Each morning I write Term Sheet, a daily newsletter that may not exist were it not for J.P. Morgan Chase vice chairman Jimmy Lee. Not because he was directly involved — beyond giving the occasional quote — but because he was a vital architect in the creation of the modern-day private equity industry, via his early efforts in creating a syndicated leveraged loans market. No Jimmy, probably no Term Sheet.

Lee passed away yesterday from a heart attack at the age of 62, after feeling faint while running on a treadmill in his Connecticut home. He leaves behind his wife Elizabeth, his son James and daughters Alexandria and Elizabeth.

At the time of his death, Jimmy was known as the consummate deal-maker, having worked on everything from the Facebook and GM IPOs to the Dell buyout. He also came close to becoming a private equity executive, going so far as to sign an offer letter with The Blackstone Group back in 2003, before deciding at the last-minute that he couldn’t leave J.P. Morgan.

Yesterday I reached out to some top private equity executives for their thoughts on Jimmy’s passing. Here are some of the responses:

Jim Coulter, co-founder of TPG: “Across the history of the buyout business there have been many years, many deals and many cycles but there has been one constant: Jimmy. In basketball no one has to ask who you are talking about when you mention LeBron. In buyouts, no one has to ask who you are talking about when you mention Jimmy.”

Steve Pagliuca, Bain Capital: “Jimmy Lee was a true legend in the business of corporate finance. No one worked harder and was more committed to his clients than Jimmy. I always marveled about how he was so generous with his praise for his clients and the companies they helped to build. He played a critical role in the IPO of Burger King (where Bain Capital had invested and I was a board member) in May of 2006 which was one of the largest and most complex offerings that JPM had led at that time and it was executed flawlessly. His passion for results and relentless drive for excellence helped make that IPO very successful. He is remembered as a force of nature on Wall Street where no deal was ever too complicated or large to make happen. He will be missed by all those at JPM and the many clients he served so well for so many years. We will remember him fondly and we were lucky to have worked with him.”

Steve Klinsky, CEO of New Mountain Capital: “Jimmy was the consummate relationship banker and a real gentleman. He and Nick Forstmann were very close during the glory days of Forstmann Little [where Klinsky worked] in the 1980s and 1990s. When I started my own firm in 1999, Jimmy – on behalf of JPM – pledged $25 million of my original $200 million of assets. Sixty-two is way too young, and he will be missed by many friends.”

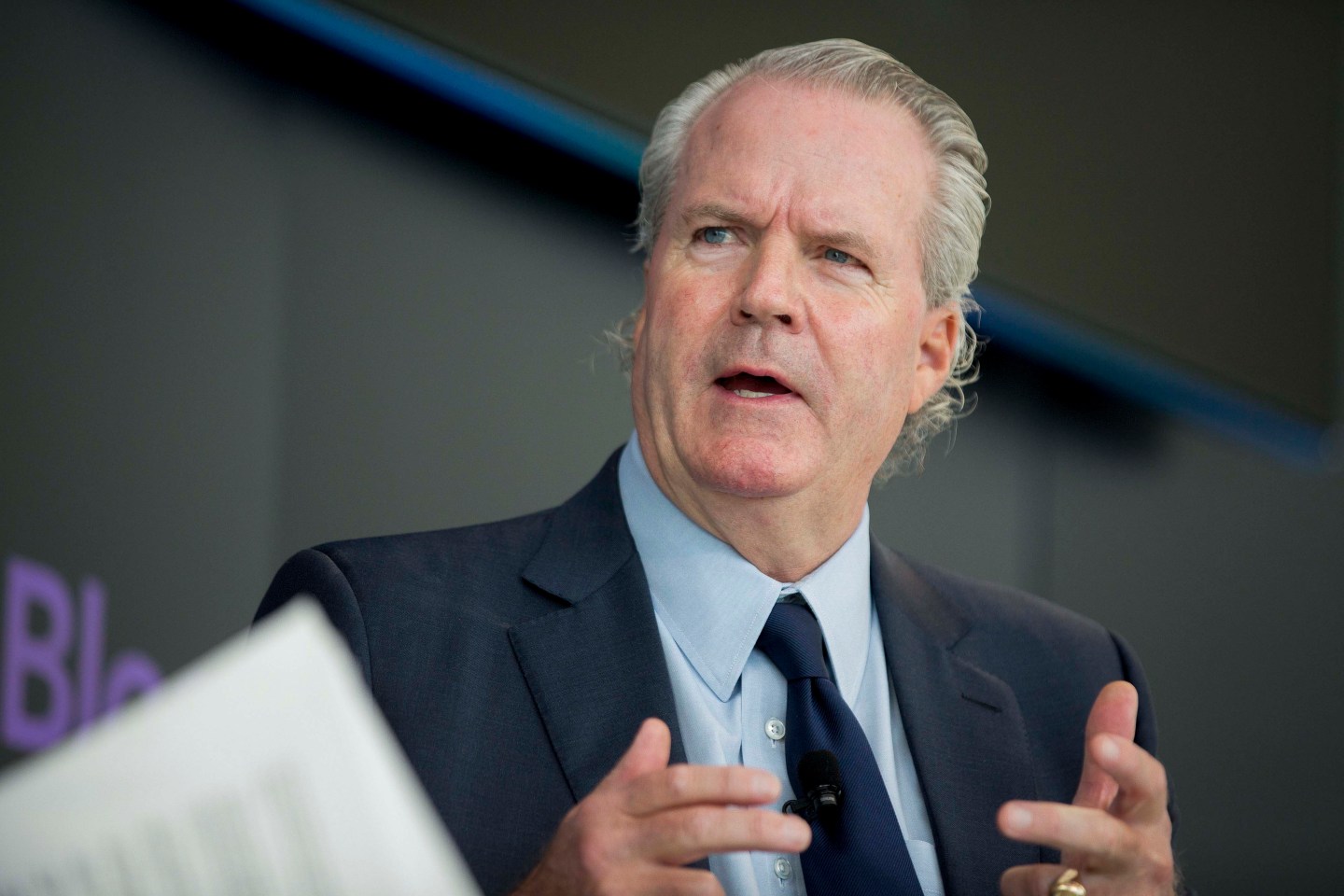

My last face-to-face with Lee was during last summer’s Fortune Brainstorm Tech, where he appeared on stage alongside me, Josh Koppelman and Jim Breyer. You can view some of our conversation here:

Rest in peace Jimmy. You are already missed.