Yesterday’s edition was such a hit with readers that I thought I’d publish some more data today—this time digging into PE returns.

There’s no true benchmark for the private markets, as closely-held, fair value performance data and illiquid, closed-end fund structures make it pretty much impossible to craft something equivalent to the Nasdaq or S&P 500. But there’s still data providers that publish numbers that GPs and LPs use to compare funds and performance.

For this newsletter, I used data from eFront, the private equity software provider owned by BlackRock. eFront publishes benchmark reports based on the cash flow information from 8,000 unique private market funds. Their data shows some interesting trends in how funds are delivering returns to limited partners—and whether they’re having success doing it.

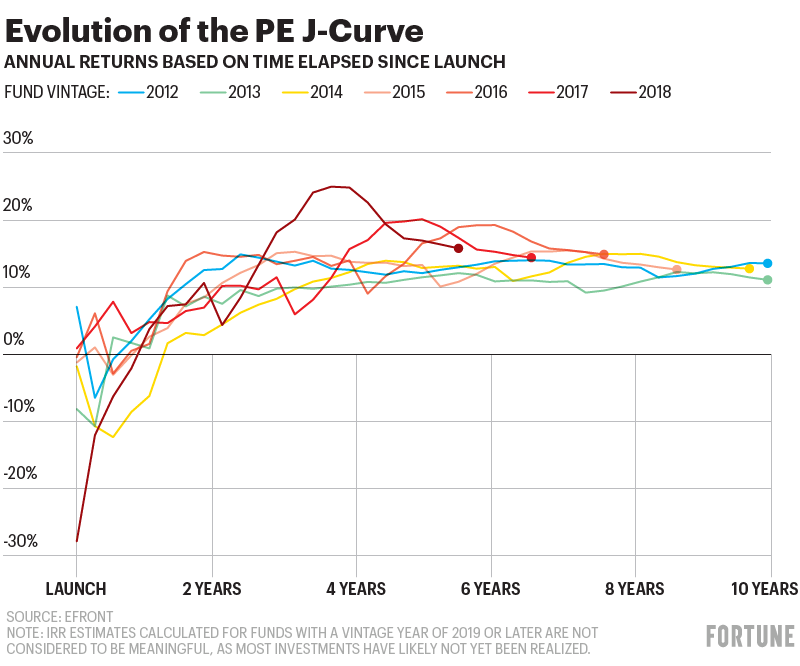

Take a look at how the COVID-induced private market boom put fat distributions into the hands of limited partners sooner than some of the earlier vintages:

In today’s market, when it’s taking longer for LPs to get distributions, I would imagine that funds with a vintage of 2020 or later won’t peak until much later. I suppose we have to wait a few years until it shows up in the data to really know.

