We all know a certain president likes to talk of having the “best” stock market. And, as such, Fortune has periodically compared market performance under Trump and Obama over comparable periods of time.

With markets down sharply in February and early March but then moving back up a bit, we again wondered how things are stacking up vis-à-vis 44 and 45. In this round, we compared the period between Inauguration Day and March 10 for Trump’s administration and Barack Obama’s first term.

Previously, the Obama administration had the edge. And it does again, as graphs below show.

The horizontal time axis shows the dates between Jan. 20 (Inauguration Day) and Mar. 10. That would be 2009 through 2012 for Obama and 2017 through 2020 for Trump.

Indexes are shown as percentages of their value on the first day. Jan. 20 would then be 100%. (So a value of 128.3%, for instance, would the index was up 28.3% since Jan. 20.)

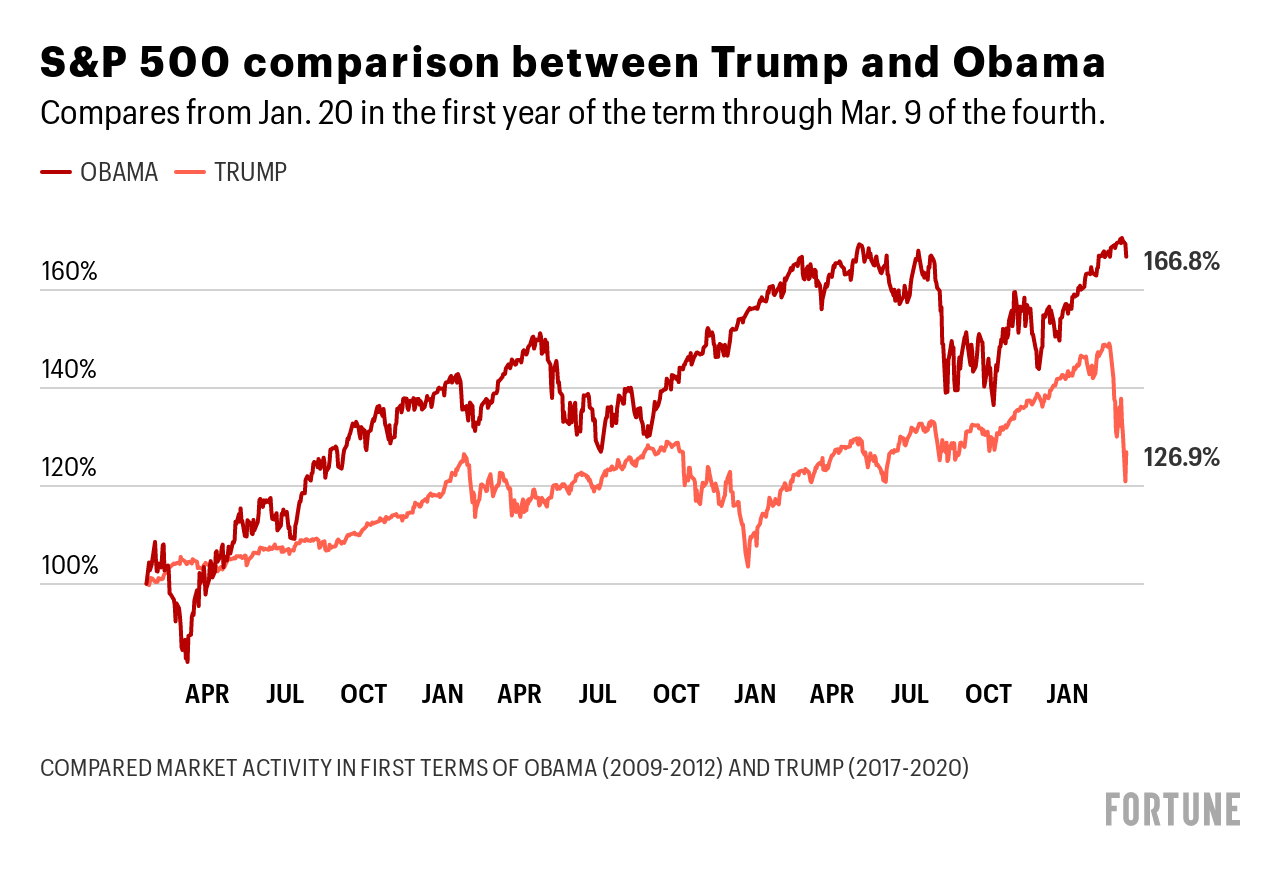

Below is the comparison graph for S&P 500 performance between the two presidents.

