In March, Ukraine’s National Bank reported the country’s annual inflation rate had reached 34.5%, its highest level in more than a decade. That’s a brutal number by any standard, but the reality is much, much worse.

Steve Hanke, a professor of applied economics at Johns Hopkins and director of the Cato Institute’s Troubled Currencies Project, estimates the inflation rate in the post-revolution nation is actually about 133%, or four times the official number. That puts Ukraine in league with war-torn Syria and world-inflation leader Venezuela on Cato’s Troubled Currencies list—countries whose citizens have lost faith in their money.

In countries with currency woes, it’s typical for official inflation numbers to bear little resemblance to real inflation, or what Hanke calls “implied inflation,” calculated using black-market exchange rates. In Venezuela where implied annual inflation is 271%, the official number is 64%. In Syria, where the implied rate is 59%, the official rate is –3.7%. Estimates diverge because measurements tend to lag reality, official inflation is suppressed by price controls, and governments have been known to rig the data.

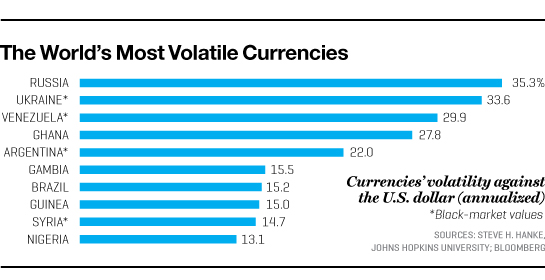

Hanke says there are two telltale signs of a currency in crisis: a booming black market and high volatility. Volatility has been on the rise globally (see chart) because of fluctuation in the dollar-euro rate—which Hanke calls the most important number in global economics. The rapid rise of the dollar relative to the euro has triggered selloffs of emerging- markets currencies and skewed commodity prices. Until there’s greater stability there, expect more cash under mattresses.

This story is from the April 1, 2015 issue of Fortune.

Watch more business news from Fortune: