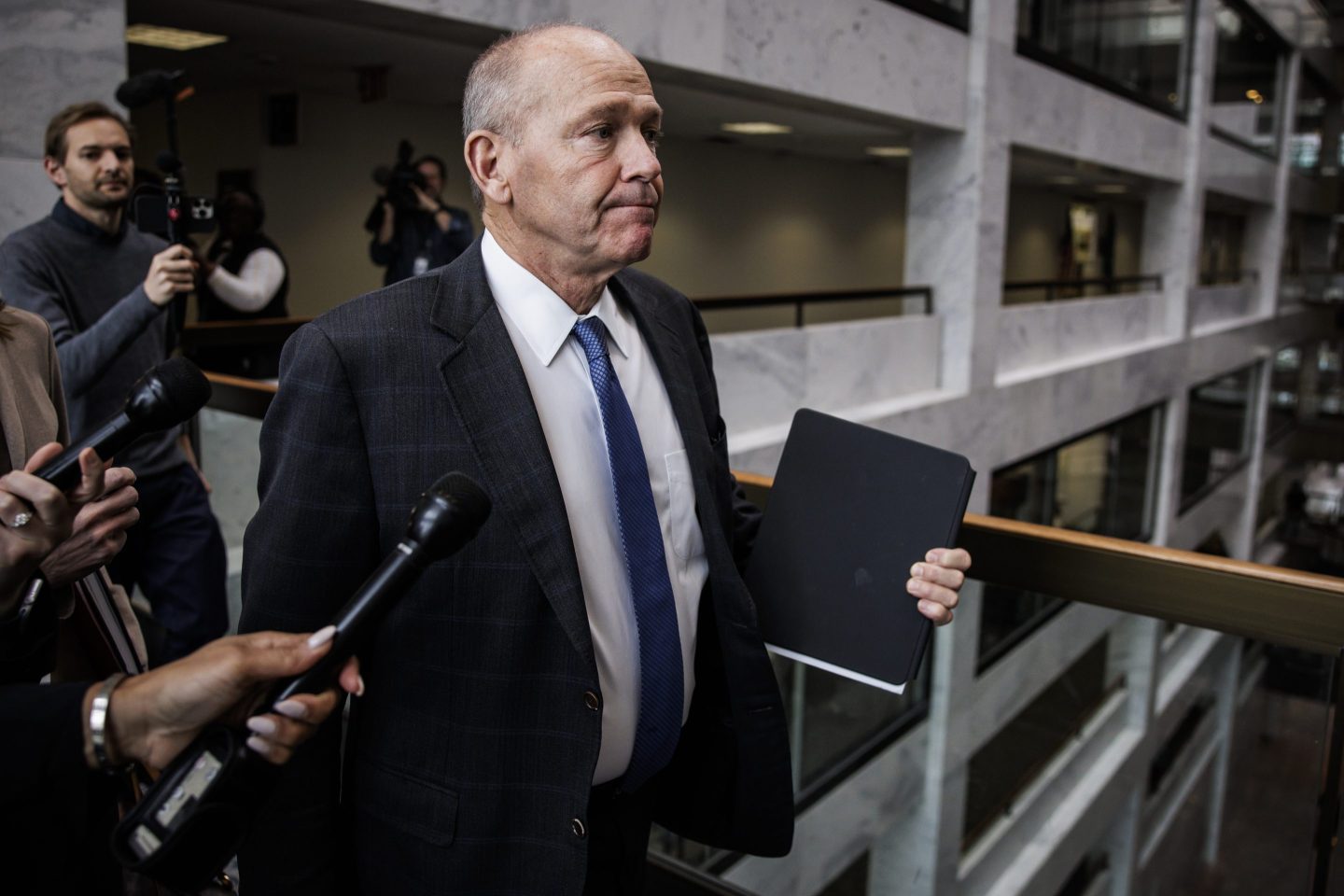

Good morning. After a door-panel blowout in January on an Alaska Airlines 737 Max, leadership changes at Boeing were all but certain. Now that includes a new CEO.

Boeing, no. 58 on the Fortune 500, announced on Monday that president and CEO Dave Calhoun—a 26-year GE veteran who took over in January 2020—would be stepping down at the end of 2024. Stan Deal, Boeing Commercial Airplanes president and CEO, will retire, and Stephanie Pope has been appointed to lead BCA, effective Monday. (Last month, Boeing announced that Ed Clark, head of its 737 program, would be leaving the company, and Katie Ringgold, a long-time engineering and operations leader, was appointed to the role.)

