.

Michael Herring was named CFO at Viz.ai, a disease detection and coordination platform. Herring's over 30 years of experience include serving as CFO for the health technology company Color Health, and also as CFO at Pandora Media and Ancestry.com.

Big deal

Mercer Investments' AI integration in investment management 2024 global manager survey provides insights on AI adoption. The survey included 150 asset management managers from various asset classes. Ninety-one percent of managers are currently (54%) or planning to (37%) use AI within their investment strategy or asset class research.

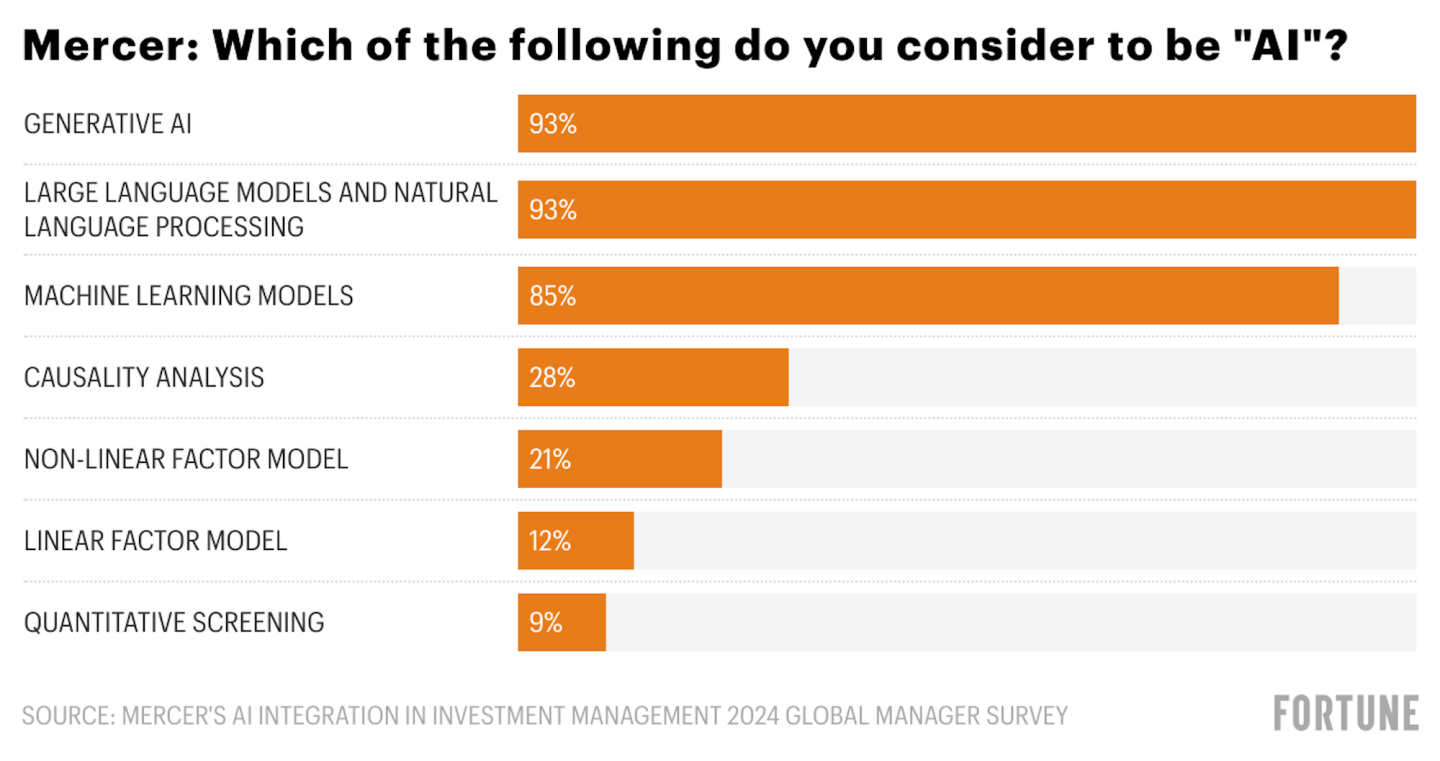

One of the key findings of the report is managers clearly agree on what constitutes AI, suggesting that when they report use of AI, they are referring to what could be termed “core capabilities," such as generative AI, large language models (LLMs) and natural language processing (NLP), and machine learning.

Currently, managers’ use of generative AI capabilities lags behind the reported use of ML and LLMs, according to the report. Just over a quarter of managers (26%) report current use of generative AI, relative to nearly half (48%) currently using ML, and 44% using LLMs and NLP.

However, generative AI is a focus in managers’ future plans. Fifty-one percent intend to use generative AI capabilities in the future, compared with 43% who plan to use LLM and NLP, and a quarter who plan to use ML (25%), according to Mercer.

Going deeper

A new study released by Nasdaq, "Scaling Today's Carbon Markets: A New Market Blueprint for 2024," examines the voluntary carbon market ecosystem based on a global survey of over 130 decision-makers across project owners, financial investors, commercial banks, brokers, and market operators. The study was produced in partnership with the ValueExchange.

The survey finds that the market for voluntary carbon credits is growing and attracting more diverse participants. However, price transparency, market inefficiencies, and fragmentation are preventing scale, according to the study.

Overheard

“Corporate actions that impact society more broadly should be fully integrated into long-term strategy, not delegated to a public relations or human resources organizational silo.”

—Bruce Shaw, executive director of The Denny Center for Democratic Capitalism at Georgetown Law in Washington, D.C., argued in his latest opinion piece for Fortune. For Shaw, companies looking at how their actions affect the economy and society, more generally, is not an altruistic venture but a way to find long-term success.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.