Good morning.

During this year, I’ve been writing about attracting the next generation of accounting professionals and some of the challenges when it comes to retaining those starting out in the profession.

I recently had a conversation with Kathryn Kaminsky, vice chair, U.S. trust solutions co-leader at PwC, about this topic. Kaminsky says CPAs need to champion the profession and be even more intentional in telling their stories.

As for Kaminsky’s story, “I’m not the typical accountant,” she tells me. Kaminsky was a history major in college, and working at a camp led her to accounting.

“I lived in Ottawa, Canada, and believe it or not, they used to call it the Silicon Valley of the North,” she says. Kaminsky would spend one half of her summer working for a company in a customer service capacity helping clients by answering software questions, and the other half as a camp counselor.

A visit to the campus recruiting center would steer the direction of her career. A recruiter explained to her: “My skill set of working in corporate and being a camp counselor actually worked really well for being an auditor,” Kaminsky recalls.

“When you think about a camp counselor, you’re taking care of people, you’re giving them direction, and you’re helping mentor them,” she says. “And that’s a lot of what we do at the firm.”

Kaminsky would go on to have a more than 30-year career at PwC, and along the way earned a CPA. “I grew up in the audit practice and I spent a lot of time in financial services, and the fact is, what we do matters,” she says. CPAs build trust in the information that drives the capital markets, according to Kaminsky.

But while the accounting workforce is projected to grow by 4% from 2022-2032, it may not be enough, Kaminsky says. Accountants can play a role in helping to increase the pipeline of CPA candidates by communicating to young professionals how vast and differentiated the profession can be.

“The world is changing so quickly,” Kaminsky says. ”Whether it be sustainability, or AI, the future of what we do is really exciting.” And that includes exploring technology in new ways, she says.

“The job of a CPA is not just about number crunching,” Kaminsky says. “It’s actually, how do you lead teams? How do you have discussions with clients?”

“There are incredible leadership skills that you learn throughout your career at PwC that we probably don’t promote enough,” she says. “Like having hard conversations. That’s a leadership skill whether it be with a client or with a team doing talent development, and that’s all part of being a CPA.”

Kaminsky says that she’s visited college campuses along with her co-leader Wes Bricker, and Tim Ryan, U.S. senior partner at PwC, to tell their stories. And in April, PwC held Destination CPA, a new, three-day in-person immersive experience for accounting students and future CPAs from across the country who have an internship offer with the firm. Over 90% of attendees accepted their offers to join PwC, according to the firm. And there are plans to host the event again in 2024.

“I think they started to learn, but part of it was also adding some fun,” Kaminsky says. Like a round of “Family Feud” around questions that you’d find in a CPA exam, she says.

“I think there’s so many options that come with earning a CPA,” Kaminsky says. “And you can take it with you wherever you go.”

Sheryl Estrada

sheryl.estrada@fortune.com

Leaderboard

William C. (BJ) Losch III, who has been serving as both president of Live Oak Bank and CFO, will add the additional role of president of Live Oak Bancshares effective, Nov. 14 and will step down as CFO at the end of this year. The company's board announced Walter J. Phifer as CFO of Live Oak Bancshares and Live Oak Bank effective Jan. 1.

Chris Lucarz was named CFO at RWS Global, a producer of live experiences around the world. Lucraz is a former NBCUniversal CFO of production and operations. He joins RWS Global with more than 20 years of experience in various leadership roles, including VP of Rockefeller Center Operations to SVP and CFO.

