Our mission to help you navigate the new normal is fueled by subscribers. To enjoy unlimited access to our journalism, subscribe today.

As Joe Biden and Donald Trump make their final plea for votes, they’re visiting battleground states with sharply different economic realities.

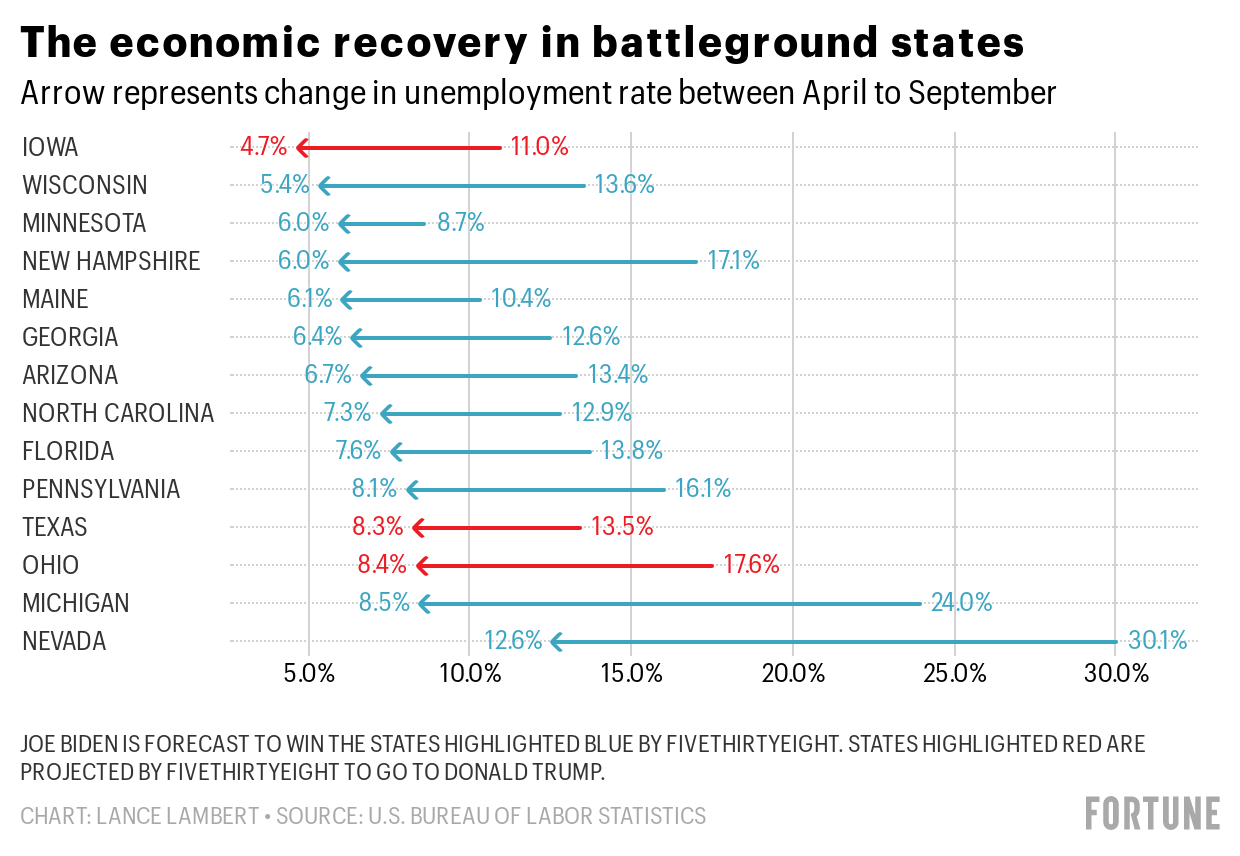

Case in point: While the unemployment rate in September in Iowa sits at 4.7%, Nevada has a jobless rate of 12.6%. Nationally, the jobless rate is at 7.9%.

Trump has a 54% chance of taking Iowa, while Biden has a 90% chance of getting a win in Nevada, according to FiveThirtyEight. But just because a state is doing better economically doesn’t mean it’s favored for Trump. The results are all over the broad. Nate Silver’s poll aggregator gives Trump the edge in two battleground states with higher jobless rates, Ohio (8.4%) and Texas (8.3%). While some states with lower jobless rates, in particular, Wisconsin (5.4%) and Minnesota (6.0%), are currently projected to go for Biden.

How did these economies get so divided?

A lot of it boils down to what types of jobs make up the state’s economy. Look no further than tourism-heavy Nevada which saw its jobless rate soar from 3.8% in February to a staggering 30.1% in April. While Nevada has since improved to a 12.6% jobless rate, it will struggle to fully recover until Las Vegas tourism business has returned to normal—something that is unlikely to happen until the pandemic is under control.

The economies in industrial Midwestern states were hard hit in the spring when factories saw their production lines halt. They’ve yet to fully dig themselves out of the mess. The unemployment rates in Ohio (8.4%), Pennsylvania (8.1%), and Michigan (8.5%) are all above the national 7.9% figure. FiveThirtyEight gives Trump a 55% chance of carrying Ohio, but in Pennsylvania and Michigan that chance is just 14% and 4%, respectively.

