Investment bankers used to rule the world. Now J.P. Morgan chief Jamie Dimon has to explain to investors why the bank is even in that business anymore. (It’s still a service that clients need, he said during a call in January.)

How times have changed. Over the past year the indignities mounted for banks’ onetime profit centers. The leading person to succeed Dimon at J.P. Morgan, Gordon Smith, runs consumer banking. Swiss giant Credit Suisse’s new CEO comes from insurance. Many large European banks are getting out of investment banking completely. And the ultimate insult: Wells Fargo and U.S. Bank, once derided for sticking to straight lending, are now more profitable than lords of finance Goldman Sachs and Morgan Stanley.

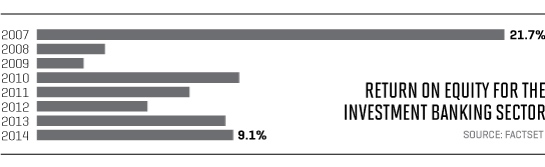

The irony is that these should be good times for Wall Street. Mergers and IPOs are back. Stock indexes are at all-time highs. Activist investors are launching hostile takeovers. And yet the Street’s profit machine seems broken. The average bank has a return on equity of 8% these days, down from 18% before the financial crisis, according to RBC Capital Markets. Much of the drop has been in investment banking.

Regulation has a lot to do with that, pushing the big banks out of Wall Street’s most profitable (and riskiest) businesses. Leverage has long been key to big investment-banking profits, but new capital rules and stress tests make it hard for the big banks to borrow. Low interest rates and never-ending lawsuits haven’t helped.

Just after the crisis, bankers’ malaise seemed temporary. Seven years later the famed $20 million bonus checks have vanished, but there is no shortage of work to do, and the Street is losing faith. Rik Kopelan, a top Wall Street recruiter, says it’s hard to find people who want to switch firms. The only move people want to make is out of finance. More may go the way of one senior Bank of America investment banker who recently fled his once-coveted perch: He’s headed to a nonprofit.

This story is from the April 1, 2015 issue of Fortune.