What started out as a meme has finally become reality: someone has invented the Inverse Cramer.

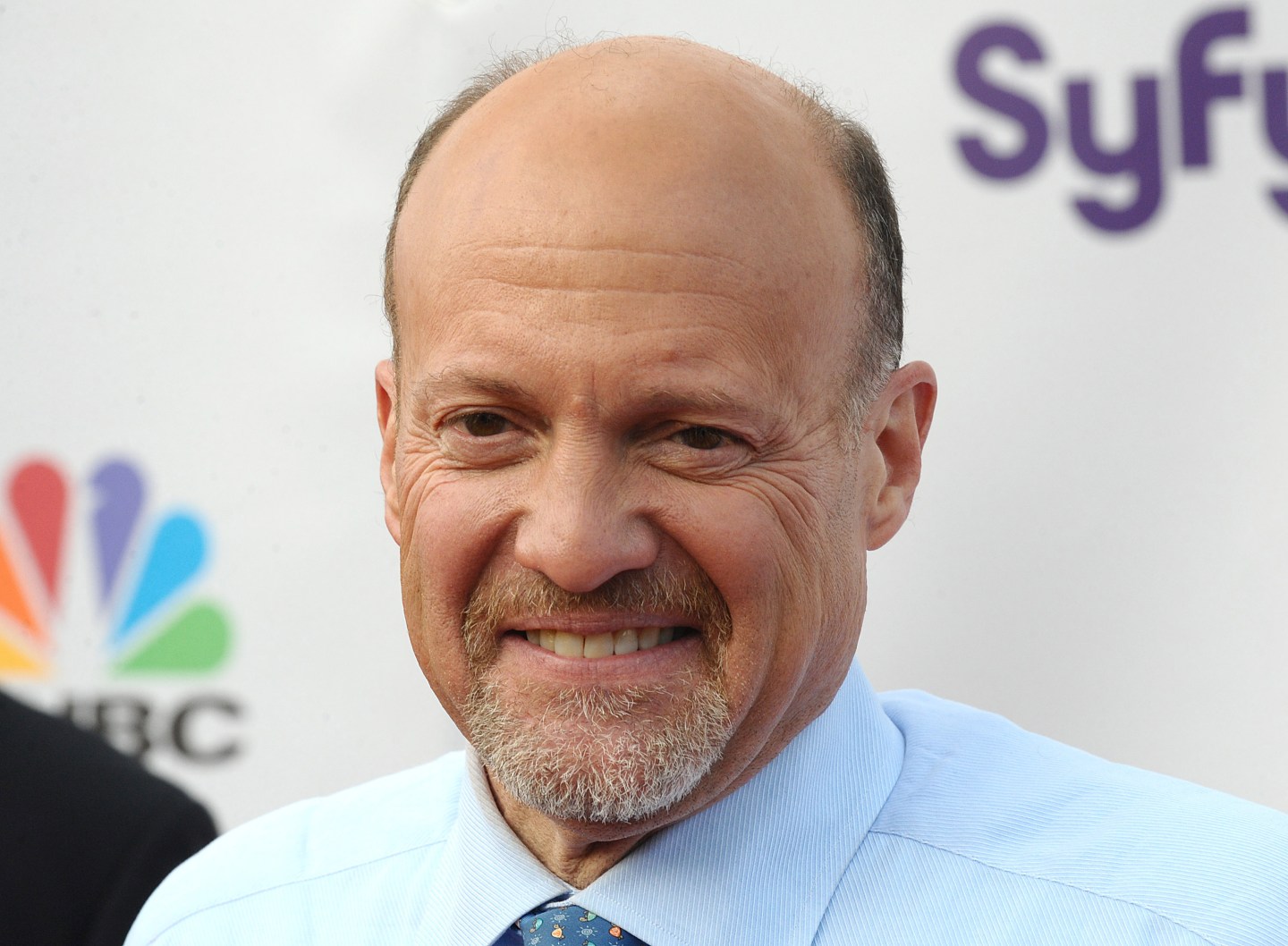

Few inside jokes on financial Twitter, or fintwit, enjoy more popularity than the theory that one should always listen intently to what CNBC’s colorful Mad Money host Jim Cramer predicts…and then bet invariably on the exact opposite outcome.

One fan of the idea appears to be Matthew Tuttle, of Connecticut-based Tuttle Capital Management, who now plans to sell a security under the ticker symbol SJIM, for “short Jim.”

His firm has filed a prospectus with the Securities and Exchange Commission for an actively managed exchange-traded fund (ETF) that seeks to provide a performance roughly the opposite of the investment return of assets recommended by the television personality, as it refers to the former hedge fund manager.

“The fund’s adviser monitors Cramer’s stock selection and overall market recommendations throughout the trading day as publicly announced on Twitter or his television programs broadcast on CNBC, and sells those recommendations short,“ it said in the filing, adding it would go long on his bearish recommendations.

“Under normal circumstances, at least 80% of the fund’s investments is invested in the inverse of securities mentioned by Cramer,” it continued.

He also shorts Cathie Wood

If Tuttle’s name sounds familiar, that’s because this isn’t the first time he has done this.

His firm reached notoriety with its ETF that shorts Cathie Wood’s ARK Innovation fund, a product that trades under the ticker symbol SARK.

Tuttle has a knack for offering ETFs with a particular investment theme. He launched his SPCX fund that tracks blank check acquisition firms, so-called SPACs, in December 2020 at the height of their popularity.

Genevieve Roch-Decter, CEO of Grit Capital and a critic of Cramer, posted on Wednesday her approval of the SJIM fund: “Finally, a way to outperform the market.”

Musk called him a ‘contraindicator’

Cramer first earned his reputation for picking duffs when he told people not to pull their money out of Bear Stearns just days before its collapse in March 2008.

When he recommended investors not subscribe to the Tesla IPO at a stock-split adjusted price of $1.13, Elon Musk quipped at the time, “We’re no Bear Stearns, but I think we’re going to do okay.”

His EV company generated “life-changing wealth,” as financial website The Motley Fool called it, rising to a current $240 per share.

“Frankly, he’s a contraindicator,” Musk said of Cramer in 2010.

More recently Cramer earned notoriety in October 2020 with his “Magnificent Seven” recommendation, a basket of names he felt investors coveted so much that their earnings didn’t matter and any dip served only as another buy opportunity.

Prominent names included all the major darlings of the pandemic bubble such as Netflix, Zoom and Peloton. All have since collapsed in value, with only Tesla managing to post sizable gains.

He’s also called it wrong on crypto, recommending token exchange platform Coinbase as a buy up to $475 a share the day of it listing in April 2021.

Not only did it never hit that level, it has since slumped to $73 a share. He predicted Ethereum’s ETH coin could rise another 35% late after it fell below $3,000 in late April of this year, prompting crypto website U.Today to run an article with the headline “Community is now worried.”

Social media took it a step further last November when a Twitter account launched with the handle @CramerTracker advertising that it tracks his stock recommendations “so you can do the opposite.” It has since gained over 100,000 followers.

Cramer shouldn’t take the whole debate around his performance too hard, though, since Tuttle Capital also applied for an ETF that seeks to reproduce his performance.

Sign up for the Fortune Features email list so you don’t miss our biggest features, exclusive interviews, and investigations.