The recovery is much more swift in rural Midwestern states with heavy agricultural economies—which have rebounded relatively quickly. The jobless rate in Minnesota surged from 3.1% in February to 9.9% in May at the height of shutdowns. But as the state reopened its economy over the summer, it fell to 6.0% as of September. But that recovery is hardly aiding Trump in the polls: Biden has a 93% chance of carrying Minnesota.

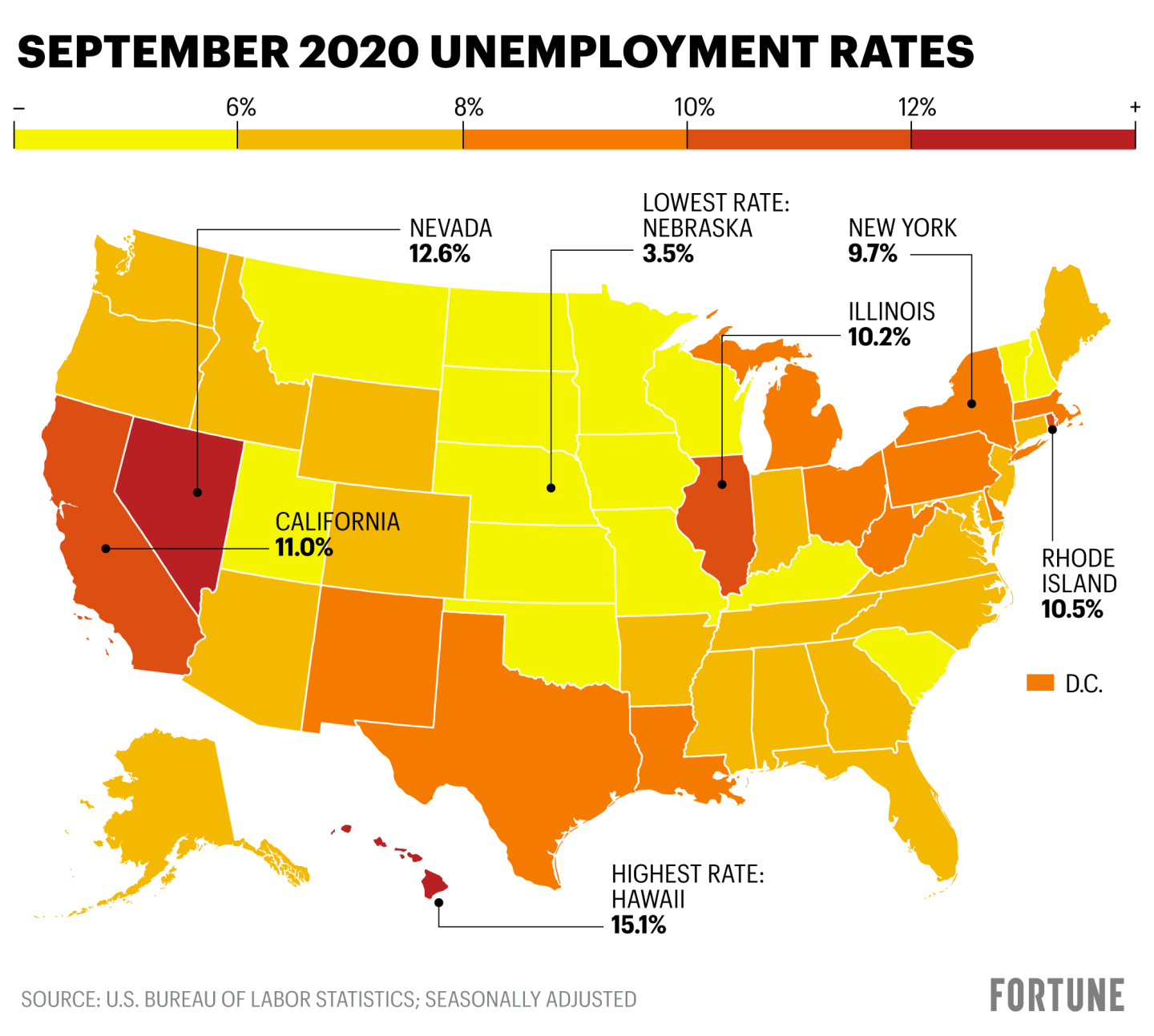

And it isn’t just battleground states. The highest jobless rates can be found in Hawaii (15.1%), Nevada (12.6%), and California (11%). The lowest are in Nebraska (3.5%), South Dakota (4.1%), and Vermont (4.2%).

It might take years for these high unemployment economies to fully rebound. Overall U.S. employment rose by 661,000 in September, bringing the total number of jobs added since May to 11.4 million, according to the U.S. Bureau of Labor Statistics‘ Friday jobs report. But that marks a downshift from the 1.5 million jobs added in August and 1.8 million added in July. If the U.S. continued to add 661,000 jobs per month, it would take 16 months to reach pre-pandemic employment levels.