The horizontal axis shows the relative dates from Jan. 20 in the first year (2009 for Obama and 2017 for Trump) to Mar. 10 in the fourth year (2012 for Obama and 2020 for Trump).

The S&P 500 grew much faster during Obama’s first term than in Trump’s first. Each line shows a couple of significant corrections to values, although not at the same time for each administration. The second big drop on the Trump line is the drop the recent few weeks have brought.

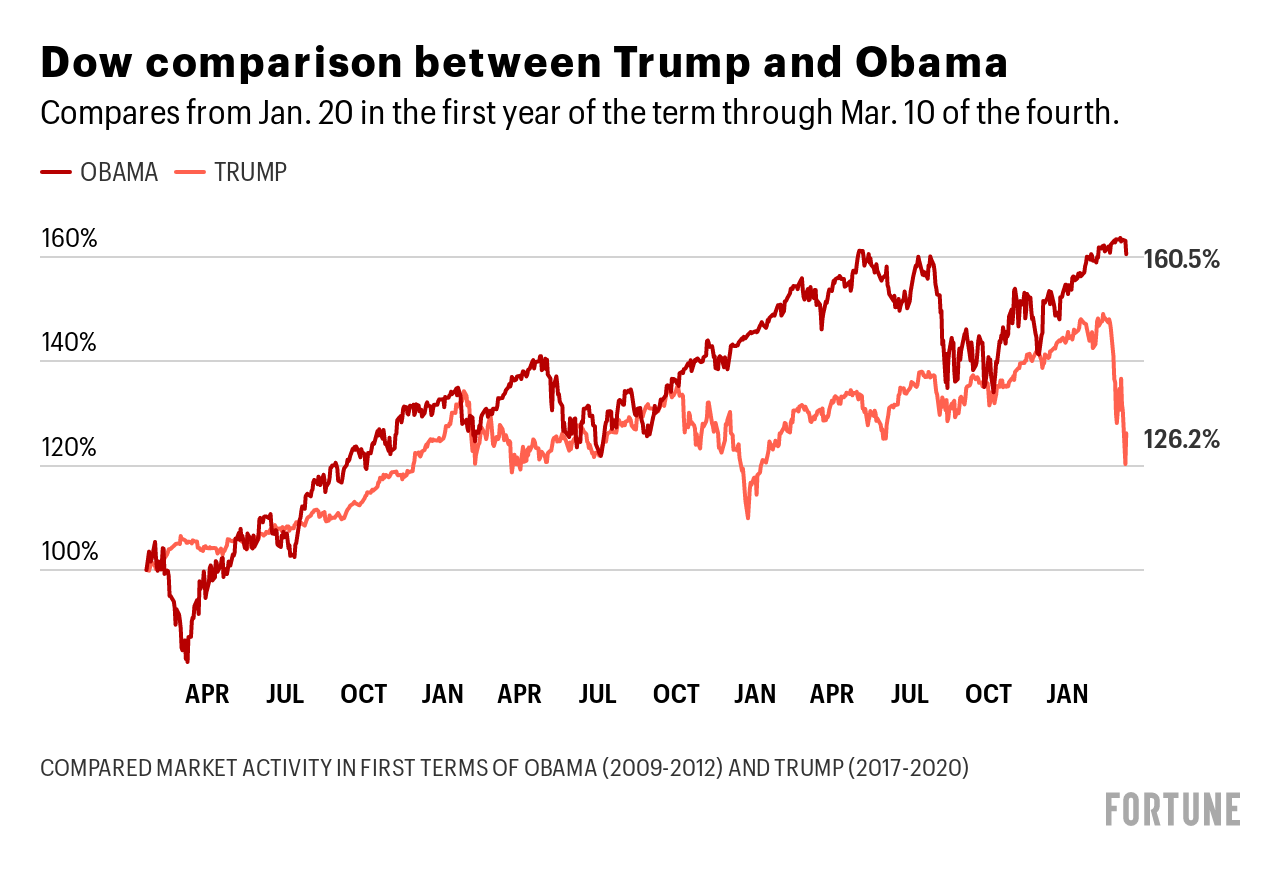

There were similar performances in the other major U.S. indexes, like the Dow Jones Industrials. Obama’s term saw a 60.5% gain over the period in discussion, while for Trump, the equivalent is currently a 26.2% gain, having taking a hard fall from where it once was.

Even with the recent rout, the Nasdaq under Trump grew a respectable 50.2% over the period. However, it more than doubled over the same time frame in the Obama administration.

