Good morning.

As Walmart is the largest retailer in the U.S., its quarterly earnings offers some insight into consumer spending. And right now those earnings are signaling an economic warning.

For the three-month period ending Oct. 31, Walmart reported on Thursday a strong quarter with consolidated revenue of $160.8 billion, up 5.2%, compared to last year. The retailer beat Wall Street expectations of $159.13 billion. And profit was $453 million for the quarter.

Walmart U.S. comp sales were up 4.9% compared to the same time last year, and e-commerce up 24%, led by pickup and delivery. The company raised its full-year earning per share outlook to $6.40-$6.48. Its previous guidance was $6.36-$6.46.

But during the earnings call, John David Rainey, EVP and CFO at Walmart, commented that in late October, shoppers slowed purchases, in contrast to spending patterns earlier in the quarter.

So what gives?

“It’s difficult to say at this point,” Rainey told me in our conversation following Walmart’s earnings call. “I think there are a couple of things to consider.” It could be partly due to unusual weather in late October, he said. For example, having winter apparel in the store, but it’s still hot outside, he explained.

“But there’s also a number of things happening in the economy, broadly, whether it be credit tightening, consumer balance sheets reverting back to pre-pandemic levels, even repayment of student loans, all of those things could be having an effect.”

Rainey continued, “November is doing pretty well right now. But that two-week period in the back half of October was off trend from everything that we had seen before. And we believe it’s bigger than just our business because we’re gaining share. We see certain categories where we are far outperforming versus what’s happening in retail.”

Based on the findings, “there could be maybe a little more variability as we look into the fourth quarter,” he said.

On Oct. 1, the government’s three-year pause on federal student loan payments ended. A new research paper from TransUnion and Boston Consulting Group finds the resumption of payments will have a “noticeable impact” on credit risk for student loans as well as other consumer credit products, like credit cards and personal loans.

“We expect 500,000 to 1.4 million consumers to become seriously delinquent on one or more of their credit products,” depending on enrollment levels in the government’s income-driven repayment plan, according to the report. The researchers also anticipate that in the next 12 months, “an additional 191,000 to 600,000 credit card consumers will become seriously delinquent at least on one of their cards,” the report states.

Walmart continues to invest in advanced technologies, including supply chain automation, and the company’s starting to see the productivity benefits, Rainey said.

An example would be the automated loading of pallets on a truck at a distribution center before they are delivered to a Walmart store, Rainey explained. The new technology is efficient and helps associates spend about 80% less time doing the manual labor of unloading trucks and sorting trailers, he said.

Have a good weekend.

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

Some notable moves this week

Lauren Dillard was promoted to CFO at LiveRamp (NYSE: RAMP), a data collaboration platform. Dillard has been with LiveRamp for nearly 10 years, most recently serving as interim CFO and SVP of finance and investor relations.

Chris Lucarz was named CFO at RWS Global, a producer of live experiences around the world. Lucraz is a former NBCUniversal CFO of production and operations. He joins RWS Global with more than 20 years of experience in various leadership roles, including VP of Rockefeller Center Operations to SVP and CFO.

Jennifer Fox, CFO at Nuvation Bio Inc. (NYSE: NUVB), a biopharmaceutical company, is stepping down from her role to pursue a new opportunity, effective Nov. 27. Fox submitted her resignation on Nov. 9. Members of the executive management team and the company’s finance team will assume the duties and responsibilities of the CFO office, according to the company.

Jeff Shepherd was named CFO at Subway, a multinational fast food restaurant franchise. Shepherd succeeds Ben Wells who will retire at the end of the year after a 46-year career. Most recently, Shepherd served as EVP and CFO of Advance Auto Parts.

Mark Secor, EVP and CFO of Horizon Bancorp, Inc. (Nasdaq GS: HBNC), is stepping down from his role. The transition comes at a time of restructuring. Secor will continue in the role until a successor is appointed and provide transitional support through April 30. The company has begun a national search for a new CFO.

William C. (BJ) Losch III, who has been serving as both president of Live Oak Bank and CFO, will add the additional role of president of Live Oak Bancshares effective, Nov. 14 and will step down as CFO at the end of this year. The company's board announced Walter J. Phifer as CFO of Live Oak Bancshares and Live Oak Bank effective Jan. 1.

Daryl Stemm was named CFO at SmartRent, Inc. (NYSE: SMRT), a provider of smart home and property operations solutions. Stemm, who has served as the company’s SVP of finance since 2021, brings four decades of experience to the role. Before joining SmartRent, he held senior finance positions with Best Western Hotels and Invitation Homes, and served as CFO at Home Director, Inc., and Catalyst Semiconductor, Inc.

Big deal

The NTT DATA report, “Innovation Index 2023: How North American Organizations are Achieving Growth, Value and High Performance,” explores the primary drivers of innovation, and where organizations focus their resources to support it.

