Good morning. Change has been a constant in the C-suite at Under Armour over the past few years, but not when it comes to the CFO role.

The Baltimore-based apparel and footwear retailer announced on March 13 that Kevin Plank, the founder and controlling shareholder, will become CEO—again—effective April 1. Plank will succeed Stephanie Linnartz, who joined the company as CEO in February 2023. Plank, who founded the company about 28 years ago, stepped down as CEO in 2020.

Linnartz’s departure was a surprise. As my colleague Maria Aspan writes: “Linnartz, a veteran executive who was previously No. 2 at Marriott International, left the global hotel chain last year to become CEO of Under Armour. She had said that her turnaround strategy for the company would take three years to execute.”

The challenges were many, Aspan adds: “Under Armour has struggled to grow revenue and profits since its early heyday. Its share price has plummeted since its 2015 peak, and retail experts call its brand identity muddled at best.”

Although Under Armour (NYSE: UA, UAA) has had some tumultuous years, including charges by the Securities and Exchange Commission in 2021, one constant has been David Bergman. He joined the firm nearly two decades ago and served in a variety of roles before becoming CFO in 2017.

Tom Nikic, analyst and SVP of equity research at Wedbush Securities, wrote in a note to investors following Under Armour’s latest CEO announcement: “The game of ‘musical chairs’ in the CEO seat that UAA has undergone in recent years (3 CEOs in the 4-year gap between Mr. Plank’s two tenures) brings a layer of inconsistency and uncertainty to the story that investors don’t really want to see.”

But what’s Nikic’s assessment of Bergman?

“Under Armour has had a lot of problems over the years, but I don’t think Dave’s been one of them,” he told me.

Since Bergman became CFO, the company’s spending and inventory management has become more disciplined, and they’re now in a net cash position after the company was “saddled with a lot of debt when he took the reins,” according to Nikic. “Given all the CEO/COO turnover, it’s at least somewhat encouraging that there’s been consistency in the CFO seat, which has likely been a function of his good relationship with Kevin Plank,” he said.

But, Nikic added, there’s only so much Bergman can do—the company needs better products, marketing, and execution. And Bergman’s long tenure doesn’t mean he’s bulletproof.

“What I think all the CEO turnover has shown,” Nikic added, “is that Kevin Plank is going to win any and all battles against other executives at the company. So if Dave ever runs afoul of Kevin, Kevin is going to get his way.”

In February, Under Armour reported earnings for the period ended Dec. 31, with revenue down 6% to $1.5 billion, which aligned with the company’s outlook. In its fiscal year 2024 outlook, the company expects revenue to be down 3% to 4%, compared with a previous expectation of 2% to 4%.

“We remain encouraged by our evolving strategies to turn our inconsistencies into strengths,” Bergman said on the most recent earnings call. Managing the supply chain, tightening expenses, optimizing investments, focusing on cash management, and making prudent capital expenditures, all remain key priorities.

“Without question,” Bergman said, “there is much work ahead of us.”

Sheryl Estrada

sheryl.estrada@fortune.com

María Soledad Davila Calero curated the Leaderboard and Overheard sections of today’s newsletter.

Leaderboard

Michael Bercovich was named CFO of Helios, a global human capital management and payments platform that will launch later this year, founded by Rick Hammell. Before joining Helios, Bercovich was the CFO for Atlas HXM, a technology-enabled outsourcing services provider, which was also founded by Hammell. Bercovich brings over 20 years of financial management and strategic planning experience to his new role.

William (Bill) McCombe was named CFO of Cytek Biosciences (Nasdaq: CTKB), a human cell analysis researcher. McCombe’s appointment comes after previous CFO, Patrik Jeanmonod, was moved to head of corporate development analytics. Before working as a CFO at several companies like Velo3D and Maxar Technologies, McCombe worked as an investment banker.

