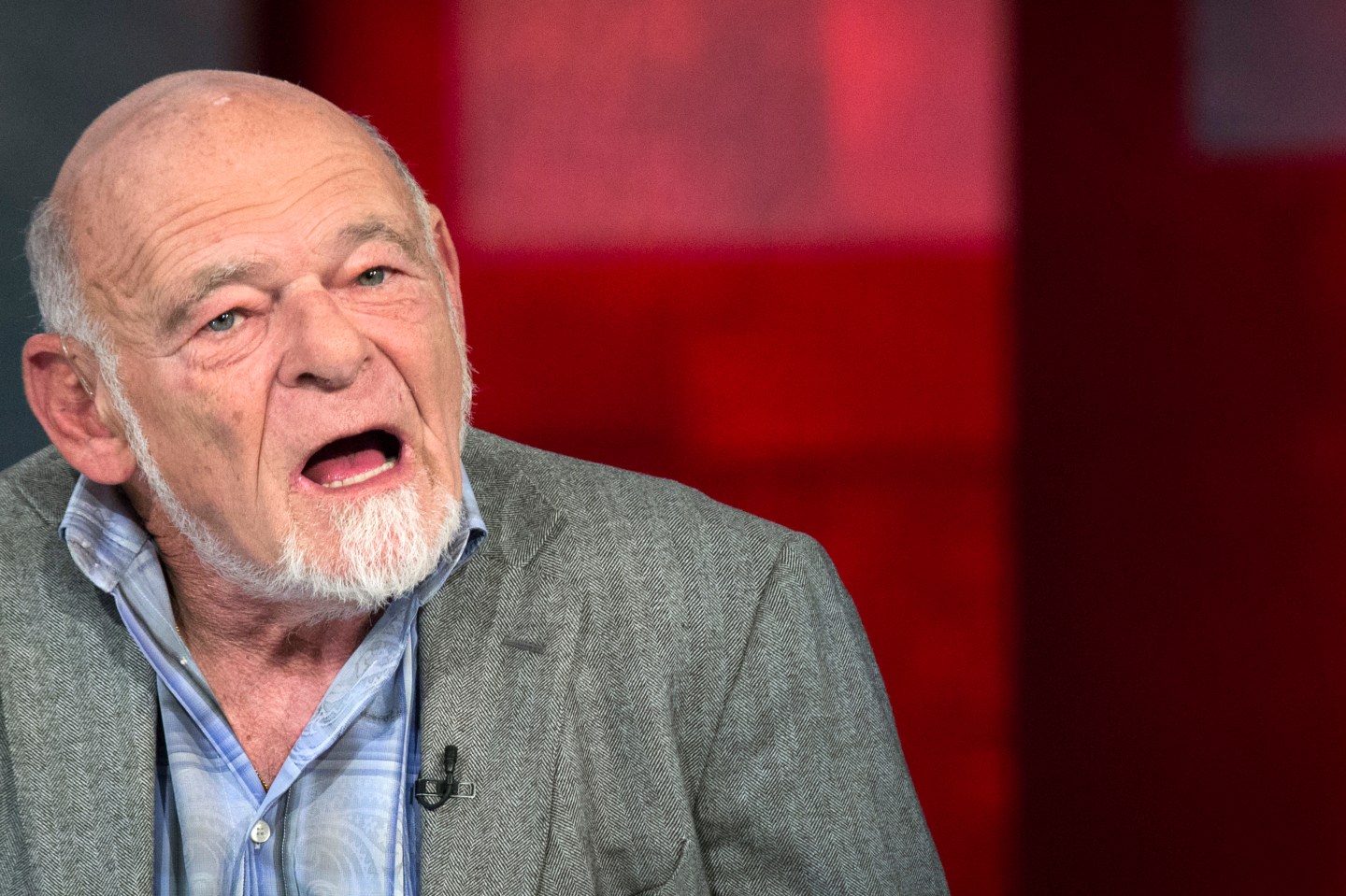

Sam Zell still thinks stocks are in a bubble.

In 2013, the legendary real estate developer announced at the SkyBridge Alternative Investment conference he thought the market was at an all-time high and due to fall. He said the still limping-along economic recovery didn’t justify where stocks were then trading. Three years later, Zell’s still thinks stock prices, which stumbled earlier this year, but have since recovered, are out of whack. “Economic activity and the stock market are not aligned, and I think the economic environment is limited,” Zell says. “The stock market is at an all-time high. Either the economy is wrong of the market is wrong.”

Zell made the comments to Fortune after speaking on a panel on Wednesday at this year’s SALT conference, which kicked off on Wednesday at the Bellagio hotel in Las Vegas.

He wasn’t the only one sounding cautious. Earlier in the day, former Treasury Secretary Larry Summers said that there was a one-third chance of a recession in the next year. Summers said that given that the economy has been expanding for seven years, there is little chance the economy is likely to accelerate from here.

On a panel, which also featured oil billionaire T. Boone Pickens, Zell said that he thought there was dramatically less opportunity in the U.S. than there used to be. Zell said that any economic data that suggests the economy has done well—like the current unemployment rate of 5%—under President Obama is a mirage. “It’s B.S.,” says Zell. “The number of people with jobs is the lowest since 1960s.”

Zell was likely referring to the labor force participation rate, which is near decade lows. The number of people in America with jobs has risen by 70 million or roughly doubled since even 1969.

For more about the economy, watch:

But Zell’s issue with the economy, and perhaps the stock market, appears to be more structural than a call that the economy looks particularly weak now. Higher regulation is the biggest stumbling block for growth for the economy, Zell said. “Businesses are having to put a lot more money to complying with regulations,” says Zell. “It’s a misallocation of capital.”

The stock market is up 28% since Zell raised the warning flag about the economy three years ago. SALT, which got its start in 2009, has been the source of other missed bearish calls in the past. Two years ago, at SALT, David Tepper said the market looked dangerous. “I wouldn’t be short now,” Tepper said. “I just wouldn’t be frickin’ long right now.”

Since then stocks are up 8%.