Is Bitcoin or gold the better investment? Opinions vary widely, with billionaire crypto fan Mark Cuban favoring Bitcoin—and slamming gold—and Euro Pacific Capital CEO Peter Schiff going the other way.

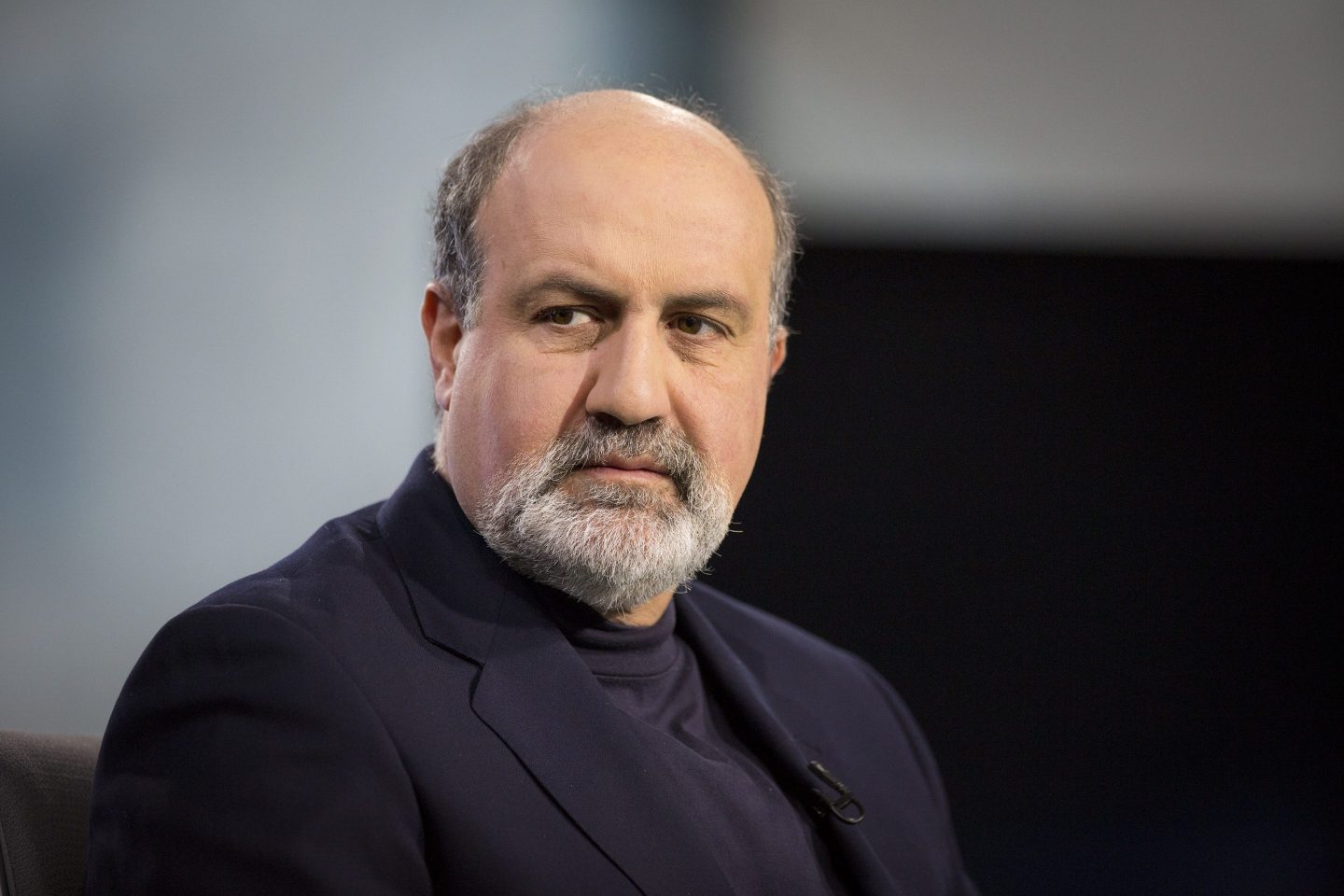

Nassim Nicholas Taleb has some thoughts too. This week the author of the 2010 New York Times bestseller The Black Swan—among the few who foresaw the 2007–2008 financial crisis—weighed in on the debate in an interview with the French weekly L’Express.

It’s safe to say Bitcoin, which has fallen more than 60% since the start of 2022, fails to impress him.

“Technology comes and goes”

One problem with Bitcoin, he said, is that “we are not sure of the interests, mentalities, and preferences of future generations. Technology comes and goes; gold stays, at least physically. Once neglected for a brief period, Bitcoin would necessarily collapse.”

What’s more, he said, “it cannot be expected that an entry on a register that requires active maintenance by interested and motivated people—this is how Bitcoin works—will retain its physical properties, a condition for monetary value, for any period of time.”

Asked about the origins of the “craze for cryptocurrencies,” he pointed to the low interest rates of the past 15 years.

“Lowering rates creates asset bubbles without necessarily helping the economy,” he said. “Capital no longer costs anything; risk-free returns on investment become too low, even negative, pushing people into speculation. We lose our sense of what a long-term investment is. It is the end of real finance.”

One of the results, he argued, was “malignant tumors like Bitcoin.”

The “everything bubble”

Taleb isn’t alone in noting the effects of what’s been dubbed the “everything bubble”—created by years of loose monetary policies from the Fed and other central banks following the Great Financial Crisis. As Fortune reported this week, the easy money era was filled with bulls—from crypto experts to hedge fund managers to economists and investment banks—who believed the good times would never end.

Interestingly, Taleb was supportive of Bitcoin early on. At the time, as he explained to L’Express, he was critical of then Fed Chair Ben Bernanke.

Bernanke, he said, did not see the structural risks of the system before the 2008 crisis, and overreacted afterward: “Instead of correcting debt and mitigating hidden risks, he covered them with a monetary policy that was only supposed to be transitory. I wrongly thought Bitcoin would be a bulwark against the distortions of this monetary policy.”

“Manipulators and scammers”

Taleb also warned that “the crypto universe attracts manipulators and scammers.”

He’s certainly not alone there.

Coinbase CEO Brian Armstrong said at the a16z crypto Founder Summit in late November: “We have to kind of come to terms as an industry with the fact that, I think our industry is attracting a disproportionate share of fraudsters and scammers. And that’s really unfortunate. That doesn’t mean it’s representative of the whole industry.”

(Armstrong added it was “baffling” to him why FTX founder Sam Bankman-Fried wasn’t already in custody—a few weeks later, he was.)

Taleb tweeted this week that he’s been trolled and smeared for his crypto criticism, but that such attacks have been offset by the “many thank-you messages for saving young people from Bitcoin.”

He shared a message in which a Twitter user said he almost bought Bitcoin but then started following Taleb’s thinking on it, writing, “I got why crypto is crap in theory. Then it went bust in practice. NNT saved my dad’s hard earned money.”

Meanwhile, many Bitcoin bulls remain bullish. ARK Invest CEO Cathie Wood recently reiterated her prediction that Bitcoin will hit $1 million by 2030—it’s now just below $17,000. She also argued Bankman-Fried didn’t like “transparent and decentralized” Bitcoin “because he couldn’t control it,” saying the FTX fiasco was caused by “opaque centralized players.”

As for Cuban, he said on Bill Maher’s Club Random podcast last month, “I want Bitcoin to go down a lot further so I can buy some more.”

Our new weekly Impact Report newsletter examines how ESG news and trends are shaping the roles and responsibilities of today's executives. Subscribe here.