Larry Kellner, a board chair, won’t be running for reelection. Steve Mollenkopf, the former CEO of Qualcomm, has been named to succeed Kellner and will lead the board’s search for the next CEO.

Brian West, EVP and CFO at Boeing, wasn’t mentioned in Monday’s announcement. A company spokesperson later confirmed to me via email he’ll remain on as CFO.

West joined the company in August 2021 after serving as CFO at Refinitiv. He also held CFO and operations roles at Oscar Health and Nielsen, and before that spent 16 years at GE. At the Bank of America Global Industrials Conference on March 20, he said of Boeing’s recent troubles: “It’s a hard moment, and we’re probably better because of it. But I’m confident we’re going to see our way through it.”

West also said the company would see free cash flow usage of up to $4.5 billion during the current quarter as it works to strengthen and support production lines. Scrutiny of its manufacturing process isn’t new. “The 108-year-old corporate icon had been dogged by safety concerns since two fatal crashes darkened its reputation and sent its finances reeling a half-decade ago—the Lion Air and Ethiopian Airlines disasters that together killed 346 people,” Fortune’s Shawn Tully wrote last month.

So how will Boeing’s board respond? “The best leaders are forged in fire,” Ron Epstein, an analyst with Bank of America, said in a note to investors. “This may be the first real chance, in a long time, Boeing has had to clean house and reset their own narrative.”

To find out what boards, in a general sense, look for when conducting CEO searches, I had a chat with Jenna Fisher, managing director and co-head of the CFO practice at Russell Reynolds Associates (RRA), an executive search firm.

“We usually think the best predictor of the future is past performance,” Fisher said. “And that means somebody who has been through other analogous challenging situations.”

But following the pandemic, Fisher added, more companies are turning to first-time C-suite talent—CEOs, CFO, officers, you name it. Candidates still need to leverage their expertise, but there’s a greater emphasis on learning agility and leading across teams.

“How can someone who perhaps has never had any exposure to a particular challenge or area come up to speed relatively quickly?” Fisher said. “This requires systems thinkers, something we have seen our clients request with much greater regularity post-pandemic.”

RRA data shows that more CFOs are being considered for the top spot. In 2023, 24% of S&P 500 CFOs who changed jobs moved to CEO or president roles, which is slightly down from 33% in 2022 but still much higher than 8.8% in 2021.

However, Fisher noted: “In almost every case in the S&P 500 that we’ve seen, there tends to be an interim step where the CFO expands his or her duties to become COO, or president, before taking on the CEO role.”

While it’s unclear how shifting leadership may affect West’s role, what’s absolutely clear is that Boeing’s board faces a very tall task.

Sheryl Estrada

sheryl.estrada@fortune.com

María Soledad Davila Calero curated the Leaderboard and Overheard sections of today’s newsletter.

Leaderboard

Dava E. Ritchea was appointed CFO at Affiliated Managers Group (NYSE: AMG), an assets management company, effective April 1. Ritchea previously served as the CFO for Sculptor Capital Management and Assured Investment Management. Her experience in private markets and liquid alternatives were key reasons for her appointment, according to the company.

Marjorie Hargrave will take over on April 10 as CFO of Hallador Energy Company (Nasdaq: HNRG). Hargrave is replacing longtime CFO, Lawrence D. Martin, who has worked for the energy company since 2007 and will remain for a transition period. Hargrave has served as CFO at High Sierra Energy, CTAP, Enservco Corporation, and Leanin’ Tree, Inc.