Big deal

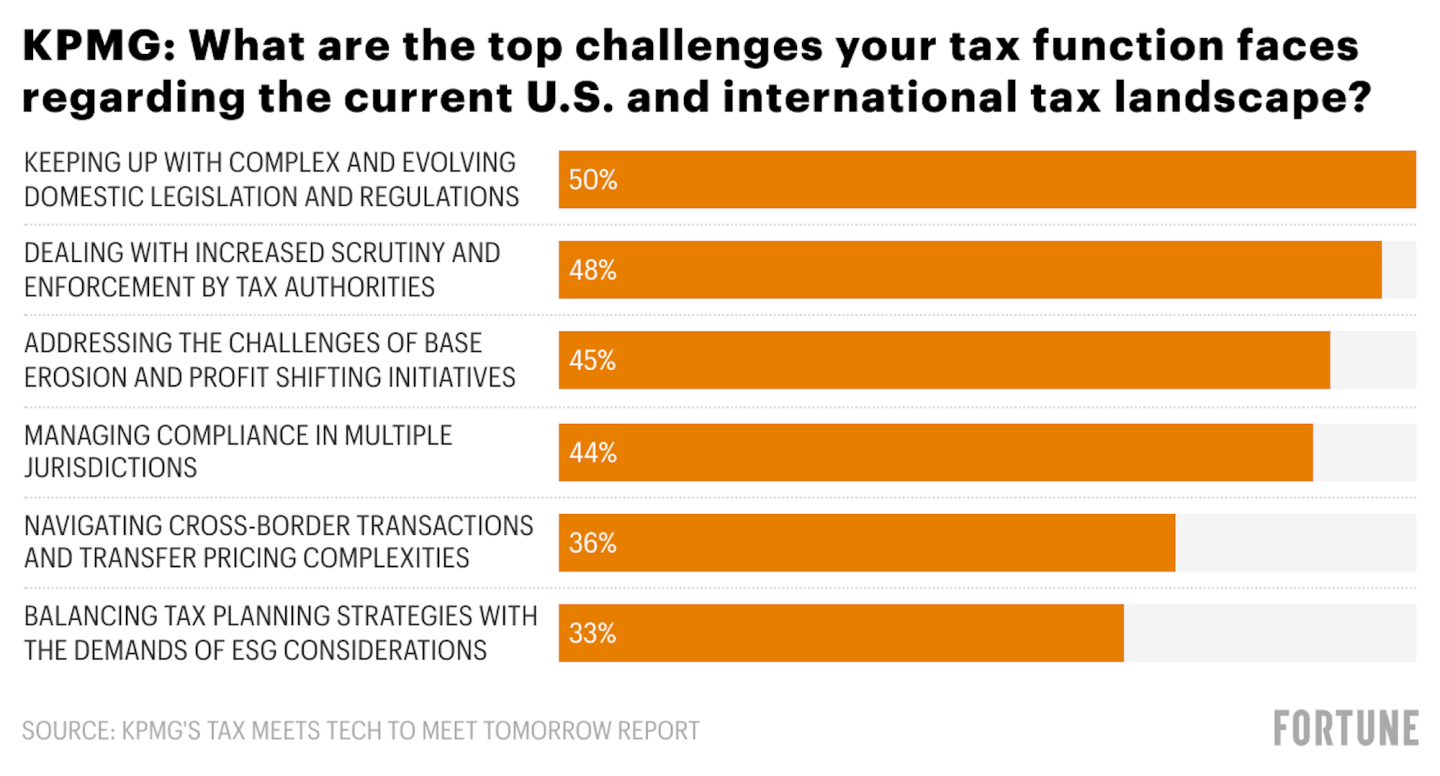

The 2024 KPMG Chief Tax Officer Outlook study is based on a survey of 300 CTOs that examines the transformations underway to deal with the current and next waves of disruption. Technology enablement is high on the agenda, including advanced tools for digesting data, making calculations, and automating compliance. In fact, the compliance and reporting burden continues to escalate, driven by multiple factors including new global tax rules, according to the report.

“Major reform initiatives—particularly OECD Pillar Two rules and EU public country-by-country reporting—continue to amplify the cost and workload of tax compliance,” according to the report. Half of the CTOs surveyed said keeping up with evolving domestic legislation and regulations is a top challenge to the tax function.

Going deeper

“Harnessing Imagination to Drive Innovation” is a new article in Harvard Business Review that argues that companies seeking growth need to develop innovative offerings to expand demand. The authors present a six-step cycle that is at the foundation of a corporate “imagination machine.”

Overheard

“As investors increasingly use social media to inform their financial decisions, FINRA’s rules on communicating with the public are especially critical.”

—Bill St. Louis, EVP and head of enforcement at FINRA, a government-sponsored nonprofit overseen by the SEC that regulates public brokerage firms, said in a statement. Louis announced that the regulatory agency slapped M1 Finance, a brokerage app for retail investors, with a $850,000 fine for hiring influencers who advertised false claims about the company, Fortune reported.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.