Good morning. Across industries, AI is top of mind for CFOs who are well aware, as noted by McKinsey, that the technology “won’t affect all businesses equally, and certainly not at the same time.”

And while the “how” and “when” may differ when looking at, say, fast-casual chains compared to software creators, many of the finance chiefs I’ve spoken with lately were eager to share insights on using AI—for everything from crunching data to augmenting talent—and what they might use it for next.

Jack Hartung, CFO at Chipotle Mexican Grill

“We’re just scratching the surface right now. I’ll give you a simple example: We have to pay a lot of bills. We have individual bills that will come into our restaurants. Most of them, we can automate because we’re dealing with very large vendors. But a lot of the folks are individual independent businesses—like, for example, a window washer or a landscaper, a small business in a local community—and those are much harder to automate.

“So when a paper invoice comes in, our team will keypunch that. The first time you do it, you have to keypunch the whole invoice. When that invoice comes in again, the program will read it, and it will populate as much as it can. And after a few iterations, it learns where all the fields need to go. By the third or fourth time that invoice comes in, it’ll be automatically scanned, and then the right fields will be populated. But if you’ve got tens of thousands of these paper invoices, and you can automate that, that is a game-changer and will save a lot of headcount.

“We also have massive amounts of data. We’re starting to think about how we can use AI to sort through the data and provide insights in terms of what the opportunities are for us to provide a better experience, or to encourage our customers to come more often.”

Tricia Tolivar, CFO at Cava

“Overall, from a finance perspective, here in the office, we’re always looking at tools and how we can use AI to forecast sales better. How do we use that to understand demands from our guests and how that might impact our labor models? And what’s the best way to deploy tools, both team member resources and other tools, to do that in a more effective way?”

John F. Woods, EVP and CFO at Citizens Financial Group

“We have to think of ourselves as much as a technology company as we are a banking organization. We have many more engineers and data scientists on staff than we would have had in the past.”

Dan Durn, CFO and EVP of finance, technology services, and operations at Adobe

“We’re going to make sure [employees] have the tools and resources to continue to grow and evolve, and future proof the careers of existing finance talent. For new people that we do hire out of school, I do think there’s going to be an evolution of skill sets where you’re going to see some more data scientists creep in.

“I don’t think we will be technologists that do finance. I think we’ll be finance professionals that have more familiarity with technology, data science, and automation going forward.”

Sheryl Estrada

sheryl.estrada@fortune.com

María Soledad Davila Calero curated the Leaderboard and Overheard sections of today’s newsletter.

Leaderboard

Garry Lowenthal was appointed CFO of PetVivo Holdings, Inc. (Nasdaq: PETV), a veterinary biotech and biomedical company. Lowenthal has over 25 years of experience, including acting chief financial officer and director of Elate Group, Inc., and taking on the responsibilities of a director, EVP and CFO of Fision Corporation.

Katja Garcia won’t seek an extension to her contract as CFO for Continental, a manufacturer of tires and other vehicle parts. Garcia has been at Continental for almost three decades and became CFO in 2021. Garcia's contract is set to expire in December, but she will stay on until a replacement is found.

Big deal

Nelson Peltz is a founding partner of Trian Fund Management LP, one of two activist investors seeking seats on The Walt Disney Company's board. Peltz recently published 133 pages worth of ideas on how to improve Disney, Fortune reported. Trian has a $3 billion stake in Disney. And the other activist hedge fund vying for board representation at the company is Blackwells Capital, which owns about $15 million in stock.

