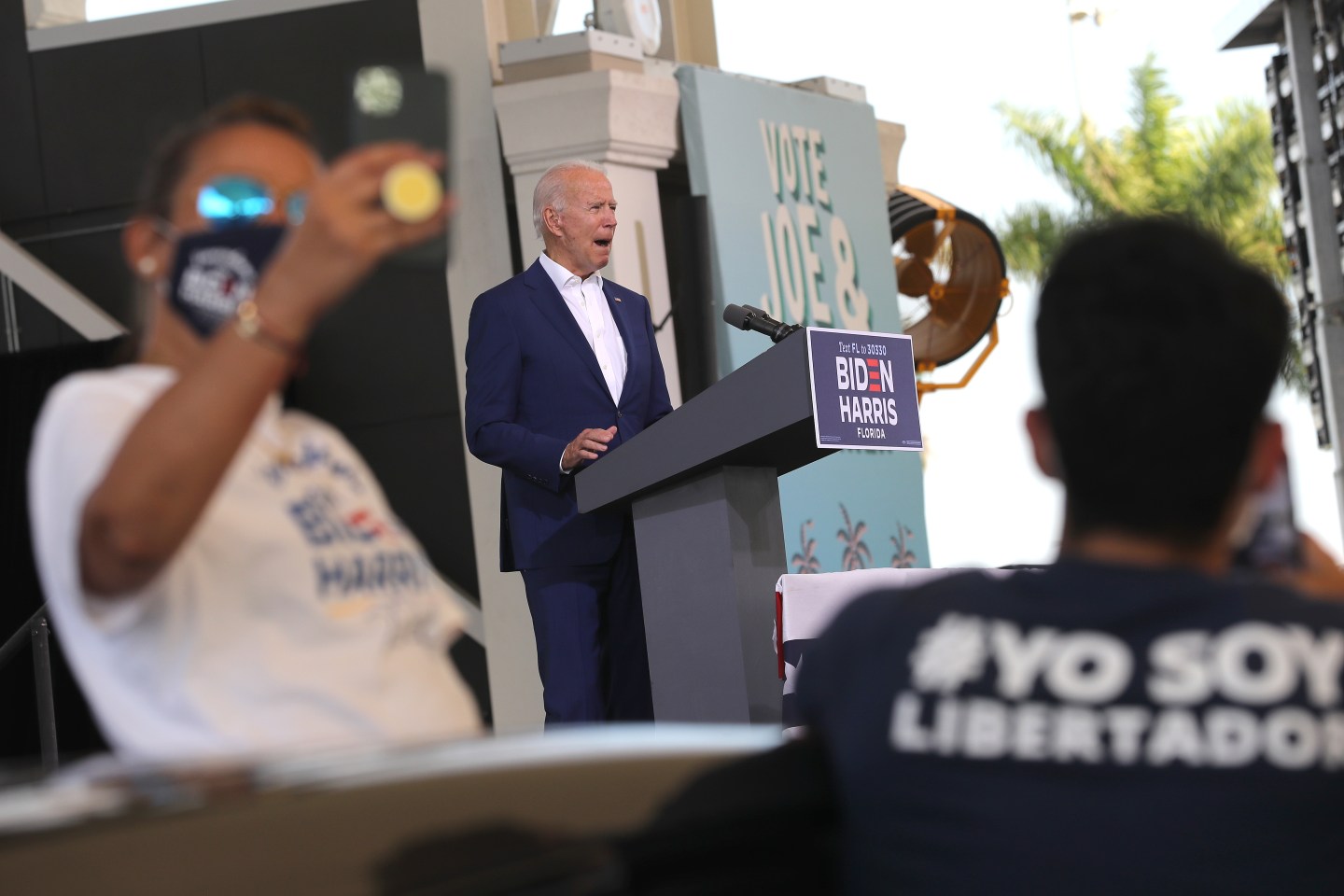

Earlier this fall, Democratic presidential nominee Joe Biden did something almost no other major presidential candidate has done on the campaign trail—he promised to raise people’s taxes. Bucking decades of conventional wisdom that talking about raising taxes is a surefire way to lose an election, Biden promised to raise taxes on America’s richest corporations “on day one” of his presidency.

