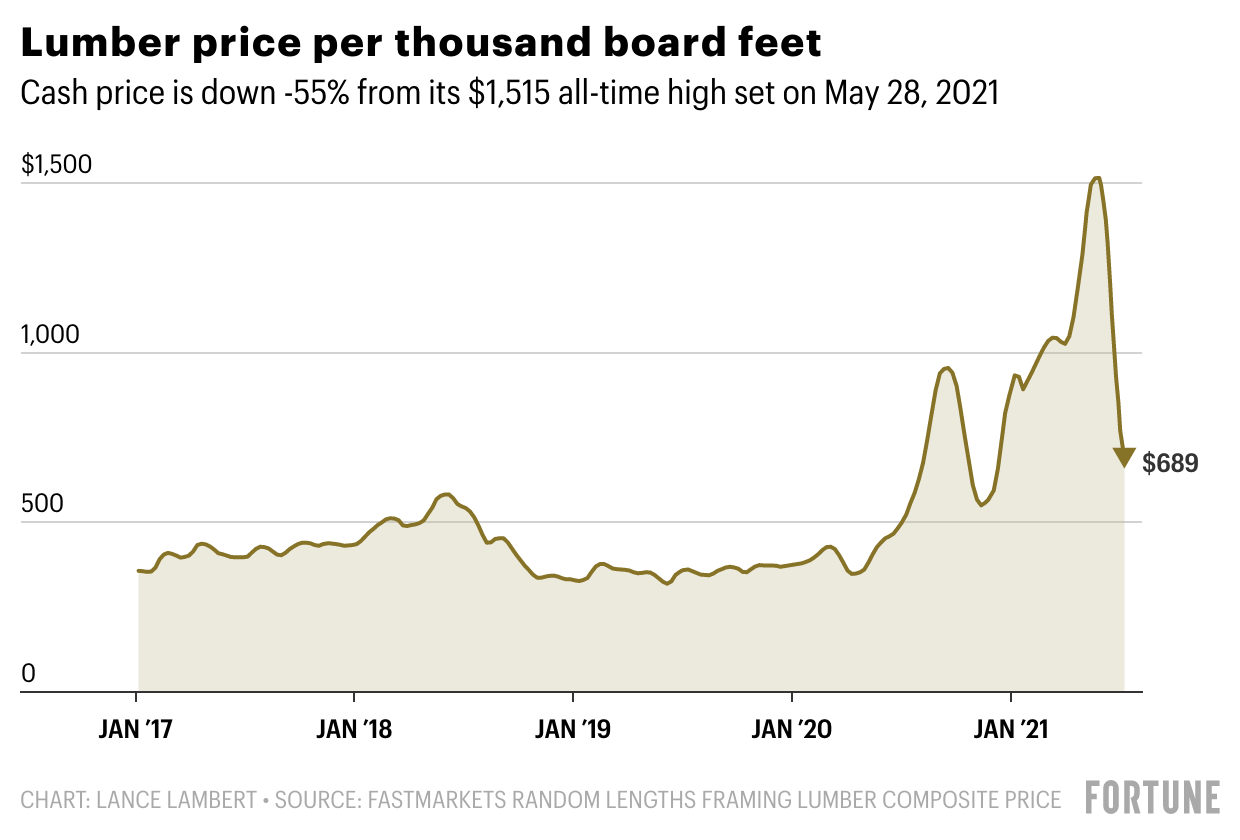

At one point this spring the price of lumber was up over 300%—terrifying both homebuilders and DIYers. Since then, lumber has come crashing down.

That descent continued last week, as it notched its sixth consecutive week of decline. On Friday, the “cash” price of lumber fell $81, to $689 per thousand board feet, according to industry trade publication Fastmarkets Random Lengths. That’s a 55% drop from its $1,515 all-time high set on May 28.

But if you’re a do-it-yourself maven searching for two by fours in the aisles of big boxes like Home Depot and Lowe’s, you’ll likely notice that prices are still sky-high. The reason? For starters, the cash price of lumber is a wholesale price—it’s what sawmills charge distributors—and it takes time for those price drops to be reflected on the retail side. Secondly, the price of lumber is still up 84% from the beginning of 2020, when it cost $375 per thousand board feet.

Just how long until these price cuts make their way into the aisles of big boxes? Michael Goodman, director of specialty products at Sherwood Lumber, tells Fortune each dip will take “about 60 to 90 days to get into the market.”

The bad news for DIYers? The bursting of the lumber bubble could be over. Industry insiders tell Fortune this latest dip has likely taken prices near to their floor.

“I believe the cash has hit its bottom,” Goodman says.

What’s going on? In recent weeks, demand from homebuilders and DIYers has been cooling as a result of historically high wood prices. That has helped sawmills and the rest of the supply chain to catch up, thus lowering the price of lumber. But that story is about to change, now that we’re at the beginning of what looks likely to become an unusually severe wildfire season. Already, fires are bursting out in British Columbia and the U.S. Pacific Northwest—the epicenters of North American lumber production. If mills in British Columbia or states like Oregon go offline, it could cause another upswing in the price of lumber.

On June 11, the cash market price was still above $1,300 per thousand board feet, Dustin Jalbert, a senior economist at Fastmarkets RISI, where he covers the lumber market, tweeted that $500 to $600 per thousand board feet would come sooner than some buyers were expecting this year. Indeed, the swift drop to $689 is a pleasant surprise for many buyers. But now, Jalbert believes, the lumber market is “squared up for a pretty decent bounce in the coming weeks” as a result of wildfire season and some turned-off buyers returning to the market now that prices have corrected.

If an uptick comes again, it’s unlikely to be anything like the run this spring. Heading into 2021, builders and vendors were hoping that lumber prices—which saw big upticks in the summer of 2020— would come back down. When the price didn’t fall this spring, those builders and vendors scrambled to buy up inventory. That stampede—or short squeeze—caused the price soar to over $1,700 in the futures market. That dynamic is no longer in play, Stinson Dean, CEO of Deacon Lumber, told Fortune last month

As Fortune has previously reported, this historic lumber shortage was spurred by a perfect storm of factors set off during the pandemic. When COVID-19 broke out in spring 2020, sawmills cut production and unloaded inventory in fears of a looming housing crash. The crash didn’t happen—instead, the opposite occurred. Americans rushed to Home Depot and Lowe’s to buy up materials for do-it-yourself projects, while recession-induced interest rates helped spur a housing boom. That boom, which was exacerbated by a large cohort of millennials starting to hit their peak homebuying years, dried up housing inventory and sent buyers in search of new construction. Home improvements and construction require a lot of lumber, and mills couldn’t keep up.

Subscribe to Fortune Daily to get essential business stories straight to your inbox each morning.