The coronavirus outbreak—now officially called COVID19, according to the World Health Organization—has driven many things in China down. With close to than 43,000 in the country infected and more than a thousand dead, factory output, consumer spending, tourism, and commodity prices have seen major drops.

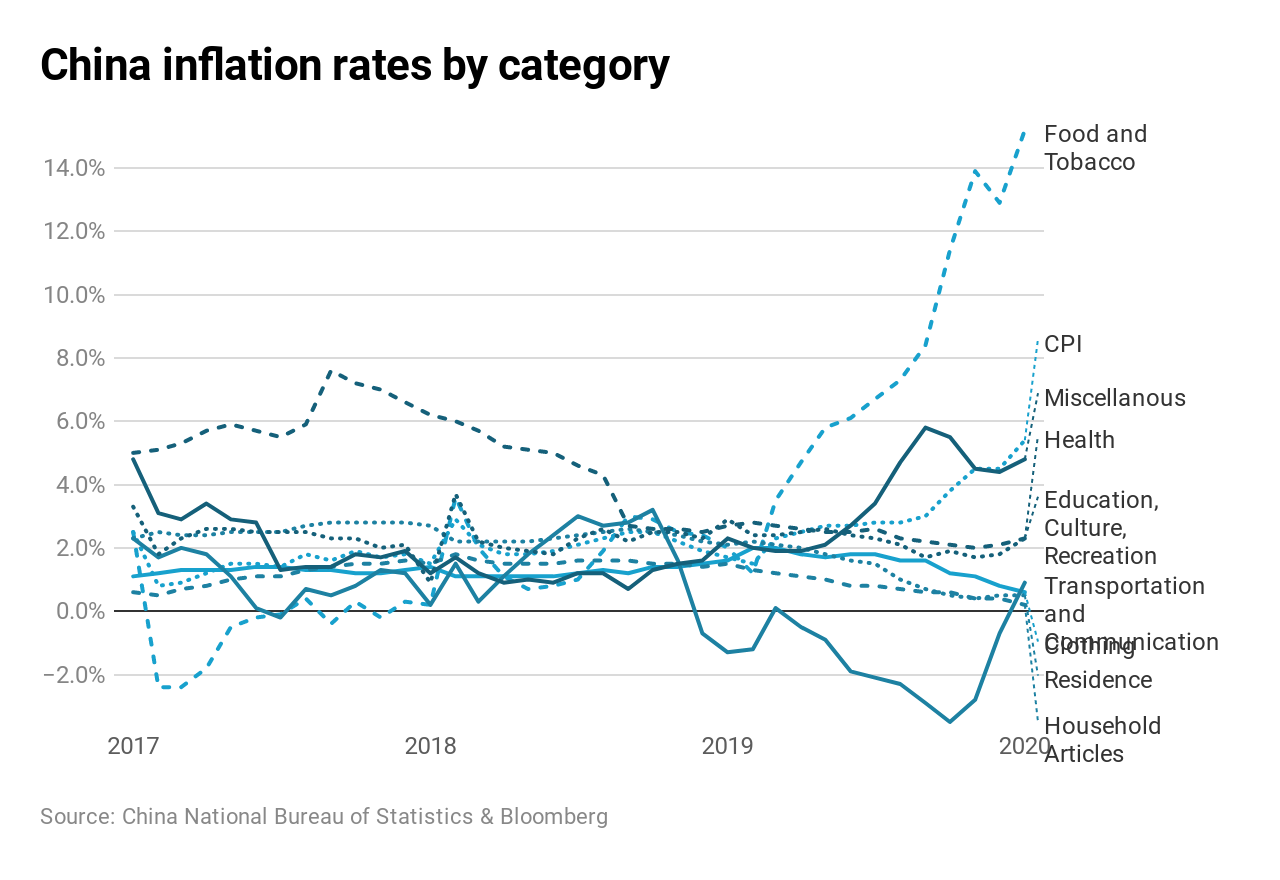

One thing that is soaring? Inflation. China’s overall consumer price index (CPI), which had been at 1.5% in January 2017 and between 2% and 3% during most of 2019, leaped to 5.4% in January 2020.