Big deal

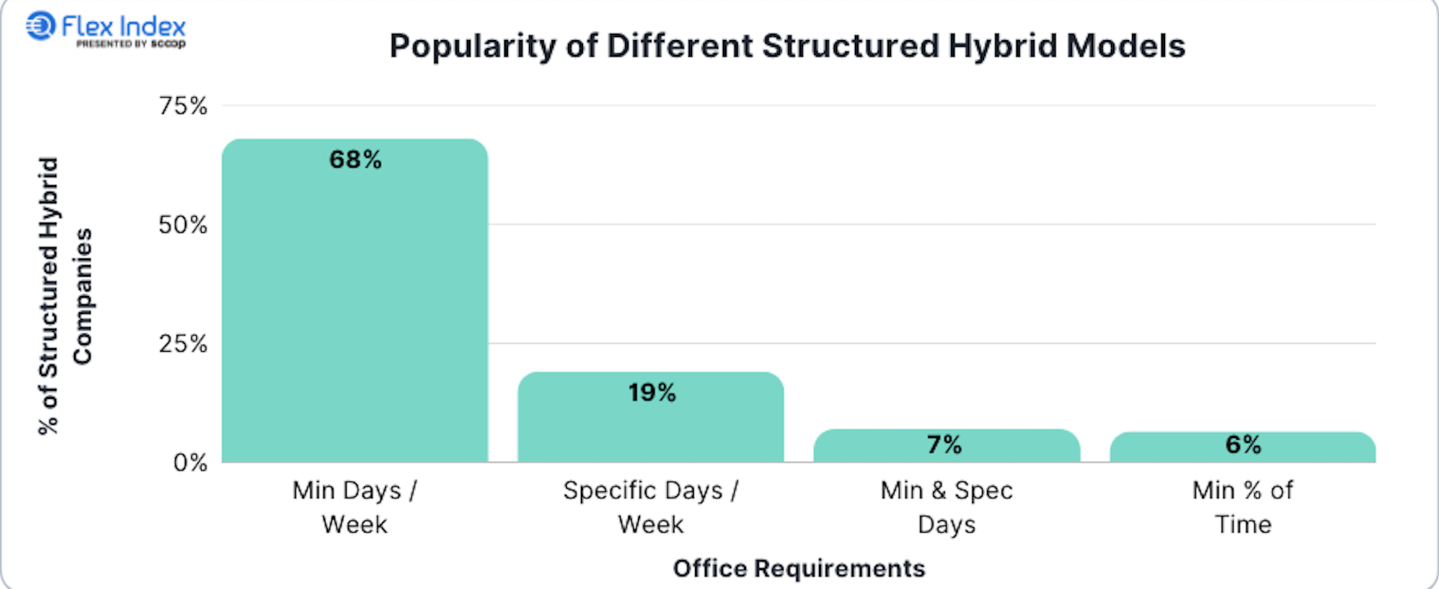

Scoop, a hybrid work management startup, partnered with the Boston Consulting Group to provide an analysis of remote work policies and revenue growth at more than 500 public companies.

One of the key findings of the research is the popularity of different structured hybrid models for the workplace. Having a requirement of a minimum number of days in the office is the most popular model (68%), followed by a specific days of the week mandate (19%), according to the report.

Going deeper

The Global CFO Turnover Index report, released by leadership advisory firm Russell Reynolds, found that in the first three quarters of 2023, about 200 CFOs at publicly held companies left their positions, compared to 196 across the same period in 2022.

In the S&P 500, 5% of CFOs left their jobs in Q3 2023, and that's the same percentage for finance chiefs in the FTSE 100. In Q3 2023, 62% of global incoming CFOs were first-timers, on par with 2022 figures. The research found that 21% of new CFOs appointed in the S&P 500 were women. And 80% of new CFOs appointed in the FTSE 100 were women.

Russell Reynolds estimates the global CFO turnover rate reached a four-year high of 15.1% in 2022, as finance chiefs are increasingly being considered as succession candidates for the CEO role. The rate was 14.4% in 2021, an increase from 12.9% in 2020, according to the report.

Overheard

“If you break it out, it’s still looking like slow, but clear, progress on each of the numbers."

—Chicago Federal Reserve Bank President Austan Goolsbee said on Tuesday about the October report on the consumer price index released by the Bureau of Labor Statistics, Reuters reported. Inflation, as measured by the consumer price index, rose just 3.2% from a year ago in October, which is down sharply from September’s 3.7%. Goolsbee indicated this may help move the U.S. economy closer to a soft landing where inflation falls but employment does not. "Absent any exogenous shocks, the Fed is increasingly likely to be in a position to cut rates in the second quarter of 2024,” Ronald Temple, chief market strategist at Lazard, an asset management and financial advisory firm, told Fortune.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up for free.