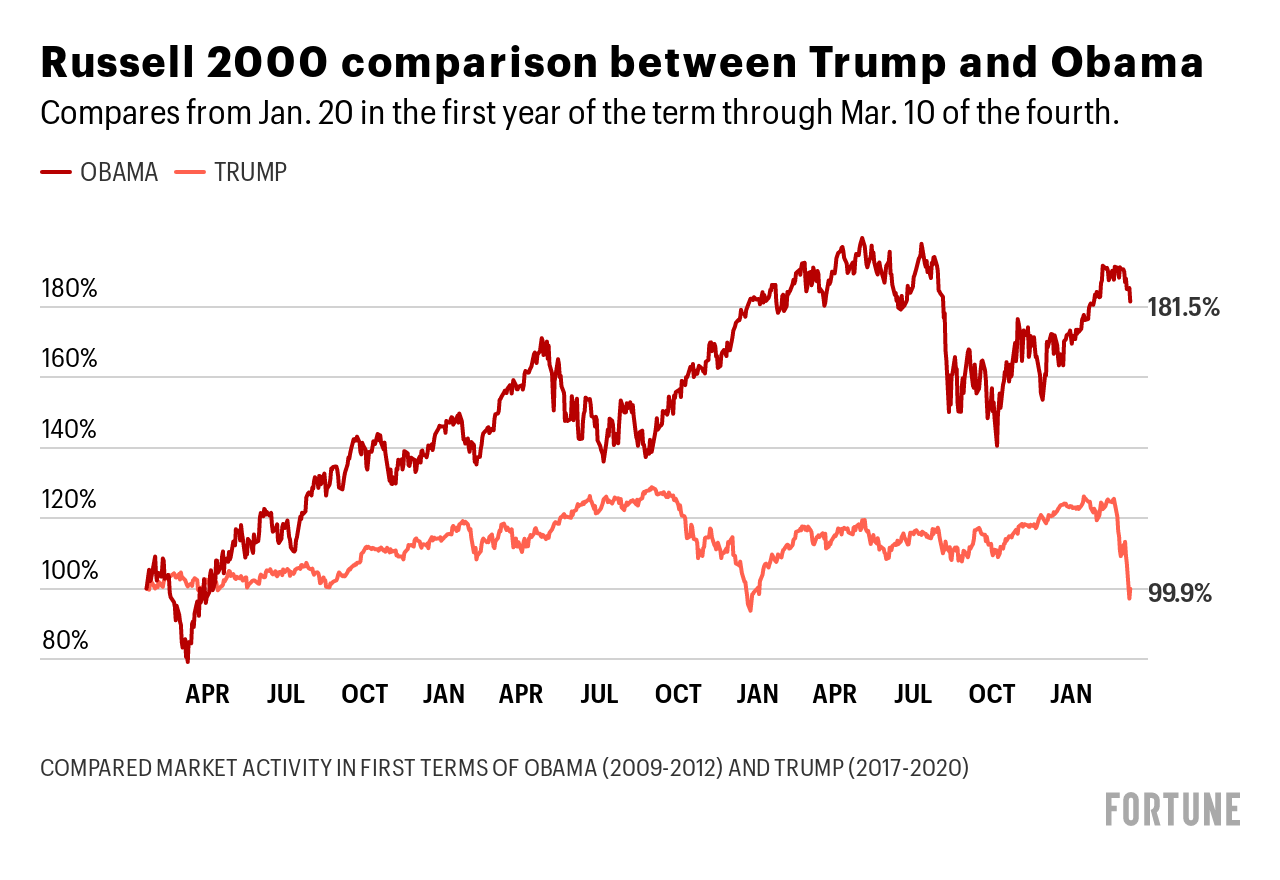

Finally, the Russell 2000, which represents small- and medium-cap companies, showed another large gap. Under Obama, the index was up 81.5% over the period. But for Trump, it’s now actually negative, having dropped a tenth of a percent.

Great reversal

That the Russell might feel more of a pinch now shouldn’t be a surprise. As financial and tax adviser Steven Jon Kaplan told Fortune in January, turbulent times and bad news in that index often precedes signs in large-cap indexes.

“Not many people pay attention to that, but that’s how many bear markets start, with the smaller and mid-sized companies,” Kaplan said. “Hardly anybody reports on a story how the Russell 2000 did on a particular day or week or year.”

According to Kaplan, it could be that markets have experienced a blow-off top with the Russell providing an advanced view. But however you look at it, it’s certainly not the best market ever.

More must-read stories from Fortune:

—Is this your first stock market crash? Some advice for young investors

—Here are two of the biggest losers from the Saudi Arabia oil price war

—Why investors suddenly turned on pot stocks

—Here are some of the most extreme ways companies are combating coronavirus

—Why it’s so hard to find the next Warby Parker

Subscribe to Fortune’s Bull Sheet for no-nonsense finance news and analysis daily.