Good morning,

Here’s what happened this week:

“The CFOs I work with, they’re going through their own personal professional development in a different way than they used to five or seven years ago,” Ankur Agrawal, a partner in McKinsey & Company’s New York office told me. “The skills they need include a lot more technology awareness and literacy.” Agrawal contributed to the development and analysis of Mastering change: The new CFO mandate released on October 7. CFOs will increasingly focusing on tech. The percentage of finance chiefs surveyed who are responsible for their companies’ digital activities has more than tripled between 2016 and 2021, from 9% to 31%, McKinsey found. But Agrawal explained that this digital progression began years before the pandemic.

If you think TikTok and its ilk are just for kids, well, you couldn’t be more wrong. These platforms are exerting a gravitational pull on corporate America. The team at Fortune recently went deep on the “Creator Economy” to examine the ways companies are using influencers and platforms to build their brands. Jeffrey O’Brien has an excellent feature on the topic, “Welcome to the TikTok economy.” Speaking of this new generation of influencers, Fortune also highlighted the “Creator 25″—several of whom happen to be making their mark in the worlds of money and finance. There are four that should be on your radar, like Li Jin, 31, a venture capitalist, artist, and immigrant to the U.S. Jin is the founder of Atelier Ventures, an early-stage VC startup. But check out the complete list here.

Innovation in technology is a major factor in the rapid growth of earnings, said Adena Friedman, president and CEO at Nasdaq. So, we’re not necessarily in a stock market bubble, according to Friedman. “I think we need to look at all of the ingredients that are contributing to the market valuations,” she said during Fortune’s Most Powerful Women Summit in Washington, D.C. on Tuesday. “First is a true digital transformation of the corporate community and everyone’s lives.” The tech that is enabling the transformation represents a “long-term growth opportunity that is massive,” Friedman said. “Investors are looking for growth and they’re rewarding companies that can do that,” she explained. This in turn drives asset values up because of the opportunities that are in front of those companies, Friedman said. “The companies that are going public today are amazing … they are driving a technological transformation of the economy,” she said. “That is a 20-year trend.”

When I interviewed Square CFO Amrita Ahuja in March for the first edition of CFO Daily, she told me, “there’s absolutely a case for every balance sheet to have Bitcoin on it.” At Fortune’s Most Powerful Women Summit, Ahuja referred to that sentiment. “At the time, it was about 5% of our cash reserves that we invested in Bitcoin,” she said. Crypto and its supporting technologies can improve efficiency, Ahuja said. If you compare the speed of the Internet to the speed of fiat currency, “it seems highly probable that the Internet will have a native currency,” she said. “We believe, at Square, that Bitcoin has the opportunity to be the strongest contender in being the native currency of the Internet,” Ahuja said. The finance chief talked crypto and the company’s M&A strategy.

Thanks for reading. Have a great weekend.

