Good morning, Bull Sheeters.

Tesla. Tech stocks. Europe. Blue chips. There are a lot of records, or near-records to discuss this morning after a manic Monday of trading.

Take Tesla. The EV pioneer is gaining again in pre-market after investors drove the shares to a new all-time high yesterday, taking its market cap above $1 trillion, and padding Elon Musk’s lead on the rich list.

That investor euphoria continues to push U.S. futures higher as a risk-on mood sits over the markets.

How long can this rally last? I dig into that question in today’s essay.

But first, let’s see what else is propelling the markets forward.

Markets update

Asia

- The Asian markets are mixed. Japan’s Nikkei is bouncing back in impressive fashion, up nearly 1.8% in afternoon trading.

- Shares in Hong Kong are going in the opposite direction. There’s real concern that the world’s biggest banks will pull resources and people out of the financial hub as the Chinese territory exerts tougher COVID-19 quarantine restrictions on incoming travelers.

- Coal and gas exporting giant Australia is pledging to go net-zero by 2050.

Europe

- The European bourses were mostly higher out of the gates, with the Stoxx Europe 600 up nearly 0.6% two hours into the trading day, putting the benchmark close to record levels. Travel and leisure, retail and auto stocks lead the way higher.

- Swiss banking group UBS posted blockbuster quarterly results this morning, helped by its booming wealth management business. The stock gained 2.4% at the open, and it’s climbed 46% in the past 12 months. Purely by coincidence, yours truly wrote a feature on UBS a year ago as the bank welcomed a new CEO.

U.S.

- U.S. futures point to a solid open. On Monday, all three major averages climbed to new gains. The S&P 500 hit a new record, and Nasdaq is about 177 points away from its all-time best. The Nasdaq 100 is outperforming this morning.

- Facebook is a big reason for that. Its shares are up 2.1% in pre-market trading after the embattled social media giant posted a big beat on earnings, and, more importantly, on new active users. There’s been an avalanche of negative headlines buffeting the company. Fortune has you covered on the latest revelations, including some eye-opening data on the teen-exodus from its top social channels.

- Elsewhere in pre-market land, Tesla shares are up a measly 0.5% this morning. That’s after the stock rocketed 12.7% higher on Monday following news the EV maker struck a deal to supply rental-car chain Hertz with 100K cars. Who else is looking forward to the tourists popping their rental Tesla in self-driving mode to get a better look at the local attractions?

Elsewhere

- Gold is off slightly, but it’s had a great run. It trades above $1,800/ounce, breaking above the 100-day moving average.

- The dollar is up.

- Crude is flat with Brent trading around $86/barrel.

- Bitcoin is flat—not just over the past 24 hours, but over the past week. BTC trades around $62,000 this morning.

***

TINA, FOMO… or FLASH?

In a frothy bull market, I do appreciate a bit of frank self-reflection every now and then. Which brings me to Morgan Stanley’s chief investment officer Lisa Shalett. I’m a big fan of her weekly “Global Investment Committee” (GIC) investor note, and her latest missive doesn’t disappoint.

“The GIC’s three-month old call for a 10%-15% correction in the S&P 500 has thus far been wrong,” she began yesterday’s note.

But, she added, the team stands behind the prevailing logic for that downer of a call from the summer when it saw a correction on the horizon. “Our calls on earnings revisions, inflation, interest rates and Fed policy have been on target, so what’s going on?”

Do investors have a bad case of FOMO (fear of missing out)? Are they under the spell of TINA (there is no alternative)? Is it something else entirely happening—are they flush with cash, maybe? (I haven’t seen a good acronym for this latter hypothesis, so I’ll call it, “FLASH.” If you’ve got a better suggestion, hit me up. My email is below.)

Whatever the reason for the October optimism, one thing’s for sure: we’ve been seeing a healthy bout of BTD—buy the dip—action. And the buy-the-dip crowd mainly consists of retail investors, Morgan Stanley finds.

