Good morning.

Being a finance chief during uncertain economic times has its pressures. But private equity-backed company CFOs, it seems, live in perpetual fear of losing their jobs.

The State of the PE Sponsor and CFO Relationship, an annual report by Accordion, a private equity-focused financial and technology consulting firm, finds that 91% of PE-backed CFOs say that they are worried about job security after a private-equity investment in their company. This represents a 25% increase since Accordion first reported on the statistic in 2019.

“CFOs are always under a tremendous amount of pressure in a private equity-backed environment,” says Nick Leopard, founder and CEO of Accordion. But with the volatility in the market, interest rates, and sustained geopolitical conflict—“There is a lot of anxiety among CFOs,” Leopard says.

“There is a whole generation of CFOs out there now that have never experienced these novel fluctuations in the overall environment,” he explains. “A lot are questioning, ‘Do I have the right skill sets to be able to manage through such a unique environment right now?’”

And private equity “sponsors” (which is what private equity firms are often called) expect a lot out of the finance function of a portfolio company, Leopard adds.

Accordion’s survey of 100 PE sponsors and 100 PE-backed CFOs gauged the expectations of the CFO role and the extent to which finance chiefs meet those expectations. Both CFOs and sponsors believe that it is the finance chief’s responsibility not just to scale the business, but to also have a strategic role in driving enterprise-wide transformation.

And the stakes are high. PE-backed CFOs have a short window of time to create change and manage through a value creation plan. In 4-6 years, “a CFO would need to create some real transformation,” Leopard says.

3 key findings

Three things stood out in the survey findings, Leopard says. “Private equity sponsors are expecting CFOs to be more multifaceted than they have been, historically,” he says. That means, thinking about and leading the strategy for cost reduction, technology enablement, M&A, and real transformation opportunities to improve the profitability of the company, he says.

Another finding is that sponsors and CFOs weren’t on the same page regarding dealmaking. Sponsors placed M&A at the top of the list. Meanwhile CFOs ranked it at the bottom. Similarly, CFOs are disproportionately focused on cost reduction relative to their sponsors.

And sponsors also have a different perspective on the reliability of the company’s data. Almost all CFOs (92%) think their data collection efforts are strong. But just 65% of sponsors agree.

As PE firms increasingly buy companies, they’re also poaching the best CEOs to lead them, and perhaps making unprepared CFOs feel the heat. In a recent article, my colleague Geoff Colvin explored how PE firms are disrupting the Fortune 500 CEO pipeline.

“The U.S. has 22,956 PE-owned portfolio companies, according to the Private Equity Info research firm, and each one needs a CEO,” Colvin writes. “PE firms choose from the entire global market of managerial talent and somehow entice high-performing leaders to leave prestigious companies to run outfits most people have never heard of. In the battle for CEO talent, PE firms are taking the fight to public companies. They’re hiring highly credentialed full-time recruiters to constantly scan the landscape for potential CEOs and other executives, not necessarily with a specific portfolio company in mind.”

However, for the standouts that are managing to thrive despite the macroeconomic challenges, “then I think the job security goes way up,” Leopard says.

Have a good weekend.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Some notable moves:

Paula Oyibo was promoted to CFO at Ulta Beauty, a specialty beauty retailer. Oyibo will succeed Scott Settersten, who will retire as CFO, treasurer and assistant secretary after nearly 20 years at the company, effective April 1. Oyibo is currently SVP of finance. She joined Ulta Beauty as VP of finance for merchandise, marketing, and e-commerce in 2019. Before joining Ulta Beauty, Oyibo served in finance and controller roles at Whirlpool Corporation.

Kris Corbett was named CFO at New Mountain Finance Corporation (Nasdaq: NMFC), the publicly traded credit BDC arm of New Mountain Capital, effective Nov. 27. Corbett joins New Mountain from Blackstone Credit, where he served as a SVP, controller and treasurer of both the Blackstone Private Credit Fund and the Blackstone Secured Lending Fund. Before that, he was a managing director at Perella Weinberg Partners.

Anastasiya “Stasy” Pasterick was named CFO at Universal Hydrogen Co., effective Dec. 4. Pasterick comes to Universal Hydrogen after more than four years at Nikola Corp. (Nasdaq: NKLA), where she served most recently as CFO. Before Nikola, she held several financial leadership positions at various OEMs, including director of accounting operations at Erickson, Inc. and Corporate Controller at nLIGHT, Inc.

Artem Gonopolskiy was promoted to EVP and CFO at Atlas Air Worldwide Holdings, Inc., effective Dec.1. Gonopolskiy has been with Atlas for more than 18 years, and has served as the interim CFO of the company since June 15. He joined Atlas in 2005 as a senior financial analyst and held several leadership roles within the finance organization, including SVP of financial planning and analysis.

Karen Sedgwick was promoted to EVP and CFO at Sempra (NYSE: SRE), a North American energy infrastructure company, effective Jan. 1. Sedgwick currently serves as the company's chief administrative officer and chief human resources officer. Over the last 31 years, she has held a series of financial leadership roles within the Sempra family of companies.

