Talk about an unfortunate stock tip.

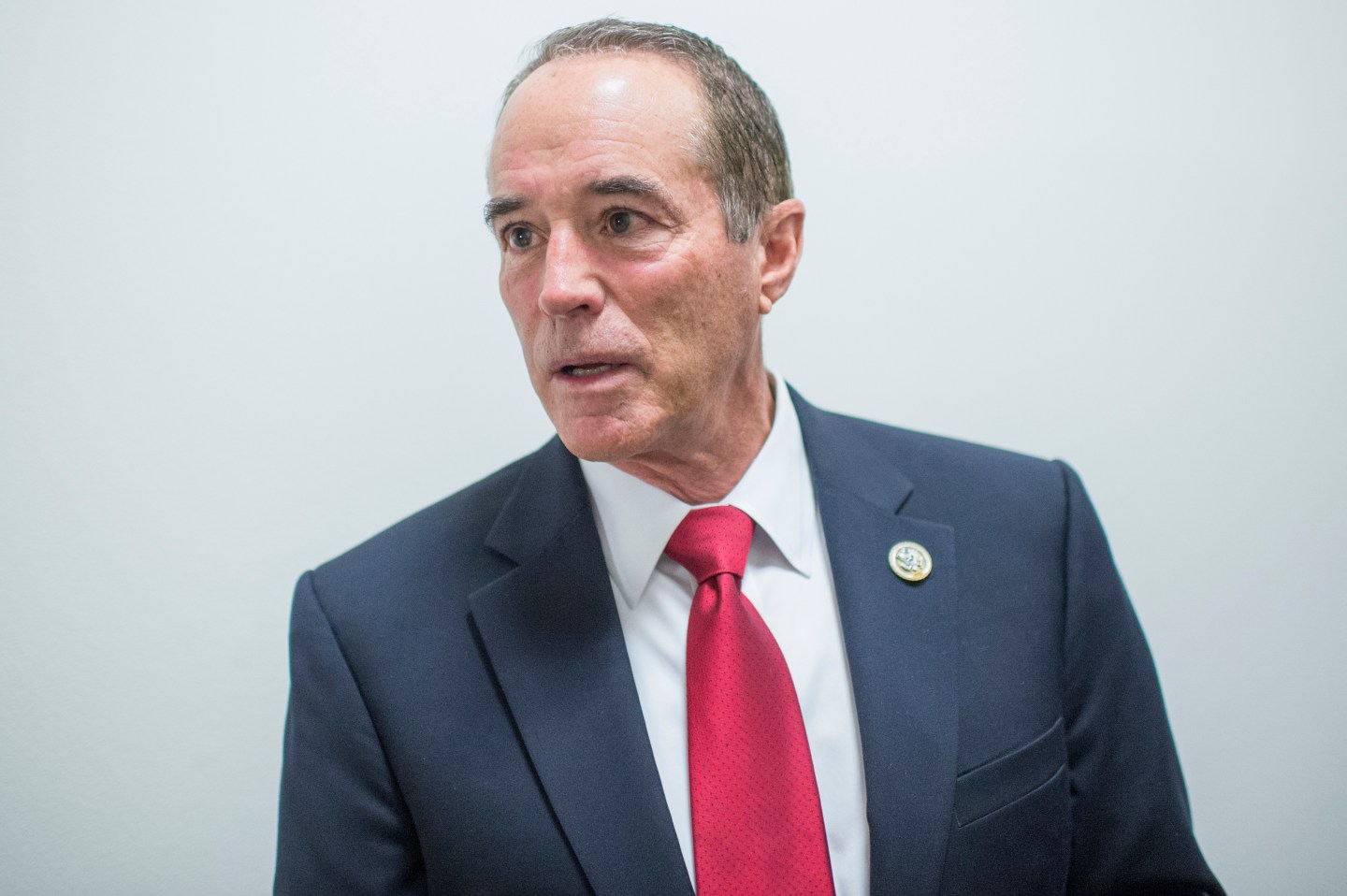

New York Republican Rep. Chris Collins lost (at least on paper) a staggering $17 million for his massive stake in an Australian biotech on Tuesday. And he probably took several of his colleagues down a couple pegs, too—Collins regularly proselytized about the company, Innate Immunotherapeutics, to fellow House Republicans and convinced at least four of them to invest, as STAT News‘ Damian Garde reports.

Click here to subscribe to Brainstorm Health Daily, our brand new newsletter about health innovations.

One particularly prominent investor? Former Congressman and current Health and Human Services (HHS) Secretary Tom Price, a physician whose own history of gigantic stakes in health care companies drew plenty of criticisms during his Senate confirmation hearings. Critics questioned Price’s investments in firms like medical device maker Zimmer Biomet and Innate, which also coincided with his championing of health legislation widely considered to benefit the biopharma industry.

Still, Price made it out of the Innate investment relatively unscathed. He dumped his stock in the company well ahead of its crash on Tuesday (caused by a clinical trial failure for its lead drug to treat multiple sclerosis), which dropped its shares into penny stock territory. Collins, on the other hand, sits on Innate’s board and is its largest shareholder with a nearly 17% stake.

The Congressman addressed the issue in a statement. “For those that invested in Innate, including me, we all were sophisticated investors who were aware of the inherent risk,” he said. “For every successful drug, there are countless numbers that fail. That’s how today’s system works.”

Members of Congress are allowed to actively invest in individual firms as long as it’s not based on non-public information, even with ethics protections like the STOCK Act in place.

Correction: June 29, 2017, 4:00 P.M.: An earlier version of this article mistakenly named Innate Immunotherapeutics as Innate Pharma. We regret the error and it has been corrected.