As a wealthy individual and a former managing director at BlackRock, I would argue the former Vice President’s open endorsement of a once-taboo subject is not just a welcome change from four years of fictional trickle-down economics under President Trump. It’s also an acknowledgment that decades of politicians prioritizing the needs of the rich and powerful has left America with a growing inequality crisis that limits our ability to respond to emergencies like the COVID-19 pandemic.

In previous presidential administrations, both Republican and Democratic, wealthy individuals and corporations successfully beat back any serious discussion of taxing the rich while simultaneously lobbying Congress for deeper tax cuts and special privileges. Decades of tax policies favoring the rich have resulted in the highest levels of wealth inequality since the Census Bureau started tracking that figure in the 1960s, peaking after the Trump administration’s 2017 tax overhaul that amounted to a $1.9 trillion giveaway to corporations and the top 1% of income earners. That bill solidified our country’s vast wealth inequality, with corporations and billionaires each now paying a lower effective tax rate than the working class for the first time in our history.

Biden has commendably taken aim at this bill often on the campaign trail, pledging to not only do away with the Trump tax cuts, but reform the tax code altogether.

As with any major campaign promise, however, the devil is in the details.

Biden’s tax plan has plenty of great policy ideas to ensure a more equitable tax code, but there are a few key places where he could improve. In the interview where he pledged to raise corporate tax rates on day one, for instance, Biden proposed raising the rate to 28%. That is an improvement upon the current level of 21%, but still lower than it was anytime between World War II and the 2017 Trump tax cuts.

Biden is also promoting the “Amazon Rule,” which involves a 15% minimum tax rate on net annual income for corporations making over $100 million a year. This tax is a way of forcing companies that use a dizzying array of loopholes and special breaks to avoid paying a single dime in federal income taxes into coughing up at least something to the Treasury. Nearly 100 major companies like Netflix, Starbucks, Chevron, and the rule’s namesake, Amazon, have gotten away with paying no federal taxes whatsoever for years despite earning sky-high profits. Although this idea is a good start, Biden needs to consider taking a hard look at the loopholes and tax breaks that allow these companies to pay nothing in the first place.

On the individual tax policy side, Biden has committed to raising the capital gains tax rate, a special rate only for investors that essentially cuts their tax burden in half. Equalizing this tax rate would drastically shrink our inequality gap and ensure that people who work for a living aren’t paying a higher tax rate than rich folks like me who are just moving money around. He also proposes raising the income tax rate on the top bracket of earners, or folks who earn over $400,000 a year, from 37% to just under 40%.

These policies are a great start, but Biden can—and should—expand upon them. Though the primaries were filled with discussions of a wealth tax, Biden’s campaign has dismissed the idea outright, but it’s worth deeper consideration. Much of the wealth currently held by America’s 600-plus billionaires is untouchable under current income tax laws. But a wealth tax laser-targeted towards only the tip-top of the top 1% could easily skirt this issue and force these ultrarich folks to pay their fair share.

Biden’s tax plan maps out an equitable future for America, one that shifts the tax burden from the middle and working class up to the top 1% and ensures that my wealthy peers stop getting away with robbing the country blind.

There’s some room for improvement, but if implemented, a Biden tax code could be one of the most progressive tax codes this country has ever had. Like any presumptive presidential candidate, Biden will face constant pressure to cave into the demands of tax-averse monied interests. For the sake of our country’s future and the livelihoods of millions of working Americans, we urge Vice President Biden to stand by his commitments and tax wealthy folks like me on day one. No exceptions.

Morris Pearl is chair of the Patriotic Millionaires and former managing director at BlackRock.