Lars Boesgaard was named CFO at PDS Biotechnology Corporation (Nasdaq: PDSB), a clinical-stage immunotherapy company, effective Dec. 4. Boesgaard succeeds Matthew Hill, who resigned as PDS Biotech’s CFO, effective Dec. 1, to pursue other professional endeavors. Before joining PDS Biotech, Boesgaard served as CFO of AM-Pharma B.V., and before that, CFO of Columbia Care. Boesgaard was also previously the VP and CFO of Roka Bioscience.

Daniel Hobbs was named EVP and CFO at Simmons First National Corporation (Nasdaq: SFNC), effective Dec. 4. He will report to Simmons president Jay Brogdon. Prior to Hobbs's arrival, Brogdon served as both president and CFO. Hobbs most recently served as EVP and head of finance at Regions Bank. During his 16-year tenure, Hobbs also served as CFO for the consumer bank and in a variety of financial roles.

Ryan Daws was named CFO and head of business development at enGene Holdings Inc. (Nasdaq: ENGN), a clinical-stage genetic medicines company. Daws joins enGene with nearly 25 years of experience. He was previously CFO and head of business development at Obsidian Therapeutics, Inc. Before that, Daws was managing director with the Healthcare Investment Banking Group at Robert W. Baird & Co., Inc.

Susan J. Young was named CFO at Apollo Intelligence, a provider of real-time data and insights to the healthcare and life science industries. Young has more than 20 years of experience in both Fortune 100 and mid-sized companies worldwide. Most recently, she was CFO at PlayOn! Sports, a KKR portfolio company.

Big deal

"An affordable, reliable, competitive path to net zero," a new report by McKinsey Sustainability, is a guide for the next phase of the transition aiming to accelerate progress and bring costs down. The research identifies seven principles for finance decision-makers to reduce emissions.

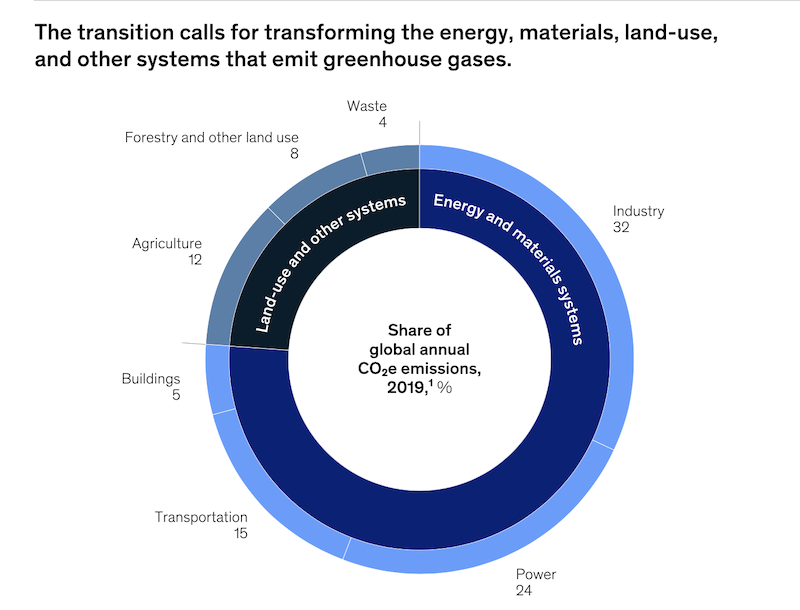

A key finding: One of the reasons why net-zero transition has been slower than hoped for is unprecedented complexity. It calls for transforming not only energy systems but also materials, land use, and other systems in a coordinated and integrated way.

"To successfully meet the global goals enshrined in the Paris Agreement will require a vast increase in total capital spent each year, from $5.7 trillion spent on low- and high-emissions technologies today to as much as $9.2 trillion, on average, spent over the next three decades," according to the report. During that period, the low-emissions part of that spending would need to increase from about $1.5 trillion per year now, to about $7.0 trillion, on average, McKinsey finds.

Going deeper

Here are a few Fortune weekend reads:

"The Fed’s favorite inflation gauge cooled in October, and Wall Street believes it may signal ‘interest rate cuts are on the horizon’" by Will Daniel

"There’s trouble below at Elon Musk’s Boring Co." by Jessica Mathews

"Williams Sonoma’s CEO defied the retail apocalypse. Now a gloomy economy is forcing even her well-off customers to spend less" by Emma Hinchliffe

"These 9 health complaints could be hurting your career success—and one culprit is fueling most of them" by Erin Prater

Overheard

“We’ve done a terrible job taking care of our bottom 30% of earners.”

—JPMorgan CEO Jamie Dimon said during the New York Times DealBook Summit on Wednesday, Fortune reported. Dimon told the audience: “You all are wealthy and have money, but their average, their average wages are [low].”

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.