Sheryl Estrada

sheryl.estrada@fortune.com

Big deal

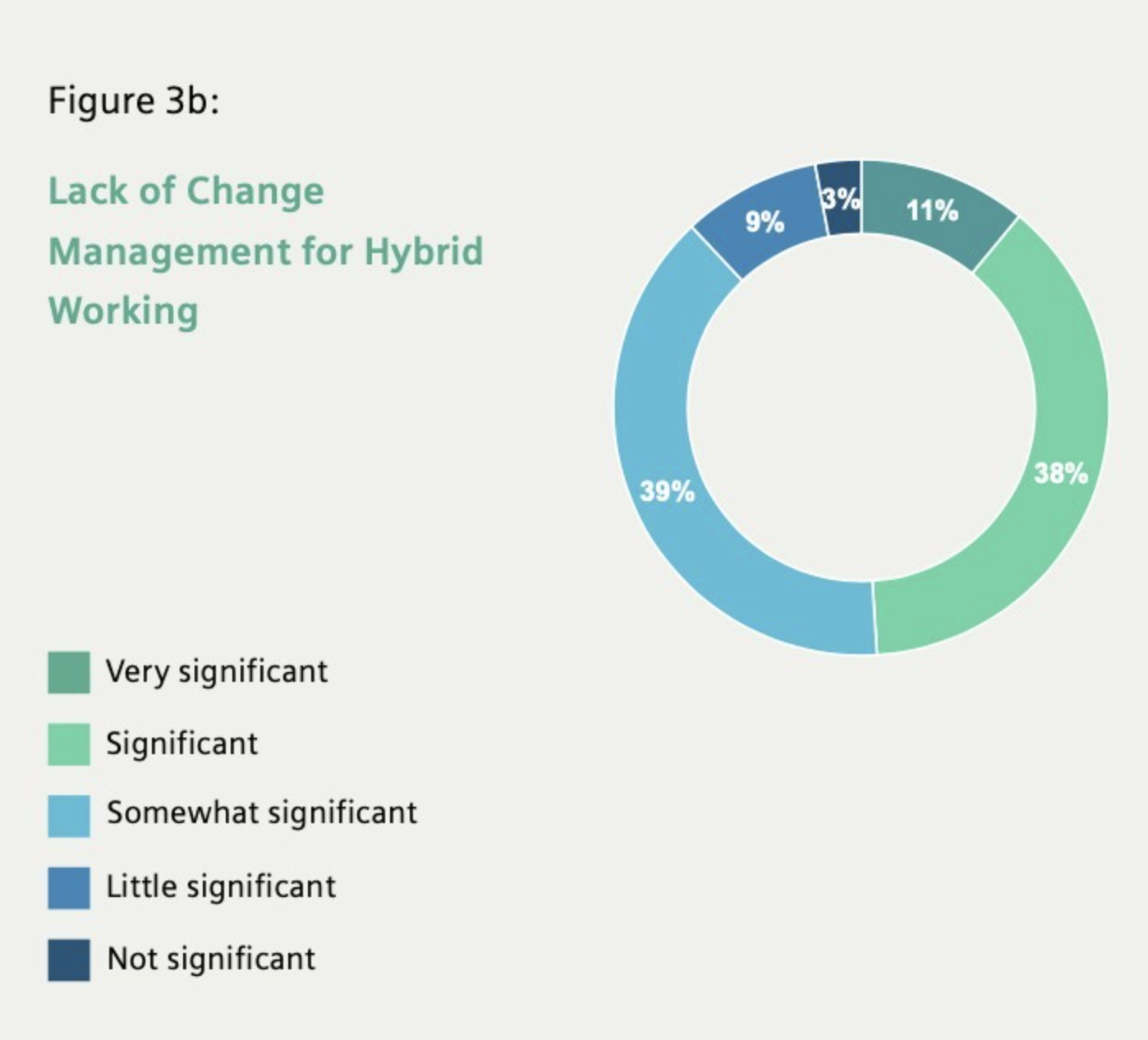

While flexible working is becoming widely accepted, many companies aren't prepared for a consistent strategy, according to a new report commissioned by Siemens from analyst firm Verdantix. About 83% of respondents said they have shifted permanently to a hybrid work model. However, 88% consider a lack of defined process for managing hybrid work to be a significant challenge. The report also found a focus on hybrid workspaces has transformed the role of the corporate real estate executive (CRE) with more than half experiencing major role changes. Verdantix surveyed 75 CREs from global companies with annual revenues of over $1 billion.

Courtesy of Siemens and Verdantix

Going deeper

Here are a few Fortune reads for the weekend, which we've pulled from our Quarterly Investment Guide. You can see the full guide here.

Value stocks are unloved, unsexy, and poised to make a killing over the next decade by Shawn Tully

Where Wall Street’s top banks see stock prices heading by the end of 2021 by Declan Harty

The beginner portfolio: 13 stocks for the new investor by Anne Sraders

What I wish I’d known when I started out: Advice from A-list investors by Chris Taylor

Leaderboard

Some notable moves from this past week:

Dmitry Kaplun was named CFO at Clubhouse Media Group, Inc., an influencer-based social media firm and digital talent management agency. Kaplun will lead financial strategy, growth initiatives, and capital raising to explore a possible Nasdaq uplisting in 2022, according to the company. He joins Clubhouse Media from his role as VP of studio finance at NBCUniversal Telemundo Enterprises. Kaplun's professional experience also includes working as a consultant at Entertainment Partners, serving as a SVP of finance and business operations for 20th Century Fox/Fox International Productions, and as a finance manager at NBC Universal International.

Adam B. Kroll was named EVP and CFO at Lordstown Motors Corp., effective October 25. Kroll will replace Rebecca Roof, interim CFO who will remain with the company in a transition role through December 31. Kroll brings to Lordstown Motors nearly 25 years of financial, operational and capital markets experience. He previously served as an investment banker at JP Morgan. Kroll also served as chief administrative officer for Hyzon Motors, interim CFO for UPG Enterprises and SVP of finance for PSAV Holdings.

Kristen Norris was promoted to CFO at Executech, a managed IT services provider. Norris joined the company two years ago as part of the acquisition of DSA Technologies. She has worked with the accounting and finance functions across Executech and its subsidiary brands. Before joining Executech, Norris worked across accounting, finance, and HR functions at DSA. She previously spent 10 years in roles that included client relations, account operations, and financial consulting.

Melissa Thomas was named EVP and CFO at Cinemark Holdings, Inc., a global movie theatre company, effective November 8. Thomas will succeed Sean Gamble, who was promoted to president on July 28, and will be named CEO on Jan. 1, 2022, upon the retirement of Mark Zoradi. Thomas joins Cinemark after serving as CFO for Groupon since 2019. Prior to her appointment as CFO, she served as Groupon’s chief accounting officer and treasurer, and VP of commercial finance prior to that. Before joining Groupon, Thomas held a diverse range of senior finance positions within Surgical Care Affiliates and Orbitz.

Harry Thomasian Jr. was named CFO at Precigen, Inc., a biopharmaceutical company, effective October 18. Thomasian will report to Precigen’s president and CEO Helen Sabzev. Prior to Precigen, Thomasian worked at EY. He most recently served as senior client services partner and the Baltimore office growth markets leader for the life sciences industry and senior partner in EY’s Capital Markets Center in Tokyo as well as other various global, area and local leadership positions.

Overheard

“Generally speaking, depleted inventories have been something that has been driving bottlenecks.”

—Kansas City Fed’s principal agriculture economist Nathan Kauffman on the 10.5% increase in meat prices this year and supply chain issues, as told to Fortune.

This is the web version of CFO Daily, a newsletter on the trends and individuals shaping corporate finance. Sign up to get it delivered free to your inbox.