Shuttered facilities and involuntarily idled workers have reduced production and tightened product supplies, driving up prices. Hardest hit is the food sector, which already faced massive shortages. The deadly African swine fever took out somewhere between a quarter to half of the nation’s pigs—a staple in Chinese diets—depending on whom you ask.

China’s overall inflation rate still isn’t huge. But the quick increase is a concern. If the pattern doesn’t moderate, the country might be forced to focus less on growth—a primary government goal for the population of 1.4 billion—and more on price stability. That could send tremors throughout the global economy.

Some inflation but not too much

Some inflation is benign—the byproduct of economic growth. More people, better productivity, and investment by the private and public sectors cause expansion. Prices typically rise in a smooth and slow fashion while wages keep pace.

But when inflation gets out of control, the danger is spiraling prices that make living too expensive for people (an extreme case is Venezuela, which saw a 2019 inflation rate of 19,906%).

In China, which has about 18% of the world’s population, a curb in consumer buying due to higher prices could ripple through the world.

A closer look at the various sectors of the Chinese economy show that inflation in the food and tobacco category, as measured by China’s government, was already racing ahead of other items. Then last month it hit 15.2%. Although that’s the outlier, consumers face multiple areas of increasing expenses, particularly in miscellaneous goods and services as well as health care and in education, culture, and recreation.

The table below shows the Jan. 2020 inflation rates for the major consumer categories, as defined by the Chinese government.

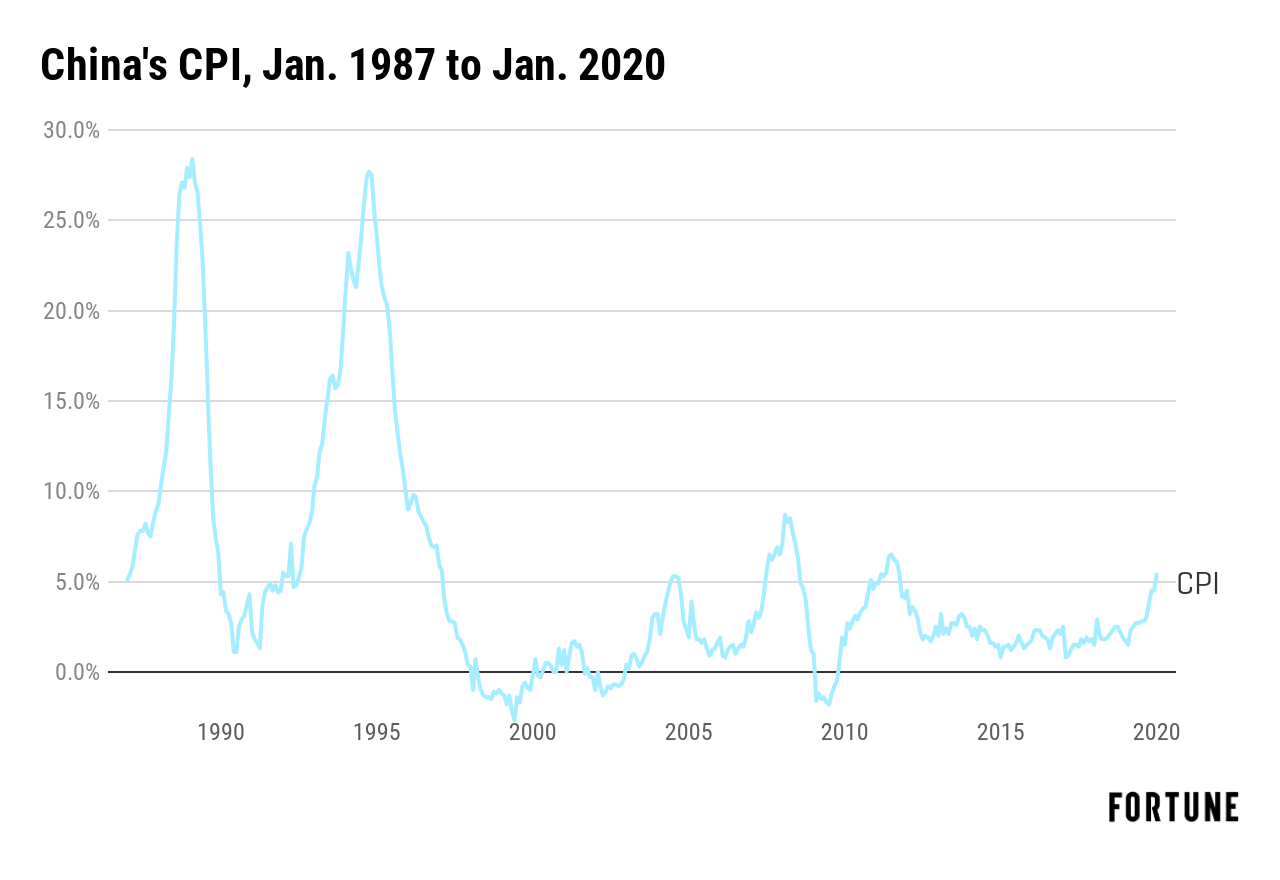

Outside of food, on the surface it might not seem so bad. A 5.4% CPI is something that at one point would have seemed low in China or the U.S. From Aug. 1988 through Jun. 1989, inflation was more than 20% with a high point of 28.4%. The pattern repeated throughout 1994 and up to May 1995, with CPI over 20% each month and a high of 27.7%.

“From time to time, [China has] inflationary spikes for all varieties of reasons,” said Linda Lim, professor emerita of corporate strategy and international business at the University of Michigan. Culprits include supply shortages due to natural disasters, a sudden change in commodity production elsewhere in the world, or a geopolitical dispute like a trade war with the United States.

Excess demand is another trigger, which can come from a run on purchases, like before a major storm. Or a big state-owned enterprise could buy up land in an area and drive overall price hikes. “People in China are used to these occasional bouts of inflation,” Lim said. “It’s more unusual now because the economy is not growing at great guns.” But spikes don’t happen constantly. The last time inflation topped 5% there was during the global financial crisis and the recovery.

Issues with imports

China for many years has imported a significant amount of agricultural products: at least $21.9 billion in food items in 2017, according to Chinese government data. That was before African swine fever, coronavirus, and trade wars. Reductions in domestic production because of the current virus outbreak, as well as the the previous drastic loss of pork herds, only add to the need to purchase more from other countries.

Imports face the twin issues of a weak currency (which helps China’s exports but makes products brought into the country more expensive) and tariffs on products from the U.S., which historically has been a major agricultural supplier.

“Tariffs … have a very mechanical impact [on prices]” and the tariffs aren’t likely to fall, said Frances Donald, chief economist and head of macro strategy at Manulife Investment Management. “In this environment of trade wars, the Chinese yuan is weakening.”

Then there is also the psychological reaction of hording in stressful times, something that anyone who has faced a major storm like a blizzard or hurricane has experienced. People worried about the ability to get what they will want stock up on items, including food.

Currently in China, CPI is not a measure that government officials pay much attention to, according to Donald. Tom Graff, head of fixed income at Brown Advisory agrees it’s unlikely Chinese officials will take action in the near term.

But, said Ying Wu, assistant professor of finance and economics at Stevens Institute of Technology, “we haven’t heard that much from the rural areas. Who are going to raise chickens, cows, and pigs to stabilize the market?” If production and distribution of basic items continue to stall, prices could go up even more. That could, in turn, would hurt small- and medium-sized businesses, with a knock-on effect spreading beyond just food and further pushing up prices.

“If inflation broadly becomes a concern to the average person in China, it’s something [the government is] not going to ignore,” Graff said. “This is not a great time to make the Chinese central bank think about controlling inflation when they need to be stimulating growth.”

To slow inflation, governments typically take actions like raising interest rates or taxes to cool the economy so prices can again come under control. China’s government has a heavy impact on the private sector and can do things like creating administrative restrictions to slow the economy, reducing demand and taking pressure off prices.

“I suspect given their recent history, they’d go for growth rather than inflation,” Graff said.

Correction, February 18, 2020: A previous version misstated Frances Donald’s title.

More must-read stories from Fortune:

—The strange tale of Jeff Bezos’s $16,840 parking ticket bill

—Stock scammers are using coronavirus to dupe investors, SEC warns

—Credit Suisse braces for an awkward earnings call

—Stock scammers are using coronavirus to dupe investors, SEC warns

—WATCH: Biggest investing opportunities and risks for 2020

Subscribe to Fortune’s Bull Sheet for no-nonsense finance news and analysis daily.