Good morning. Accounting is “the language of business,” according to Devina A. Rankin, EVP and CFO at WM, which previously was known as Waste Management. And her love of that language has helped propel her more-than-20-year-career at the company.

Houston-based WM, a leading provider of comprehensive waste management environmental services in North America, ranks No. 204 on the Fortune 500. Last month, the company reported 2023 revenue of $20.4 billion, up 3.7% year over year. Through 2026, WM plans to invest up to $2.9 billion in its recycling and renewable energy platforms.

Rankin, a CPA, joined the company in 2002. She held several key corporate finance positions, including assistant treasurer and treasurer, before becoming WM’s first female finance chief in 2017. I sat down with her to talk about her journey at the company—and any career advice she could share.

(This interview has been edited for length and clarity.)

In your early years at WM, were you one of the few women in a managerial role?

As a 26-year-old at a large company, I was less focused on what the structure of our C-suite looked like, and I was much more focused on my direct leadership team, the people that I saw and engaged with on a daily basis. There were very few women in those leadership roles at the time.

What I’m proud of is that I’m now part of a senior leadership team that’s 33% women. What’s also important to me is that we are not focused solely on building strong female leadership and representation in the C-suite but also making sure that we’re doing that throughout the organization.

Were mentors and sponsors a part of your career journey at WM?

The mentors and sponsors in my working years have been both men and women. I think it’s good for everyone to seek mentors that don’t just look like you, and have your work experiences, and recognize that we can learn from one another, no matter our skills, our backgrounds.

Can you share an example of something a mentor or sponsor helped you with?

I have worked with Jim Fish, our CEO who was the CFO before his current role, for over 12 years. He has really mentored and sponsored me the entire way through.

I’ve never had operating experience. So, from the optimal CFO profile perspective, that’s a void or a missing link for me. What we’ve talked about is what I can do within my current scope of responsibility to ensure that I am amplifying the impact that I can have, showing I understand our business and I appreciate our business.

The other thing that Jim and I talked a lot about is confidence. When you’re in that room, you deserve to be in that room, and you’ve just got to let the rest of your nerves settle.

Regarding operations, is that an area where you’re becoming more and more involved?

Absolutely. Our business is very human-centric, and certainly very capital intensive. But at the end of the day, we have 48,000 men and women across our organization that make it happen every day. In terms of thinking about the operations, people are at the core of who we are. So, while I’ve not ever driven a truck myself, I’ve had many conversations with our drivers, and I understand how they think about service to our customers.

John Morris, chief operating officer, and I truly have a partnership, and we work through things together each day for the benefit of the organization. I’m there with him thinking about the demands on our human capital and our financial capital.

What is a pivotal moment that’s shaped you as an executive?

That moment for me was knowing that I no longer should just be looking in one direction for career growth. I moved from the accounting organization to the treasury organization more than 10 years ago, and that move made all the difference for me. It was the first time that I trusted myself, and I recognized that my capabilities and my potential were not defined by my degree or the last role that I had. I was hardworking, thoughtful, and engaged. I learned to trust my own capabilities, my own worth, in a way that I wouldn’t have if I had stayed on the ladder.

You’ve been at WM for more than 20 years. What’s the secret to longevity at a single company?

At the core of my career success and career satisfaction have been the relationships that I have built, and relationships take time. The strong sense of connection and purpose that can come from building lasting relationships over many years is done by working together day in and day out.

Any advice for reaching the C-suite?

You need to be sure you’re engaged in what matters to the company. You need to deliver—set clear and achievable goals, and do what you say you will do. Care about the results, the people you lead, the team that you’re part of, and your brand. And inspire—work to be the leader you wish you always had.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Rob White was promoted to executive vice president and CFO of Marathon Oil (NYSE:MRO), an independent oil and gas exploration and production company. White will take over the role on May 1, and his predecessor, Dane Whitehead, is set to officially retire on July 1, following more than seven years of service. White joined Marathon Oil in 1991 and has more than 30 years of experience in oil and gas accounting and finance. He has served as VP, controller, and chief accounting officer since March 1, 2022.

Danielle De Rosa was appointed CFO for Safety Shot, Inc. (Nasdaq: SHOT), effective March 1. De Rosa joins Safety Shot, manufacturer of a blood alcohol detox beverage, with more than 25 years of experience in financial services. She previously served as CFO of VirTra, senior finance officer at Common Spirit, and CFO at Lorts Manufacturing.

