On May 8, the CEO and founder of the world’s most valuable car company and one of the richest men in the world appeared on a sketch comedy television show dressed in a fat suit, oversize purple overalls, and a fake mustache, to play Wario, the fictional antagonist from Nintendo’s Mario video game series. He went on trial for Mario’s murder: On the stand, he proclaimed, in a fake Italian accent, that he was “not-a evil, I’m-a just-a misundahstood!”

If it were any other era, this might seem like an utterly bizarre, even embarrassing choice for all parties involved. But it’s almost 2022, and somehow nothing quite encapsulates the absurdity of the moment we’re living in more than Tesla CEO Elon Musk playing a cartoon villain on Saturday Night Live.

Musk is an entrepreneur and a visionary, an eccentric and a self-described wild card (and as of September, No. 1 on the richest-man list, thanks to Tesla). But he has also proved himself to be an entertainer and a storyteller, a creator of drama—and comedy—at a time when the American public is hungry to break out of a malaise that has settled in as we near the two-year mark of the pandemic. We are at a point where we can’t possibly bring ourselves to bake another loaf of sourdough or log on to another Zoom happy hour. There is no more Ted Lasso to watch. Sure, investors that back Tesla are betting on the future of electric vehicles and their potential to underpin a new, green economy. But they’re also buying a form of escapism, a front-row seat to the Elon Musk Show.

Musk is a Gen Xer—he turned 50 this year—but the show features the personal transparency, social-media fluency, and lolz informality that digital natives crave. His off-the-cuff public narrative can persuade millions of people to bid up the price of dying retailers, or decide whether to buy deliberately useless crypto coins with cute canine mascots. (Dogecoin soared because Elon bought it; Shiba Inu stumbled because he didn’t buy it.)

And above all, it can drive massive belief in Musk’s own company. The result is an obscene detachment between Tesla’s stock price and its fundamentals, which Fortune’s Shawn Tully dissects. Among his many eye-popping findings: Tesla would need to make more in revenue than any corporation on earth has ever generated to justify its $1 trillion–plus market cap—a figure that puts it in the same stratum as Microsoft, Apple, Amazon, and Alphabet.

To crunch the numbers, Tully uses two analytical tools that investing veterans cherish. But you can almost see the eye rolls from the Musk fanboys across the ether. Snooze. They have zero interest in classical market theory, only Elon market theory. They’re young, comfortable in a meme-driven ecosystem, and distrustful of anyone who is an officially sanctioned expert. Many of the retail investors who are now driving stocks to new highs had never put a dime in the market before the pandemic—and they are doing just fine without having read their Benjamin Graham, thank you very much.

The new rules of the market—or lack thereof—have the quants desperately searching for ways to make sense of what to an untrained eye looks like utter chaos. In a poetic piece, Bernhard Warner dives into the world of econophysicists, who believe that what seems like irrational behavior is always based on some kind of pattern. This worldview hopes to explain how FOMO and fantasy, pipe dreams and memes can fuel the likes of the GameStop rally that has dumbfounded traditionalists. (Musk, of course, made a cameo in the GME saga, sending the stock up nearly 100% in a single day by simply tweeting “Gamestonk!!”)

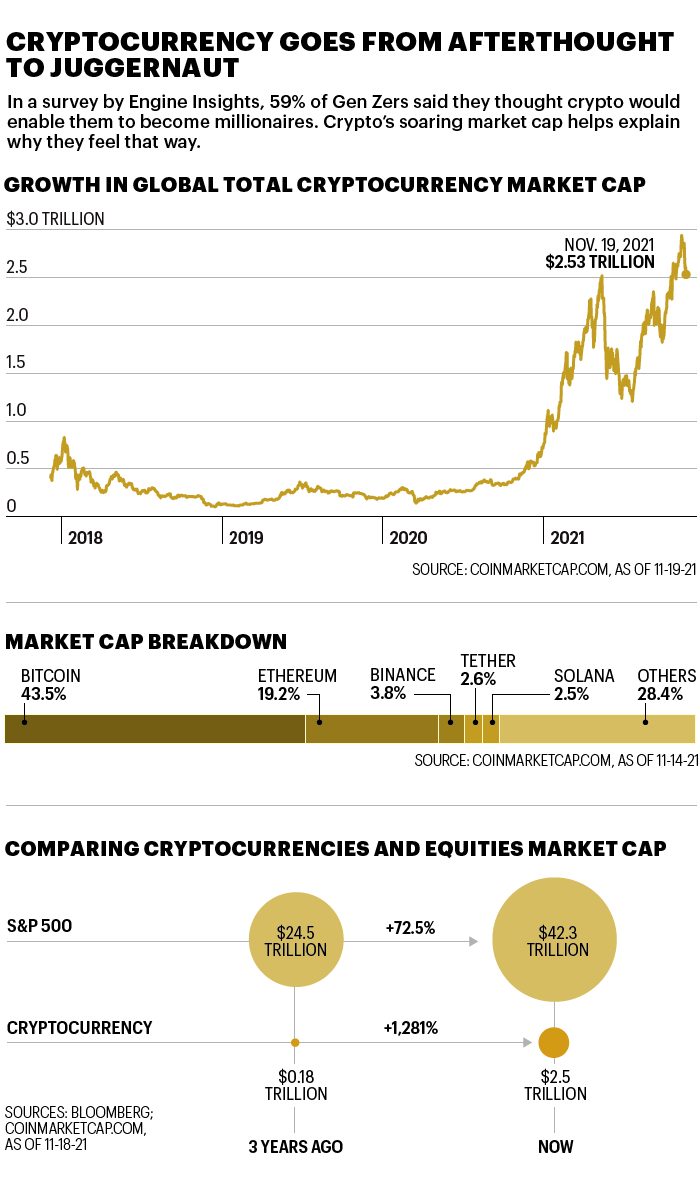

It’s a comforting thought that, in a confusing and dangerous financial world, all can be explained away by logic and reason. But in this case, it might not be all that complicated—and logic may not be what a certain class of investors is looking for. Tesla is potentially revolutionary. So is cryptocurrency, with its promise of getting investors in on the ground floor of a new financial order. Each reflects a story about a more hopeful future, in contrast to a present-day reality that can sometimes feel bleak. It’s obvious why a lot of people are willing to buy into that right now. Still, it’s worth remembering that sky-high prices imply a happy ending, and that’s something that nobody—not even Wario—can guarantee.

A version of this article appears in the December 2021/January 2022 issue of Fortune with the headline, “Musk rules the markets.”

This story is part of Fortune's 2022 Investor's Guide.