Big deal

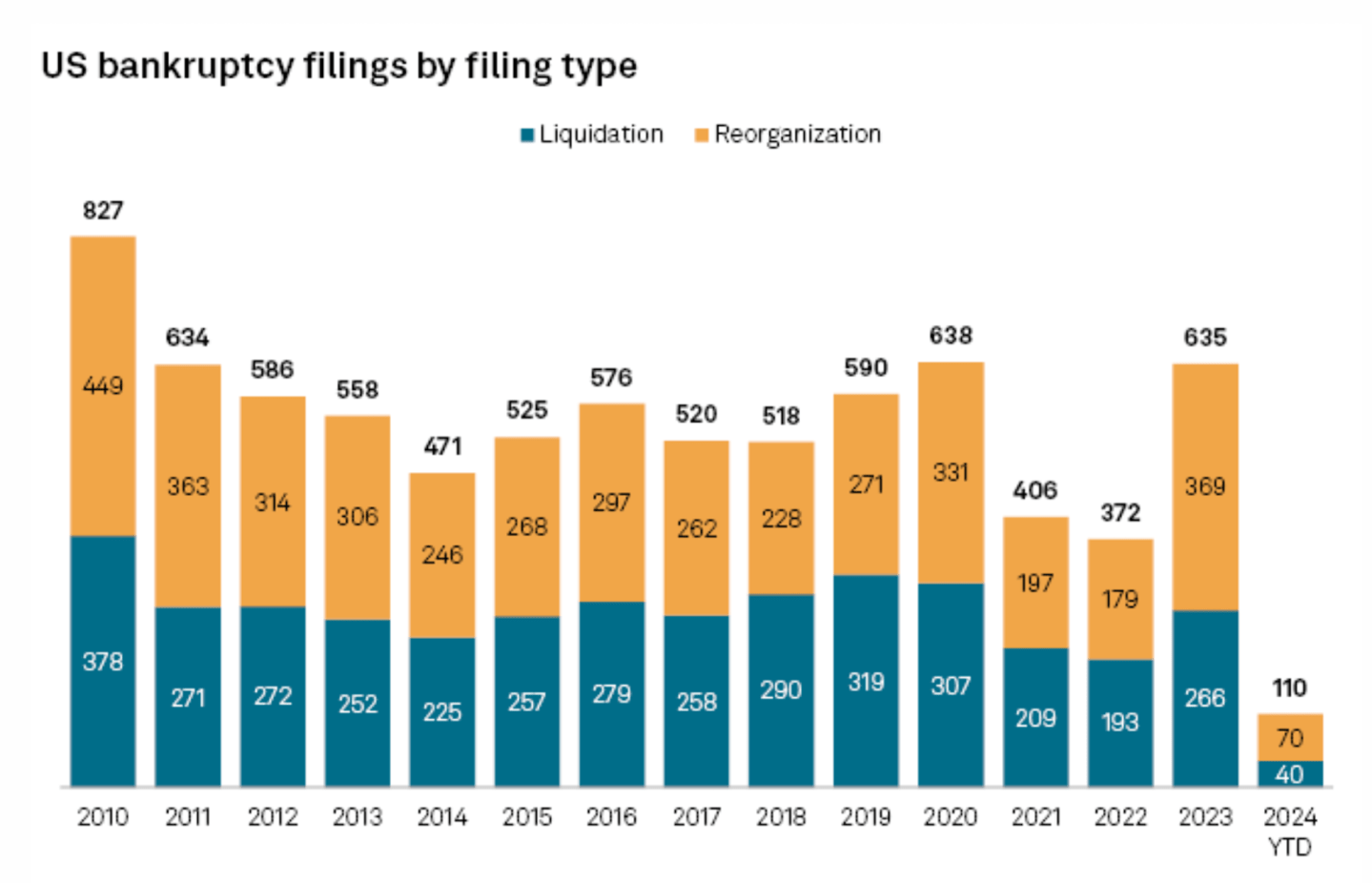

An S&P Global Market Intelligence report finds that reorganization is becoming a more popular option for U.S. companies seeking to address their financial challenges through bankruptcy. In 2023, compared to any other year since 2010, a greater proportion of companies pursuing bankruptcy opted to reorganize instead of liquidate, according to the report.

Going deeper

“ESG Investments Lead to Higher Sales,” a report in Wharton's business journal, explores research by Wharton visiting professor of finance Jean-Marie Meier that finds consumers really do care about ESG. “Consumers really are putting their money where their mouth is,” Meier said in the report. “This is good news for firms that want to pursue ESG practices. And for others that are unsure, this paper is evidence that it might be worth it.”

Overheard

“The number of safety-related events in recent weeks have rightfully caused us to pause and evaluate whether there is anything we can and should do differently.”

— Sasha Johnson, United Airlines’ vice president of corporate safety, said in a memo to employees late Friday. United Airlines lost $600 million in value after the Federal Aviation Administration announced it would increase oversight of the airline following a series of safety mistakes.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.