Good morning. Although most firms don’t deploy co-CEOs, at least one that does is happy to sing the praises of such a setup.

“I tell people, I don’t understand why there aren’t more co-CEOs,” Mellody Hobson, co-CEO of Ariel Investments, told me. “I think this is an underutilized way of leading a company.”

I recently sat down with Hobson to discuss the firm’s new documentary, “Ariel at 40,” produced by Crystal McCrary McGuire Productions. An internship led to her more-than-30-year career at Ariel, the first Black-owned mutual fund company in the U.S. Ariel was founded in 1983 by John W. Rogers Jr. when he was just 24 years old. He’s now co-CEO.

Headquartered in Chicago, with offices in New York, San Francisco, and Sydney, Ariel holds $14.9 billion in assets. It is a global value-based asset management firm serving individual and institutional investors. Among the top 10 holdings in Ariel’s Small Cap Value strategy are OneSpaWorld Holdings (OSW), Mattel, Inc. (MAT), and Jones Lang LaSalle (JLL).

“John and I can cover so much ground, both separately and together,” Hobson said. “You also have a shoulder to lean on.”

She continued: “We’re very clear about our responsibilities in the firm, and they’re separate and distinct. So, the areas that I manage and oversee, John always says his goal is to be like a board member advisor to me in those areas. But he does not overrule or veto because those are my areas, just like I don’t tell him what stocks to buy.”

What really stands out in the firm’s documentary is the story of how Rogers, who graduated from Princeton in 1980, recognized Hobson’s talent and how she could help take the company to new heights—and how Hobson, a 1991 Princeton grad, charted her path to becoming one of the most influential business women in the world, landing on Fortune’s Most Powerful Women list every year since 2019.

Hobson went on to spend nearly two decades as the firm’s president before becoming co-CEO in 2019. In addition to her career at Ariel, she’s Starbucks board chair and a director at JPMorgan Chase. She also participates in philanthropic endeavors through The Hobson/Lucas Family Foundation, cofounded with her husband, George Lucas, the creator of Star Wars, whom she married in 2013.

I had an interesting conversation with Hobson about everything from how her tenure at Ariel began to what Rogers told her at lunch on her first day of work to how she navigated the global financial crisis, which she called “the worst time in my career.”

You can read the complete article here.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Albert Meo was appointed CFO at Prometheum Inc., a digital assets marketplace. Meo was previously executive director of regulatory policy at Morgan Stanley (NYSE: MS) and comes as Prometheum Capital, a subsidiary of Prometheum, received approval to offer services related to digital asset securities.

Marshall Woodworth was promoted to CFO at the biotechnology company NeuroBo Pharma (Nasdaq: NRBO). Woodworth has been the acting CFO since Oct. 27. Before joining NeuroBo Pharmaceuticals, from May 2017 through May 2023, he served as the CFO at Nevakar, Inc. Woodworth also served as CFO of Braeburn Pharmaceuticals, Inc.

Big deal

Compensation, Budget, and Satisfaction Benchmark for CISOs in Financial Services, 2023–2024, a new report by IANS Research and Artico Search, finds there is increased pressure and scrutiny being placed on chief information security officers (CISOs). Twenty-five percent of financial services CISOs surveyed have low job satisfaction, with 70% open to job changes.

