Good morning. Finance chiefs have traditionally viewed marketing as a cost center, but at least one CFO and CMO tandem is working to turn it into a growth center.

e.l.f. Beauty, an American cosmetics brand, rang the opening bell at the New York Stock Exchange on Monday in celebration of the company’s 20th anniversary. I sat down with Kory Marchisotto, SVP and chief marketing officer, and Mandy Fields, SVP and CFO, at the NYSE to talk about the dynamics of their partnership—a big reason the company’s stock is up over 1,500% in the last five years.

Marchisotto (February) and Fields (April) both began their e.l.f. tenures in 2019, but the two first met for cocktails before officially starting at the company.

“I was still interviewing, and I think you had already accepted,” Fields said to Marchisotto. “And I just knew that this was going to be an incredible ride.”

“The first day we met,” Marchisotto recalled, “we just knew that, whatever was going to happen around us, there was just this common respect and admiration for each other’s career.”

The company has a large representation of women—e.l.f.’s more than 300 employees are over 70% women, 40% diverse, and 65% millennial and Gen Z.

“One of the things we both appreciated about each other is that we have this common mission to help others as we climb,” Marchisotto said. The two agreed that they would mentor and coach others to show there’s a tangible path to the C-suite.

“It’s important for finance and marketing to have a strong relationship,” Fields said. “But oftentimes they’re at odds because finance looks at marketing as an expense. And we have taken a different approach where we see marketing as a sales driver, and that has proven to work for us. Driving net sales growth, investing in marketing, and expanding EBITDA margin—I want to do all of those things. Kory has got to be my partner on that.”

The Oakland-based company, founded in 2004, recorded its 20th consecutive quarter of growth for the period ending Dec. 31. Net sales for the quarter increased 85% to $270.9 million year over year, primarily driven by strength in both retailer and e-commerce channels. The company’s outlook for fiscal 2024 reflects an expected 69% to 71% year-over-year increase in net sales.

The brand boasts a strong Gen Z following, but e.l.f. is working to court more millennials, Gen Xers, and even baby boomers. Along with its value proposition—most products retail for about $6—and a push for innovation, marketing is another growth driver, Fields told me.

In fiscal year 2019, e.l.f. spent 7% of net sales on marketing. The company spent about 22% in fiscal year 2023. e.l.f.’s brand awareness in the U.S. has doubled from 13% to 26% since 2020, according to Fields.

‘An incredible ability to know what’s coming next’

Marchisotto recalled the first big endeavor in 2019 was to rally the entire organization around a mission to recharge the brand. “We had just come off a troubled period in the brand’s history, which happens, all brands ebb and flow,” she said. They then decided to “plunge into TikTok in a crazy way,” she added.

“So I was like, ‘Hey, Mandy, I’m gonna go create an original music track,'” Marchisotto recalled.

“I remember being in the office, and Kory said, ‘I’ve got a song I’m putting on TikTok. We’re gonna get a billion views.’ I never heard this stuff,” Fields recalled.

Fields said that she and e.l.f. Beauty CEO Tarang Amin asked Marchisotto to first test it out over the weekend to see if there’s really traction on the social media channel. On Saturday night, Marchisotto texted Fields.

“This is how we work—occasional text bombs,” Fields quipped. “But seriously, we saw the results immediately. We said, we’ve gotta go after that.”

“I think Kory and her team just had an incredible ability to know what’s coming next,” Fields continued. “And they are listening to the community so closely. I would have never, ever thought that we should have a song and a music video.”

And e.l.f.’s social media marketing engine has continued to expand. “We have 13 to 14 million followers across social platforms, and TikTok represents about one-and-a half-million of those followers,” Fields said. “We’re on every platform that our community wants to participate in, even Roblox and Twitch.” Other marketing projects include two Super Bowl ads, one in 2023 that was regional, and this year’s ad, which was national.

Looking ahead, Fields said, “We just have incredible whitespace still ahead of us. We’re the number three brand in color cosmetics. We have aspirations to become number one.”

Sheryl Estrada

sheryl.estrada@fortune.com

María Soledad Davila Calero curated the Leaderboard and Overheard sections of today’s newsletter.

Leaderboard

Ana Maria Chadwick was named EVP, CFO, and treasurer of Insulet Corporation (Nasdaq: PODD), the manufacturer of the insulin pump Omnipod, effective April 22. Chadwick currently is the CFO of the shipping and mailing company Pitney Bowes and will stay on as advisor until April 21, with John Witek appointed interim CFO. Chadwick has 30 years of experience at global organizations, including more than 27 years at GE.

Roop K. Lakkaraju will transition to EVP and CFO of Bio-Rad Laboratories (NYSE: Bio), a developer of clinical diagnostics products, on April 15. He’s stepping away from his current role as CFO of the electronic manufacturer Benchmark Electronics (NYSE: BHE) on April 1 and will be replaced by Arvind Kamal, the current vice president of Finance.