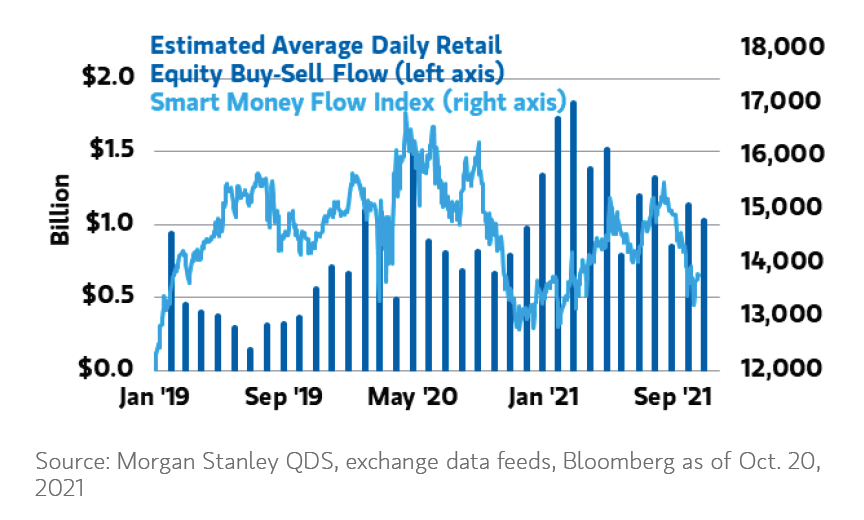

“While the Smart Money Flow Index shows institutional investors have derisked their portfolios in September and October, individual investors have remained strong net buyers of stocks,” Shalett’s team writes. “Their influence is assumed by some to be a key factor behind S&P 500 rebounding from a slight pullback and coming back to make new highs.”

Here’s the chart they use to underscore their observation.

You can see the volume of daily retail trading (represented by the darker blue lines) is surging again, suggesting retail army is back and buying. The flows from institutional investors, meanwhile, shows a much more bearish view.

Morgan Stanley isn’t convinced this retail-fueled rally can last. Why’s that? For starters, they write, “our analysis suggests that despite a record-high level of household savings, there may be less available cash on the sidelines than some think.

“This means the market may be closer to the ninth inning,” they conclude.

***

Postscript

The scene: dinner at Casa Warner.

My daughters: Dad, guess what we did at school on Friday?

Me: What did you do at school on Friday?

My daughters: We made vino.

Me: Wine? In which class was this?

My Daughters: Technology class.

Me: That’s what you do in technology class?

My wife: In America, you code. In Italy, we make wine.

They went on to explain that, over two recent Fridays, the class squashed the grapes (in case you’re wondering, the grape variety was Montepulciano d’Abruzzo), collected the juice and started the vinification process.

They measure the pH, sugars and other vitals. The aim is to produce a good 70 liters of a red “vino da tavola” wine, which the kids will take home to the parents at the end of the school year, a nice accompaniment to a dish of pasta amatriciana.

I’m very bullish on this future vintage.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

As always, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

Democrats look to Billionaire tax on unrealized capital gains—Fortune

Hyperinflation: Why Jack Dorsey is worried—Fortune

Just 0.1% of Bitcoin miners control half of all mining capacity—Fortune

Lucid Motor’s Air EV finally hits the roads with a range that blows Tesla away—Fortune

Proposed Tax on Billionaires Raises Question: What’s Income?—The New York Times

Natural-Gas Sticker Shock Is Coming to Your Dinner Table and Commute—Wall Street Journal

Market candy

20.4%

In the tech press, Facebook is having a hellish year. But investors seem to shrug off all the rough headlines, sending the stock up more than 20% YTD, narrowly outperforming the Nasdaq. Fortune's Declan Hardy details how FB diehards have stuck with the stock through thick and thin over the years, and why they're likely to weather this storm too.

This is the web version of Bull Sheet, a no-nonsense daily newsletter on what’s happening in the markets. Sign up to get it delivered free to your inbox.