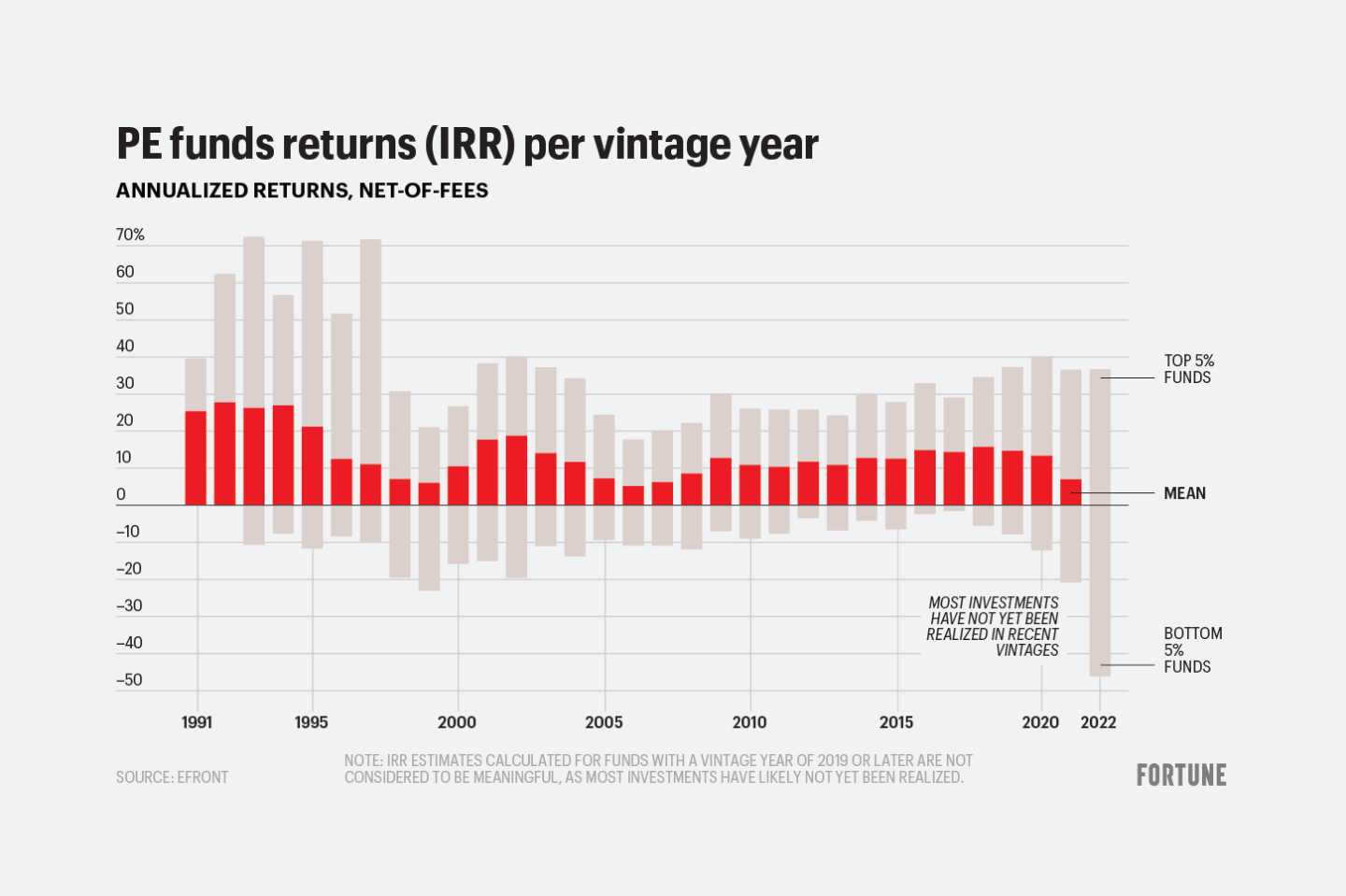

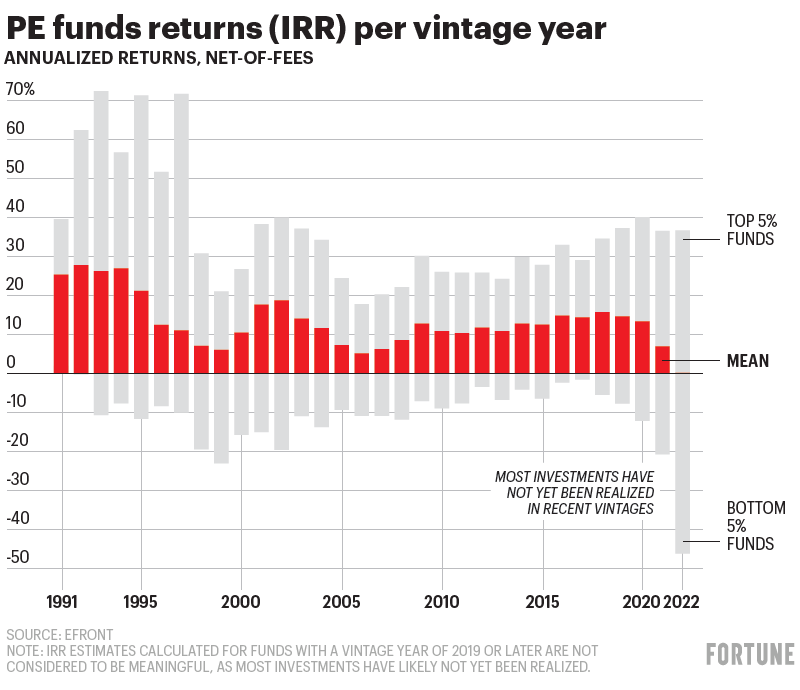

As for performance, investing in the private markets is extraordinarily risky—with LPs either racking up exceptional returns or exceptional losses. The key is choosing the right managers, which is why it’s so competitive to get access to top-tier funds. Here’s a look at the divergence over the last three decades:

What’s really interesting from this data is how top-quartile returns fell to earth after the collapse of the dotcom bubble. And, looking at the past decade, even the worst-performing funds posted smaller-than-normal losses in 2016 and 2017, likely thanks to the low-interest-rate era of 2020 and 2021.

A special thanks to Fortune graphics director Nick Rapp, who spent hours in back-and-forth with me yesterday building these charts after my initial sorry attempt ended poorly.

See you tomorrow,

Jessica Mathews

Twitter: @jessicakmathews

Email: jessica.mathews@fortune.com

Submit a deal for the Term Sheet newsletter here.

Joe Abrams curated the deals section of today’s newsletter.

VENTURE DEALS

- Urbanic, a London, U.K.-based fashion brand using AI to generate fashion designs and improve supply chain efficiency for the fashion industry, raised $150 million in Series C funding from Mirabaud Lifestyle Impact & Innovation Fund, D1 Capital Partners, JAM Fund, and others.

- Blockchain.com, a London, U.K.-based cryptocurrency financial services platform, raised $110 million in Series E funding. Kingsway Capital led the round and was joined by Baillie Gifford, Lightspeed Venture Partners, LSVP, GV, Access Industries, and others.

