For many real estate markets, 2014 might be as good as it gets.

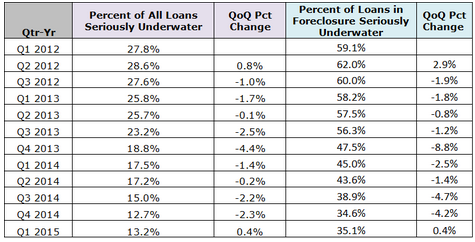

According to real estate data firm RealtyTrac, the percentage of seriously underwater homes rose for the first time since the housing recovery began in earnest in 2012. RealtyTrac considers a seriously underwater home those where the owner owes more than 25% of the market value of the house.

The data underscores two big trends in real estate this year. One is that the housing recovery is losing steam, with CoreLogic data showing that home prices nationally rose just 5.6% year-over-year in February, after two years when home prices consistently showed double digit gains.

Second, it’s an indication that the real estate market is increasingly bifurcated into luxury markets and everything else. Macro trends like rising income inequality are creating increased demand for homes at the high end of the market and less demand for homes in less expensive neighborhoods.

Meanwhile, a lack of demand for homes at the bottom of the market is compounded by the fact that underwater homeowners are clustered in these very markets. These folks, who might have wanted to sell their homes to move for a job or a housing upgrade, are unable to leave their homes because they owe more than their property is worth. This creates a hole in demand for homes in less expensive neighborhoods.

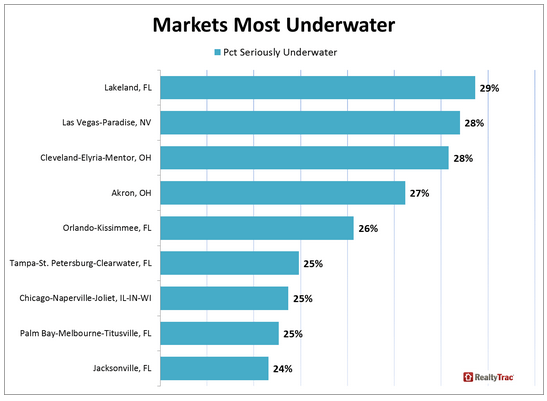

Finally, with income growth remaining tepid, and home values generally at or near their pre-crisis peaks, there is no momentum for further, significant price increases. That means that markets with large shares of underwater homes are likely going to be dealing with the problem for many years to come. Here’s RealtyTrac’s list of the markets with the largest share of underwater homes: