This is the web version of the Bull Sheet, Fortune’s no-BS daily newsletter on the markets. Sign up to receive it in your inbox here.

Good morning. The global markets are rebounding this morning as we await the latest U.S. jobless numbers. They’re due out before the opening bell.

Let’s check in on what’s happening.

(I’m trying out a new quick-scan format. Let me know if you like it).

Markets update

Asia

- The major indices are mixed. Tokyo and Hong Kong were down while Shanghai was clinging to small gains.

- In emerging markets, G20 finance ministers yesterday agreed to a debt moratorium. As of May 1, the world’s poorest countries can pause debt payments as they grapple with the fallout of the coronavirus pandemic.

- Australia defied the odds. Employment ticked up last month.

Europe

- European bourses bounced back solidly on Thursday. The blue-chip Euro STOXX 50 opened 1.4% higher.

- There’s reason to cheer. Italy reported a month-low in new infections yesterday. And, Germany is planning to reopen the region’s largest economy as soon as next week. It will be a gradual and deliberate process—”small steps” as German Chancellor Angela Merkel called it.

- If you think yesterday’s U.S. retail sales report was bad, check out what happened to the U.K. sector—down 27%.

U.S.

- The Dow, S&P 500 and Nasdaq are poised to open higher, but by less than 1%, as I type. All three sank yesterday after a volley of awful data from retailers, home-builders and manufacturers.

- The big story today is the weekly jobless claims. Economists expect it to come in around 5.5 million. If that forecast holds, the U.S. economy will have lost all the jobs created in the past decade. All of them.

- President Trump is expected to unveil today guidelines for reopening the U.S. economy. We’ll see how many governors heed the call.

Elsewhere

- The dollar is up. Again. King dollar typically spikes on uncertainty. And it’s been gaining in recent days.

- Gold is up too. (See dollar explanation above.)

- Crude is flat after falling to an 18-year low yesterday. Whenever you see WTI crude hover around $20 (as it is today), you’re likely to see headlines on subzero oil. What’s subzero oil? “Producers could soon be forced to pay consumers to take [oil] off their hands—effectively pushing prices below zero,” the Wall Street Journal explains.

- It’s a demand problem. Orders for oil in April are forecast to drop by a record 29 million barrels/day, per the International Energy Agency.

The path forward

I’ve been reviewing a lot of sentiment data—mostly investor sentiment data—recently. And I’ve shared my views on that here in Bull Sheet over the past week. Today, let’s look at how Corporate America’s finance chiefs view the upcoming quarters.

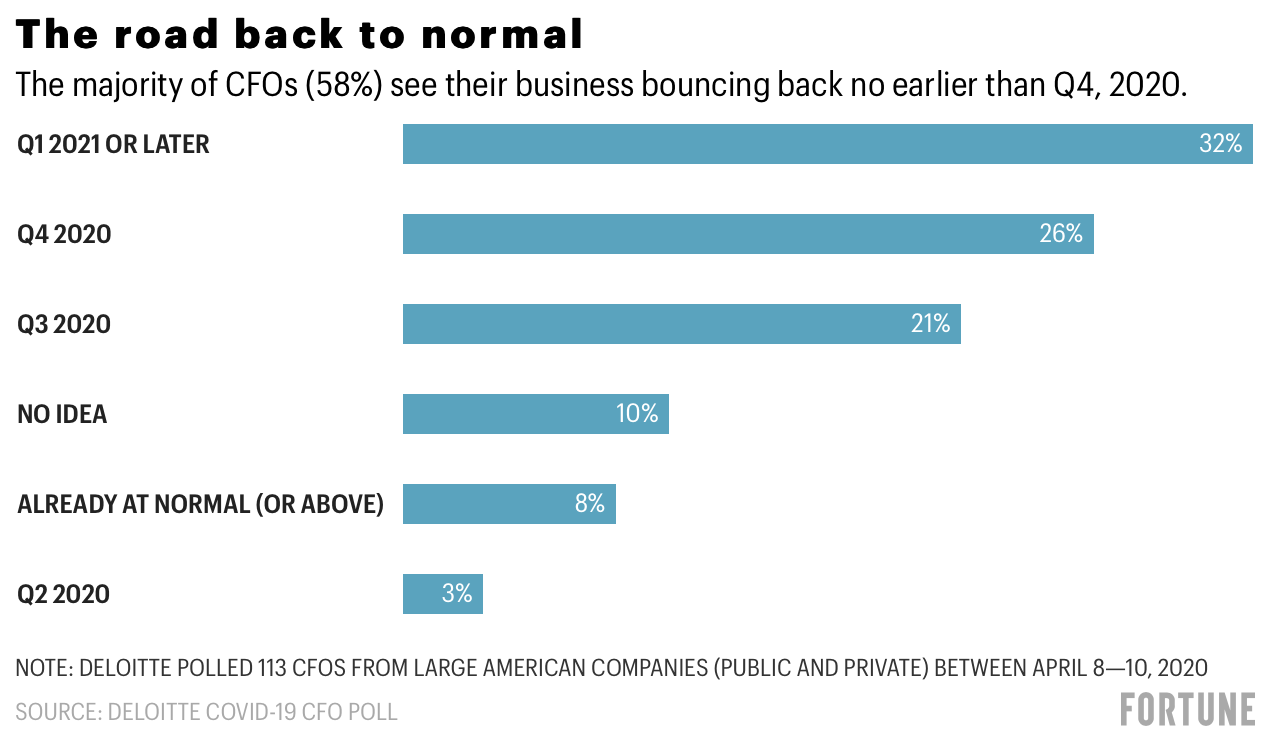

Everyone wants to know when we can expect business—and life in general—to bounce back to something approaching normal. It’s unlikely to be this quarter, as today’s chart show.

The data for this chart comes from a new survey by Deloitte. They polled 113 chief financial officers last week on their views about how the coronavirus outbreak is impacting operations, staffing and liquidity. Most CFOs are banking on a rebound in Q3 or later—the further out, the more confident they are on a return to normal.

There’s been a lot of discussion about the shape of the recovery: will it be a quick bounce-back or a more protracted one? Now that the world’s biggest economies are (hopefully) approaching the peaks of coronavirus infections and plotting a resumption of business, these surveys are becoming increasingly important to gauge when we can expect to start emerging from this crisis.

This sentiment data, showing a dismal 1H; recovery in 2H, seems to track the GDP forecasts I’ve seen. Businesses are ready to get back to work. But public health officials will, and should, have the last call.

Postscript

Yesterday, my wife asked me about Canadian dollar. Her foundation learned they’d be getting coronavirus emergency funding from a donor in Canada, and she wanted to know: when should we transfer that money to the foundation’s bank account in Europe? When will the CAD/EUR exchange rate be most favorable?

In her line of work—she’s in the save-the-world sector—even the smallest bit of money goes a long way to help feed, provide skills-training and basic health care to some of the most impoverished people on earth, mainly in the Global South. And so she’s keen not to lose money on FX fluctuations and bank fees. Every dollar/euro/Congolese franc that gets to her programs makes a huge difference to the people there.

She expects the funds to be green-lighted from the donor any day now, and, following that, she would like to make the transfer at the “optimal time” within 30 days of the money becoming available.

I told her not to hesitate on executing the transfer, but beyond that I didn’t have any good advice. FX is not my specialty. Here’s what I think I know about the loonie, the Canadian dollar. If the energy markets are doing okay, so too is the loonie. The energy markets are performing terribly this year. Sure enough, the Canadian dollar has been fairly weak, falling nearly 5% YTD against the euro. But is there anything on the horizon—in, say, the next month—that points to a rebound? Even an FX rate improvement of 1-2% could make a big impact on the ground, she tells me.

So, I’m opening up the question to you. I told her I would. If you were in her shoes when would you make the transfer of Canadian dollars into euros? Remember: a lot of people in need stand to benefit.

Please let me know, and I’ll share it with her. And I’ll report back here at some point later on where the money went, and the impact.

Have a good day, everyone. I’ll see you here tomorrow.

Bernhard Warner

@BernhardWarner

Bernhard.Warner@Fortune.com

Looking for more detail on coronavirus? Fortune has a new pop-up newsletter. The aptly named Outbreak will keep you up to date on the latest news surrounding the coronavirus outbreak and its impact on business and commerce globally. Sign up here.

And, you can write to bullsheet@fortune.com or reply to this email with suggestions and feedback.

Today's reads

New era for airlines. There are serious strings attached to the $50 billion aid package just enacted to aid America's stricken airlines. The aid will help them through these rough times, but will also fundamentally change the industry for years to come. In exchange for the cash, the major carriers will halt stock buybacks and dividends, possibly for years, making their shares far less attractive. Strict caps on C-suite pay could make it difficult to recruit top talent. And carriers may need to shoulder hazardous levels of government-guaranteed debt simply to survive.

Sleight of hand. Not for the first time, that master of illusion Donald Trump has landed a big deal by giving little or nothing away. The president just saved OPEC from the worst oil price war in history by offering cuts in U.S. production he didn't have to make—because the coronavirus outbreak had already forced even bigger cutbacks, Fortune’s Shawn Tully writes.

Amazon primed. The coronavirus pandemic isn’t hurting Jeff Bezos’s finances. Quite the opposite. The world’s wealthiest person is getting richer, opening up a big lead over his rivals for the crown. Stuck-at-home consumers are relying on Bezos’s Amazon.com more than ever. The retailer’s stock climbed 1% to a new record close Wednesday, lifting the founder’s net worth to $140 billion.

Market candy

What’s in a name?

Quite a lot, according to an accounting professor at UC Berkeley’s Haas School of Business. Omri Even-Tov’s research shows that analysts make more accurate predictions about a company’s earnings when he or she—get this—shares the first name of the CEO they're covering. Perhaps investment banks should appoint an analyst named Tim to cover Apple or Jeff to cover Amazon, suggests The Wall Street Journal.