- MBrace Therapeutics, a San Diego, Calif.-based biopharmaceutical company developing antibody-drug conjugates, which administer chemotherapy agents to kill cancer cells, raised $85 million in Series B funding. TPG led the round and was joined by Avidity Partners, Cowen Healthcare Investments, and existing investors.

- Spark Car Wash, a Summit, N.J.-based express car wash operator, raised $30 million in Series B funding from GoPoint Ventures.

- Keychain, a manufacturing platform for the packaged goods industry, raised $18 million in seed funding. Lightspeed Venture Partners led the round and was joined by BoxGroup, Afore Capital, SV Angel, and others.

- Sunnyside, a San Francisco, Calif.-based app and program designed to help people form better alcohol habits, raised $11.5 million in Series A funding. Motley Fool Ventures led the round and was joined by Will Ventures, Uncork Capital, Offline Ventures, Joyance Partners, and others.

- Defacto, a Paris, France-based company using AI to automate B2B loans, raised $10.7 million in a Series A extension from Citi Ventures and others.

- Zero Emission Industries, a San Francisco-based developer and distributor of power and fueling systems for the maritime sector, raised $8.8 million in Series A funding. Chevron New Energies led the round and was joined by Trafigura and Crowley.

- Pippin Title, a New York City-based provider of title, tax, and transaction information to title insurers, banks, and mortgage services, raised $8 million in funding. Deciens Capital led the round and was joined by Joe Mansueto, Caruso Ventures, NKM Capital, and the University of Chicago Endowment.

- Aikido Security, a Ghent, Belgium-based developer of a software security app, raised €5 million ($5.4 million) in seed funding. Notion Capital and Connect Ventures led the round and were joined by others.

- Rewind, a Tel Aviv-Yafo, Israel-based biomass carbon removal and storage company, raised $5 million in seed funding from Frontier, the Israeli Government Innovation Fund, Yes VC, and others.

- Stockoss, a Paris, France-based supply chain management and logistics provider, raised €4 million ($4.4 million) in seed funding. Pi Labs led the round and was joined by others.

- Baton, a New York City-based platform for sharing and curating unreleased creative material, raised $4.2 million in funding. BITKRAFT Ventures led the round and was joined by Techstars, Dorm Room Fund, NYU’s Innovation Venture Fund, and others.

- Tradespace, a San Francisco-based AI-powered IP management platform designed to enable organizations to develop, evaluate and commercialize higher-quality IP, raised $4.2 million in seed funding. Eniac Ventures led the round and was joined by Abstract Ventures, Amplo VC, and Scrum Ventures.

- Layer Health, a Boston, Mass.-based developer of AI-powered data management and task automation tools for the health care industry, raised $4 million in funding from Google Ventures, General Catalyst, and Inception Health.

- Resistomap, a Helsinki, Finland-based developer of an antibiotic resistance monitoring platform, raised €2 million ($2.2 million) in seed funding. Ananda Impact Ventures led the round and was joined by others.

- BeMe Health, a Miami, Fla.-based platform that provides mental health services to teenagers, raised $1.5 million from Blue Cross and Blue Shield of Kansas.

- Pure Glow, a Boston, Mass.-based spray tan alternative, raised $1.4 million in seed funding. Maripat Pacino led the round and was joined by others.

- Fractl Inc., a Cupertino, Calif.-based developer of AI-powered programming platforms, raised $1 million in pre-seed funding. WestWave Capital led the round and was joined by January Capital, Arka Venture Labs, and others.

PRIVATE EQUITY

- Sumeru Equity Partners agreed to take Q4, a Toronto, Canada-based capital markets access platform, private for approximately C$257 million ($187.6 million).

- Granite Creek Capital Partners acquired NYP, an Elizabeth, N.J.-based packaging manufacturer and distributor in the wholesale nursery, agricultural, and industrial markets. Financial terms were not disclosed.

- Juniper Landscaping, backed by Bregal Partners, acquired Shooter and Lindsey, a Katy, Texas-based landscaping maintenance and installation provider. Financial terms were not disclosed.

OTHER

- Cox Enterprises acquired a minority investment in DSD Renewables, a Schenectady, N.Y.-based provider of large-scale commercial, industrial, and municipal clean energy solutions, for $250 million.

PEOPLE

- Angeles Equity Partners, a Santa Monica, Calif.-based private equity firm, hired Ursula Ster as an operating partner, finance in Angeles’ affiliated operations group. Formerly, she was with Divergent Technologies.

- BayPine, a Boston, Mass.-based private equity firm, hired Cory A. Eaves as partner and head of portfolio operations and Jason Currier as partner and chief financial officer. Formerly, Eaves was with General Atlantic and Currier was at Audax Private Equity.

- .406 Ventures, a Boston, Mass.-based venture capital firm, hired Trip Hofer as a venture partner. Formerly, he was with Optum Behavioral Health Solutions.

This is the web version of Term Sheet, a daily newsletter on the biggest deals and dealmakers in venture capital and private equity. Sign up for free.