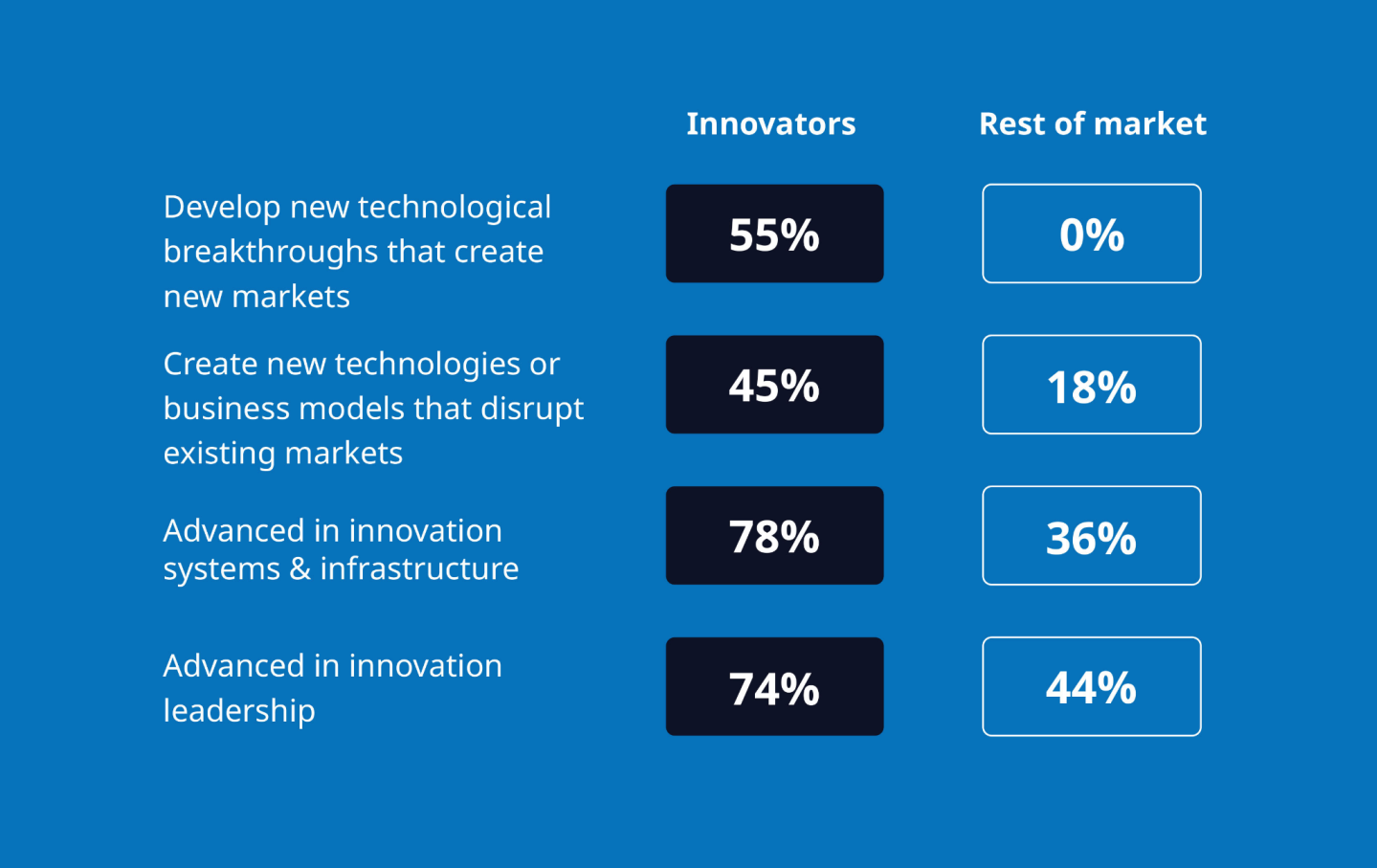

The study identified “innovators,” as the 11% of organizations surveyed that are exceeding expectations from innovation investments compared to the rest of the market. This group is more profitable: 54% more innovators achieved net profit margins of 10% or greater than the rest of the market. For example, 78% of the innovators advanced in creating systems and infrastructure to support innovation.

Innovation depends on data to power technologies like predictive analytics and generative AI, according to the report. The findings are based on a survey of 1,000 North American executives in various industries and company sizes.

Courtesy of NTT DATA

Going deeper

Here are a few Fortune weekend reads:

"Forget the gloom of the 1970s—UBS thinks the U.S. economy is headed back to a Clinton-like era of the bustling 1990s" by Eleanor Pringle

"This chart shows why millennials, the biggest generation in American history, will keep housing prices sky-high for years to come" by Alena Botros

"Brian Chesky: Airbnb’s ‘holy grail’ is to become an AI travel agent," by Michal Lev-ram

"Jay Shetty, host of the acclaimed podcast ‘On Purpose,’ launches a MasterClass on navigating change. Here are his 3 keys to conquering uncertainty," by Alexa Mikhail

Overheard

"AI has the power to democratize access to the financial services that were previously reserved for a select few, create real personalization, and meaningfully enhance financial literacy."

—Lauren Kolodny, a co-founder and managing partner at Acrew Capital, writes in a Fortune opinion piece. Kolodny leads the firm’s fintech practice.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.