Big deal

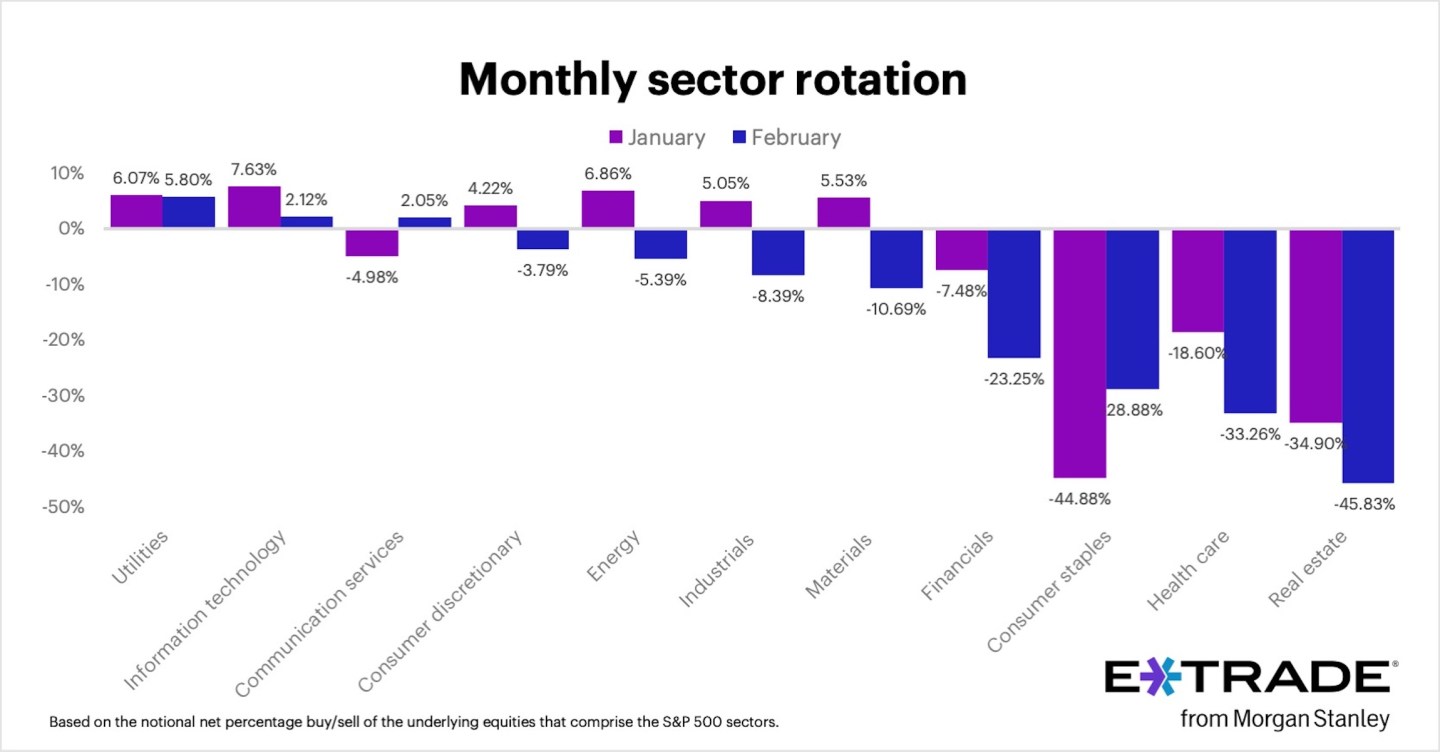

Morgan Stanley’s E-Trade released data from its monthly sector rotation study. The results are based on the trading platform’s customer notional net percentage buy/sell behavior for stocks that comprise the S&P 500 sectors.

In February, E-Trade clients looked for profit-taking opportunities with net selling in eight of the 11 sectors, according to Chris Larkin, managing director of trading and investing at E-Trade from Morgan Stanley. Interest remained strong in "perennial favorites"—information technology and communication services. “And as utilities lag the broader market, investors may see a buy opportunity,” Larkin said in a statement. “With bottom sectors including health care and consumer staples, there’s some indication that traders are 'risk on' as these are historically defensive plays. As the mixed inflation data in February “rocked the interest rate boat,” real estate opportunities “may have come into question,” he said.

Going deeper

"Adapt Your Strategy to Higher Interest Rates," a new article in Harvard Business Review, explains that to increase sales and profits in this environment, executives need to rediscover the concept of economic profit.

Overheard

“The market now has to realize that the data is just not slowing down, and the Fed pivot has given an additional tailwind to the economy and to financial markets and financial conditions and to capital markets.”

—Apollo Management Chief Economist Torsten Slok said in a Bloomberg Surveillance Radio interview. Slok is part of a growing number of voices that argue that the Federal Reserve will not lower interest rates in 2024.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.