Big deal

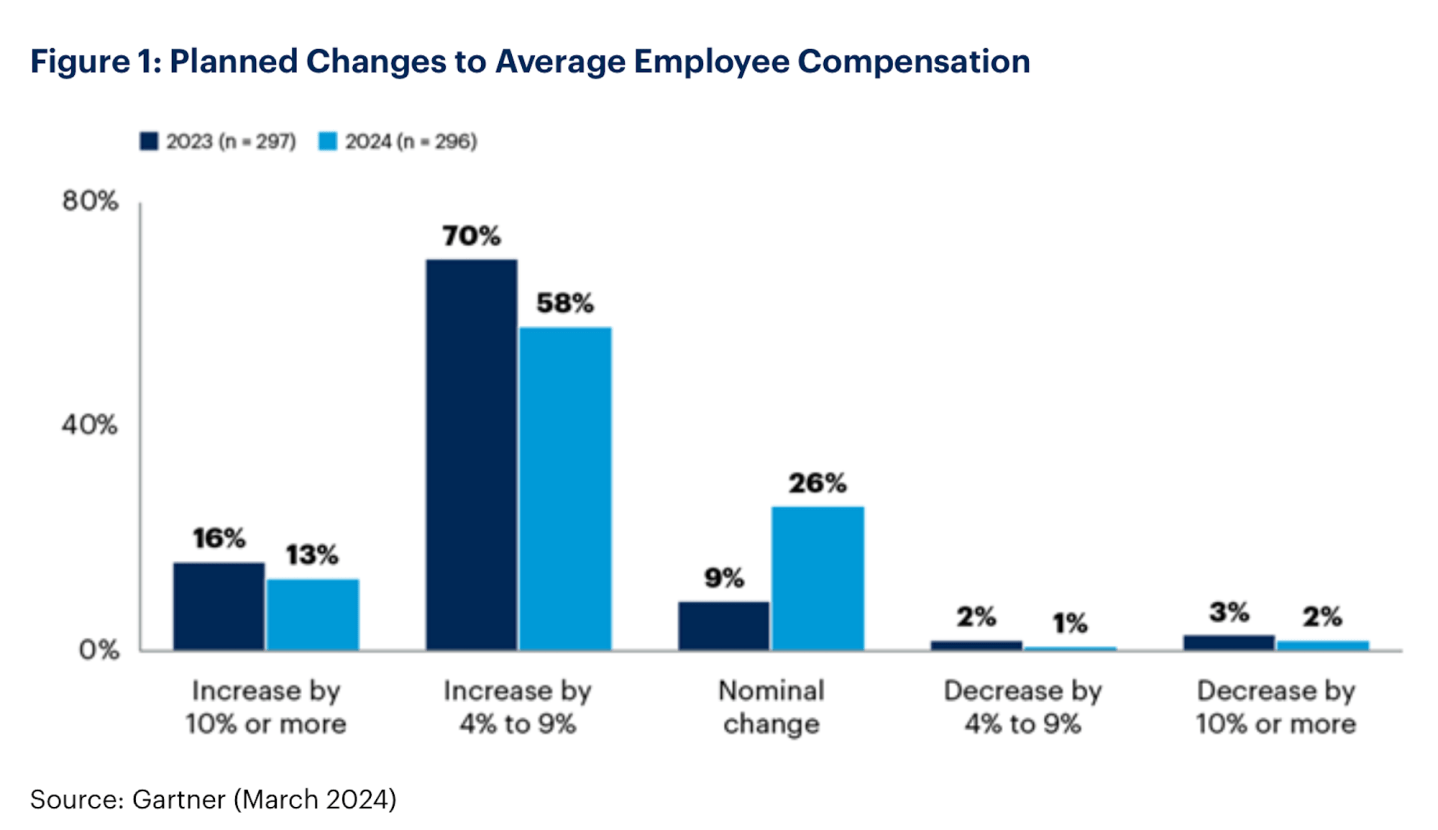

Gartner surveyed 296 CFOs and senior finance leaders to find out how budgets and spending will change in 2024. The findings point to employee compensation as one of the top areas.

There has been a shift toward smaller pay increases compared to 2021-2023 when inflation was running near 8%. However, the majority (71%) of CFOs are planning to increase average pay by at least 4%, above the current rate of inflation in most major markets, according to the report.

Fifty-eight percent of respondents plan for the average employee compensation to increase by 4%-9% in 2024. And 13% of respondents expect it to increase by 10% or more.

Going deeper

The U.S. Federal Reserve announced on Wednesday that it would leave its benchmark interest rate unchanged in the 5-1/4 to 5-1/2 percent range. “The Committee does not expect it will be appropriate to reduce the target range until it has gained greater confidence that inflation is moving sustainably toward 2 percent,” according to the announcement. But the Fed also indicated that there would still be three rate cuts this year.

Overheard

“The institutional audience has in the past dominated this space, but with the rise of retail investing, it’s hard to ignore that this part of the market is growing and smart and cares.”

—Cody Slach, senior managing director of Gateway Group, said about Reddit’s decision to reserve 8% of their shares offering for redditors as well as friends and family, a practice known as directed share programs. Likewise, UBER and Airbnb reserved shares for their drivers and hosts, respectively. However, it remains to be seen whether the move will work out for Reddit.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.