Good morning,

When it comes to retaining talent at U.S. companies, it appears bonuses are just a temporary solution.

In March, a record number of people quit their jobs—4.54 million, The U.S. Bureau of Labor Statistics (BLS) reported on Tuesday. In Q1 2022, retaining talent—not just attracting new employees—was a top internal worry among finance chiefs, Deloitte’s latest research found.

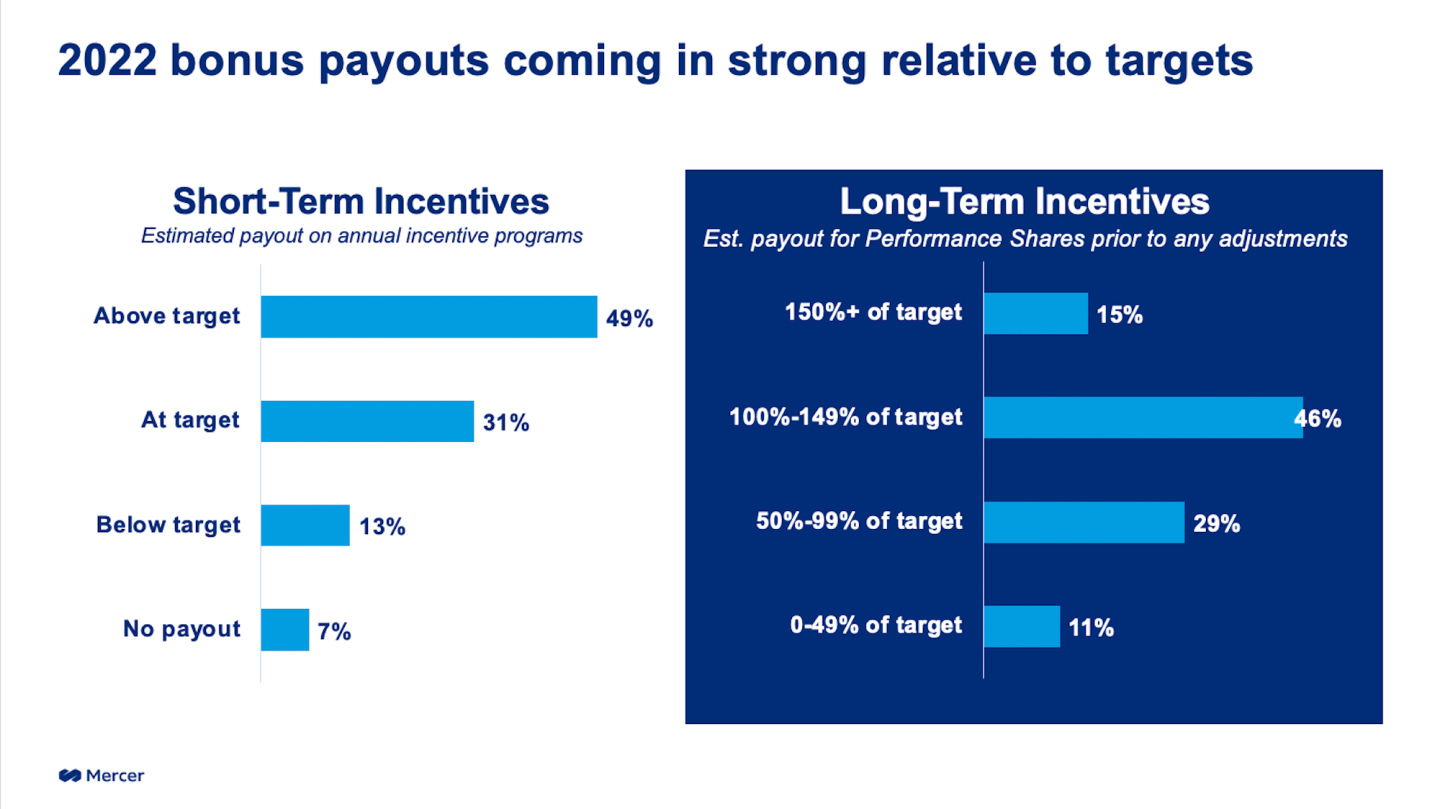

Employers have increasingly relied on bonuses in a tight labor market. The 2022 U.S. Compensation Planning Survey released by Mercer, an asset management firm, took a look at bonus payouts. About half of employers are paying out above target levels for both short-term and long-term incentives, Mercer found. The data is based on a March survey of nearly 1,000 U.S. organizations. The results were shared with Mercer clients in April.