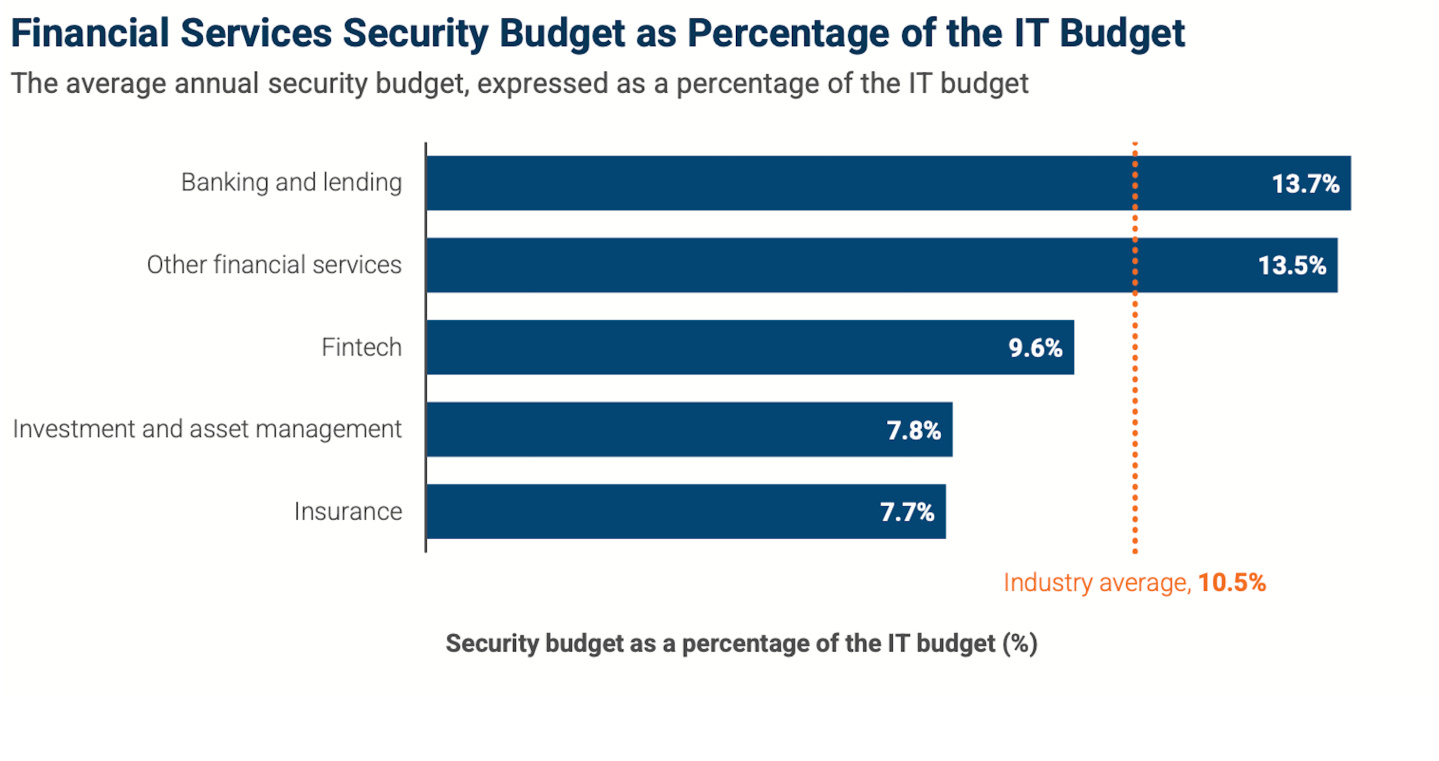

Another key finding of the report is eight out of 10 financial services CISOs use the metric “security budget as a percentage of the IT budget” to determine and report on their budget status. For most financial services CISOs, this metric hovers around 10.5%. However, in the banking and lending subsector, this is slightly higher at 13.7%. And for insurance and investment and asset management, it is below the sector average at 7.7% and 7.8%, respectively.

The findings are based on a survey of 660 CISOs, including 167 in financial services across companies with AUM ranging from under $100 million to over $25 billion.

Going deeper

Thomson Reuters Corporation (NYSE: TRI), a global content and technology company, announced it has acquired Pagero Group AB for approximately $800 million. Pagero is a provider of e-invoicing and indirect tax solutions. The acquisition marks the sixth deal closed by Thomson Reuters since Jan. 1, 2023, with a total acquisition value of approximately $2.1 billion. "We are excited by the unique potential of Pagero’s Smart Business Network and fully recognize the significant value this open ecosystem provides to customers, suppliers and authorities,” Steve Hasker, president and CEO of Thomson Reuters, said in a statement.

Overheard

“I’m going to raise a point that sounds weird, but humor me. I don’t see what’s so bad about bubbles. I think bubbles are how markets deal with change.”

—Aswath Damodaran, a finance professor at NYU’s Stern School of Business told CNBC on Tuesday. While there is a debate on whether an AI bubble exists, Damodaran argued that whenever there is new technology investors tend to overdo it, but eventually there’s a correction and innovation was spurred as a result of the initial optimism.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.