Good afternoon. Or not really.

It has been quite the news day so we’re bringing Term Sheet readers the latest after a crazy stretch. In a mere 48 hours the world has been turned upside down for founders, VCs, bankers and the journalists that write about them given the sudden failure of Valley stalwart Silicon Valley Bank. Yesterday, investors and depositors tried to withdraw $42 billion in deposits from the bank, according to a California regulatory filing. And while most of the world was blindsided by a run on the bank, Fortune spoke to one short seller who saw the writing on the wall months ago. As Jessica wrote in Fortune earlier today:

Less than an hour before the California financial regulator closed Silicon Valley Bank’s doors on Friday, short seller Dale Wettlaufer is walking me through their financials, and laying out some metrics he’s been closely eyeballing for months.

“I’ve never seen a situation like this change so quickly,” says Wettlaufer, partner at the short-selling shop Bleecker Street Research, which opened its short position into SVB in January.

Wettlaufer wasn’t talking about the events of the last two and a half days—when a bank run ushered the California financial regulator into its offices to close it down not long after SVB said it was raising more than $2 billion in capital through a share sale. No—Wettlaufer was referring to the last two years.

At the height of the venture boom, with the bank sitting on so much cash, its long-term securities portfolio grew from $17 billion to $98 billion, Wettlaufer explains. SVB invested that cash at the height of the market.

Now, interest rates aren’t zero any more, and that long-term securities portfolio is underwater by about $15 billion, Wettlaufer says, meaning that, if SVB had wanted to trade bonds within that long-term portfolio to free up capital, it might have had to recognize somewhere up to $15 billion in the unrealized losses it had reported at the end of 2022.

But another result of the newfound high-interest rates of 2022 was that Silicon Valley Bank’s own interest expenses would soar to absurd levels—both because of the Fed hikes, which necessitated SVB to up the interest rate it was paying to customers, but also because venture funding slowed down in 2022. That slowdown caused inflows of non-interest-bearing deposits at the bank to fall below outflows of those deposits. That’s because startups and other customers were burning cash. Because of this, the composition of SVB deposits changed drastically. Noninterest-bearing deposits fell $45 billion in 2022, forcing the bank to replace those with higher-cost liabilities than what had funded it previously.

As of Dec. 2021, SVB’s interest expense on its deposits was $62 million. By Dec. 2022, it was $862 million. By the end of this year, Wettlaufer was projecting it to be nearly $4 billion.

You can read the full story here. But suffice to say even those who are on the happier end of this trade aren’t cheering. “That is certainly not something to be celebrated,” Bleecker Street Research founder Chris Drose says.

The myriad startups who banked with SVB would certainly echo that sentiment, as Anne dug into earlier today:

One startup founder who banked with SVB told Fortune in a private message that, hours after the bank failed, “Our heads are spinning over here—not entirely sure what happens next.”

Another founder told Fortune in a private message that “My take is the entire ecosystem is effectively paralyzed.” They said that the focus right now is freeing up “cash basically, however you can, and make sure you can pay your people.”

Meanwhile some venture capital investors are also unsure what’s going on with their portfolio companies and the startup community at large: One VC told Fortune that the question of what happens with startups’ funds over that insured amount and whether those funds are locked up is the “question of the day,” adding that this weekend “will be critical.”

You can read that full story here.

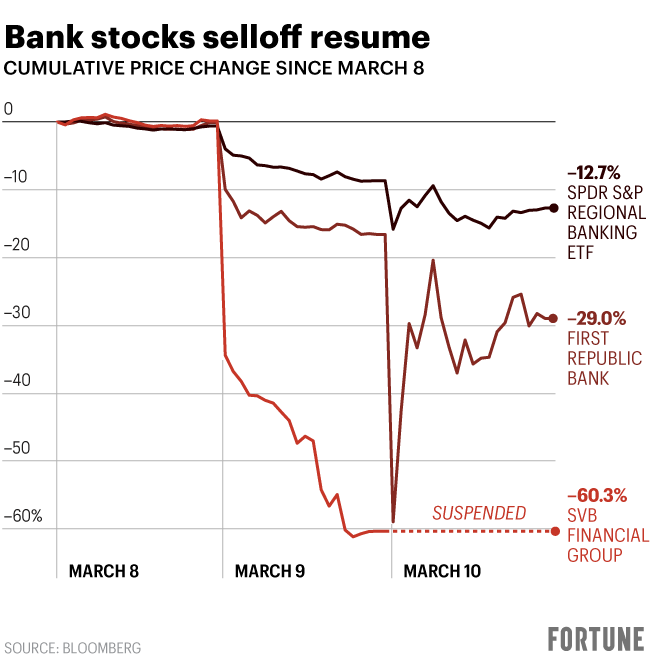

Before we leave you, here’s a look at how the demise of Silicon Valley Bank has put pressure on share prices of First Republic—and the whole regional banking sector—in the last couple of days:

We’ll keep you posted as the story unfolds; all of the coverage from across the Fortune newsroom can be found here. And as always you can email tips to jessica.mathews@fortune.com and anne.sraders@fortune.com.

Worth reading

- Silicon Valley Bank had no official chief risk officer for 8 months while the VC market was spiraling by Prarthana Prakash

- SVB’s collapse could lead to ‘contagion’ among regional banks—but experts say it’s not a systemic risk to the entire financial system by Will Daniel

- Silicon Valley Bank’s collapse devastated the tech world. Here’s what that could mean for crypto by Leo Schwartz

- Silicon Valley Bank just sucked all the oxygen out of SXSW by Kylie Robison

Fortune's CFO Daily newsletter is the must-read analysis every finance professional needs to get ahead. Sign up today.