Mercer’s survey also found that the average merit increase budget is 3.4%, with total increases (including other types of base pay increases, such as promotional awards) reaching 3.8%. The budgets are the highest we’ve seen since the 2008 financial crisis, Lauren Mason, a principal and senior consultant in Mercer’s career practice, says.

But compensation is seemingly not enough. Culture is a big part of why employees stick around or leave. For example, a recent survey by FlexJobs of more than 2,000 workers found the number one reason people quit their job was a toxic company culture (62%), followed by low salary (59%).

More transparency around pay and ensuring pay is competitive for all employees is important, Mason told me. But it’s also important for employers to take “a more holistic view beyond compensation in looking at how they can deliver a more compelling employee experience,” she says.

Nvidia’s CFO Colette Kress talked to me recently about how the tech company is making strides in retaining talent. Company culture is key, she told me. “The best thing that we can do is to say, ‘everybody is valuable to us,’ Kress said. “We are a very horizontal company, meaning—if you are the person in charge of the project, and you are the most knowledgeable about it, let’s hear from you, regardless of your title. We continue to try and work in an environment where everyone has that opportunity to lead. As leaders, we want to drive an environment of intellectual honesty, doing our best, promoting agility and removing any type of bureaucracy in the company.”

Providing learning opportunities helps as well, she said. “A big part of the education [our engineers] receive every day is about the future technology,” Kress said. “And that’s honestly what excites so many of the employees.”

The BLS report also found that in March, a record number of jobs were posted by employers—11.5 million. A signing bonus may attract candidates, but no guarantee they’ll stay.

See you tomorrow.

