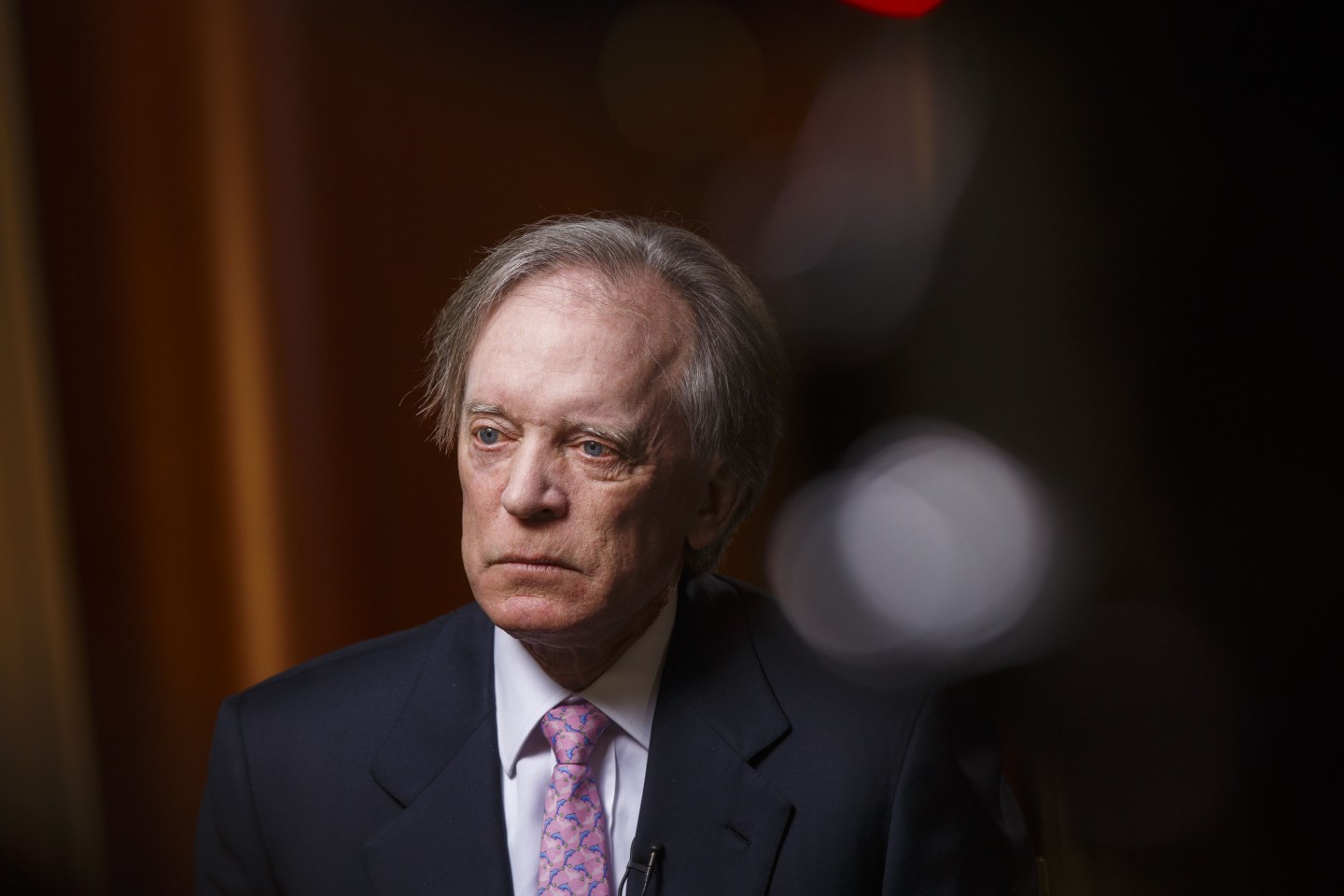

Bond investor Bill Gross said on Monday that without quantitative easing from the European Central Bank and Bank of Japan, the 10-year U.S. Treasury yield would “rather quickly” rise to 3.5% and the U.S. economy would sink into recession.

Gross, who runs the $1.8 billion Janus Global Unconstrained Bond Fund, said in his latest Investment Outlook to clients that Treasury yields will likely rise gradually, yet will stay artificially low due to the “kindness” of foreign central bank quantitative easing policies.

“Without that financial methadone, both bond and stock markets worldwide would sink and produce a tantrum of significant proportions,” Gross said.

“A 2.45% 10-year U.S. Treasury rests at 2.45% because the ECB and BOJ are buying $150 billion a month of their own bonds, and much of that money then flows from 10 basis points JGB’s (Japanese Government Bonds) and 45 basis point Bunds into 2.45% U.S. Treasuries.” (A basis point is equal to one one-hundredth of a percentage point.)

On Friday, the yield on the 10-year U.S. Treasury settled around 2.47%.

Gross repeated in his latest research note an assertion he has made for several years that loose monetary policies have “promoted higher asset prices and engendered a modicum of real growth.”

“Capitalism has been distorted: savings/investment has been discouraged by yields/returns too low to replicate historic productivity gains; Zombie corporations have been kept alive in contrast to Schumpeter’s ‘creative destruction,'” he said.

Gross added that debt has continued to rise relative to gross domestic product; the financial system has not been cleansed and restored to a balance where risk and reward are on a level playing field. “Disequilibrium has replaced equilibrium, although it is difficult to recognize this economic phantom as long as volatility is contained,” he said.

Overall, Gross said a client of his recently asked when the Federal Reserve or other central banks would ever be able to sell their assets back into the market.

“My answer was ‘NEVER’. A $12 trillion global central bank balance sheet is PERMANENT—and growing at over $1 trillion a year, thanks to the ECB and the BOJ,” Gross wrote.