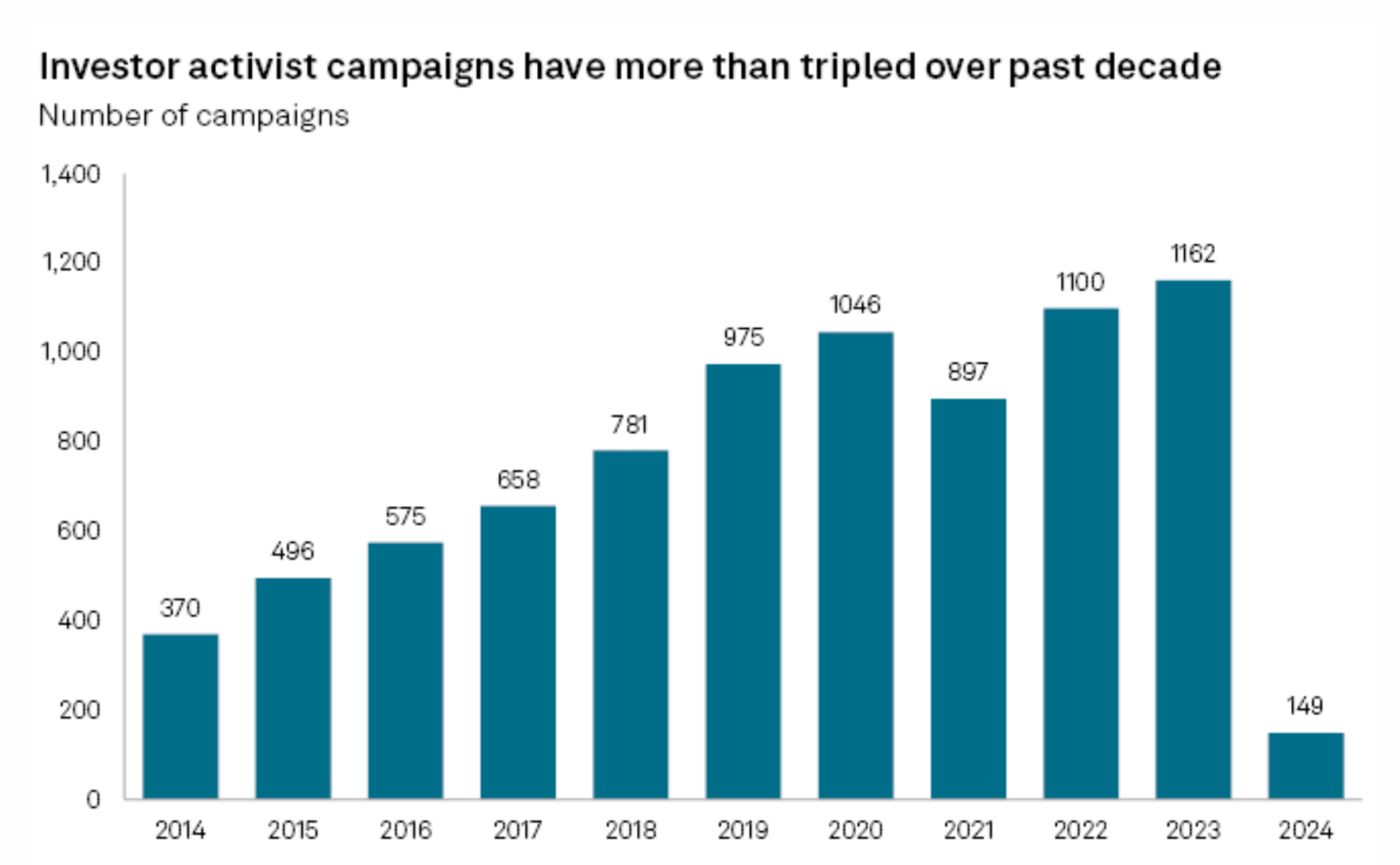

In fact, new data released by S&P Global Market Intelligence finds that investor activism hit a record high in 2023. Last year, there were 1,162 activist campaigns, up from 1,100 a year earlier and 370 campaigns in 2014, according to the report.

Companies faced new pressures over climate change, executive pay, and racial justice. The activist campaigns included shareholder proposals, proxy fights, and organized requests for board representation.

"We certainly do not see it slowing down in 2024 or even 2025 due to a growing track record of success and support from investors," John Karageorge, a managing director with Market Intelligence, said in a statement. "If we see interest rates fall this year, we could see a pickup in the M&A markets, and both of these factors could actually incentivize higher levels of activism."

Going deeper

AICPA & CIMA Economic Outlook Survey for Q1 2024 found that business executives are becoming increasingly optimistic about U.S. economic prospects. The findings are based on a survey of 275 CEOs, CFOs, controllers, and other certified public accountants in U.S. companies. Forty-three percent of business executives said they were optimistic about the U.S. economy over the next 12 months, up from 24% last quarter.

In the same time period, revenue growth is expected to be 2.6%, up from 1.8% last quarter. And profit expectations are now 1.4%, the highest level since early 2022. For more key finding, you can access the report here.

Overheard

“While the economy is strong on paper, a lot of families aren’t feeling the benefits, because they’re struggling to afford the house they want or already live in. As a result, many feel stuck, unable to make their desired moves and life upgrades.”

—Redfin’s chief economist, Daryl Fairweather, said about the current housing market that has either locked people in their houses or locked them out of the market altogether.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.