Sheryl Estrada

sheryl.estrada@fortune.com

Big deal

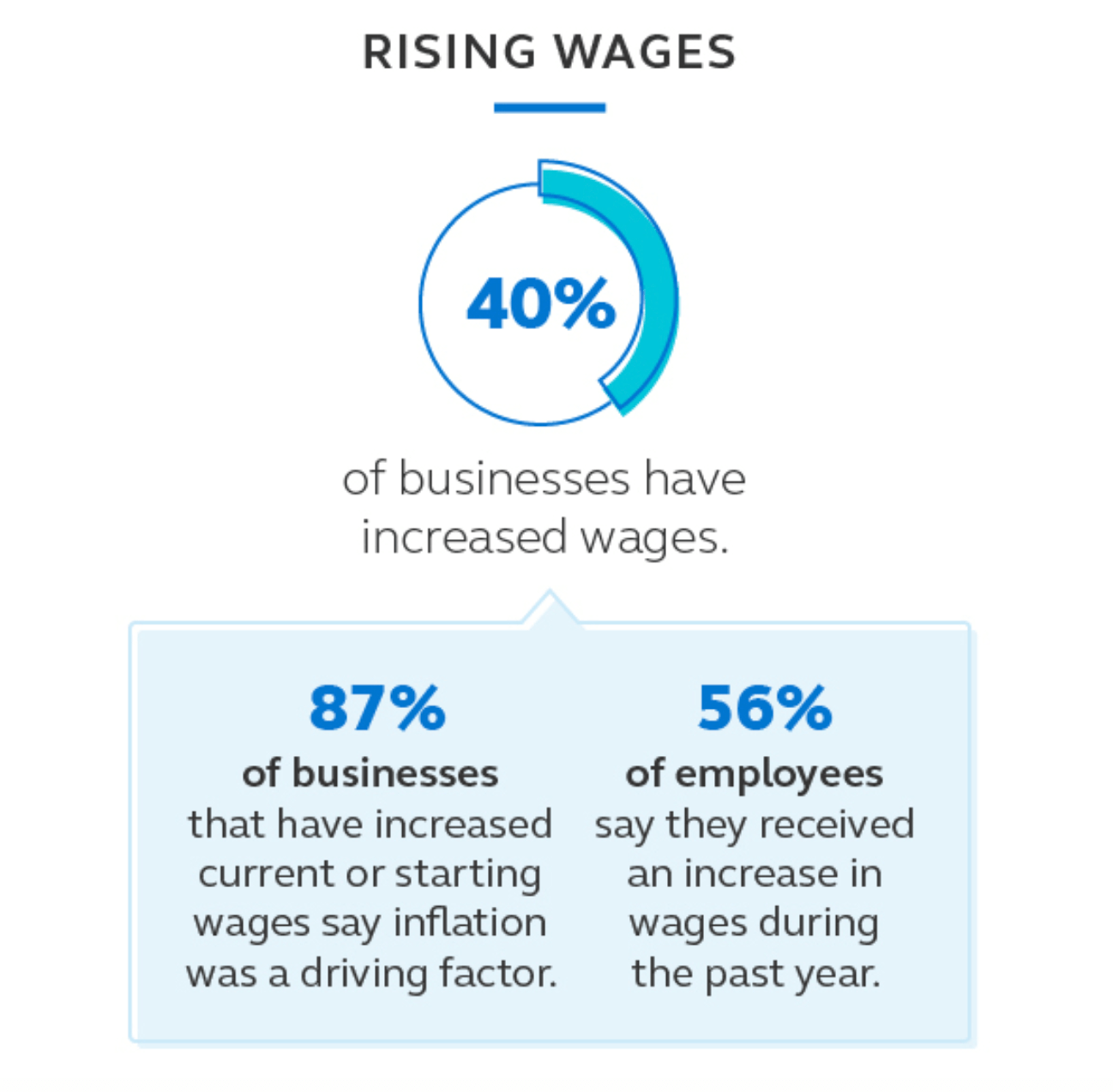

A new report by Principal Financial Group found that many small and midsized businesses are focused heavily on growing their number of employees. About 40% have increased wages for the majority or all of their employees. And 56% of employees surveyed reported receiving a wage increase during the past year, the most common amount was a 3% increase, according to the report. Regarding job vacancies, small businesses are faring better than their larger counterparts. Just 28% of employers with less than 500 employees said they have high job vacancy levels compared to 43% of employers with more than 500 employees. The findings are based on a survey of 500 business owners, and 200 employee participants.

Going deeper

A research feature in MIT Sloan Management Review, Break the Link Between Pay and Motivation, explores how pay-for-performance (PFP) compensation systems can undermine the performance of modern, collaborative work teams. "Organizations may have more to lose by failing to move beyond PFP compensation systems," coauthor, Jonas Solbach, market reach strategy manager at Hilti Group, said in a statement. "After conducting a large-scale experiment with a target-independent compensation system, the results point to a strong case for leaving PFP behind."

Leaderboard

Kristen Shults was promoted to SVP and CFO at Western Midstream Partners, LP (NYSE: WES), effective on May 2. Shults joined Western Midstream in 2019 as VP of investor relations and communications, and most recently served as SVP of finance and sustainability. She has 15 years of accounting and finance experience, including 10 years within the oil and natural gas industry. Shults served in various roles of increasing responsibility with Anadarko Petroleum Corporation’s tax organization, and began her career at Ernst & Young, LLP.

Kirby Toolan was named CFO at RW Capital Partners, Inc. ("RW Partners"). Toolan comes to RW Partners with over a decade of experience in financial management, business leadership and strategy. She was previously senior manager in reporting and analysis at Comcast Corporation. Prior to Comcast, she was an audit manager in PricewaterhouseCoopers' Private Company Services practice.

Overheard

"We will be looking for clues as to what Fed Chair Powell recently meant by 'moving expeditiously to a more neutral policy stance' in terms of the speed of rate hikes—how many more 50 basis point hikes, or even three-quarter point hikes."

—Andrzej Skiba at RBC Global Asset Management on the Federal Reserve's latest policy decision on interest rates that's expected later today, as reported by Fortune.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up to get it delivered free to your inbox.