It’s easy to understand why international expansion is tempting for retailers eager for hot markets to sustain their growth rates.

Target (TGT) thought the same in 2011 when it bought store leases from a dying Canadian discount chain as a quick way to open 124 stores in its first international market, one where archrival Wal-Mart Stores (WMT) gets $20 billion a year in sales. But as Target learned, international markets can be very tough to crack, even Canada, a market supposedly very similar to the United States. Target has announced it is exiting Canada and taking a $5.4 billion write down on a business which has also incurred more than $2 billion in operating losses, to better focus on its home market.

Other retailers, American and international, have also followed the yellow brick road abroad only to exit after the going was tough.

Here are just a few of the many examples of retailers exiting from once-promising markets in recent years.

1 Best Buy exits China a year after pulling out of Europe (2014)

Best Buy (BBY) announced in December it would sell its struggling China operation, Five Star, to a domestic real estate firm so it could better focus on North America, still by far its biggest market. Best Buy had struggled with local competition in a crowded market that nonetheless had been generating about 4% of sales. A year earlier, Best Buy had left Europe when it sold its stake in Carphone Warehouse Group, losing half of its initial investment. And it 2011, it had closed 11 Best Buy stores in China.

2 Home Depot exits China (2012)

Home Depot (HD) made a rare stumble when it entered the Chinese market in 2006 by buying 12 local stores, underestimating how much cheap labor made 'do-it-yourself' skills less important for home improvement in that country. So in 2012, the retailer decided to cut its losses and close its seven remaining big-box stores. The retailer ended up taking a $160 million write down.

3 Office Depot says adios to Mexico in 2013

Office Depot (ODP) said in June 2013 that it would sell off its half of a Mexican joint venture to Grupo Gigante for some $690.2 million, after facing pressure from an activist investor to exit the business. The venture operated almost 250 stores in Mexico and Central America, with sales exceeding $1 billion.

4 Wal-Mart exits Germany (2006)

Wal-Mart Stores (WMT) had hoped Germany would give it a toehold in continental Europe but in 2006, after eight years of trying, it found itself unable to make a profit in the continent's biggest economy. The discount retailer said it would sell its German operations to rival German retailer Metro. At the time, Wal-Mart said it expected to incur a pretax loss of $1 billion on the deal.

5 Tesco exits U.S (2013)

Tesco, the gigantic British supermarket chain embroiled in an accounting controversy, threw in the towel in 2013 on its efforts to finally succeed in the U.S. by selling most of its Fresh & Easy chain to Yucaipa, an investment company owned by American supermarket billionaire Ron Burkle. The moved ended a six-year foray into the U.S. he world's third-largest retailer built Fresh & Easy from scratch, but never managed to make a profit. A year earlier, Tesco had exited Japan.

6 Carrefour leaves India

The French retailer, world's second largest after Wal-Mart, said last summer it would shut down its operations in India less than four years after opening its first store in the country. It was the latest departure from underperforming markets so Carrefour could focus on Europe, China and Brazil. Carrefour had operated five "cash-and-carry wholesale stores" aimed at professional customers in India.

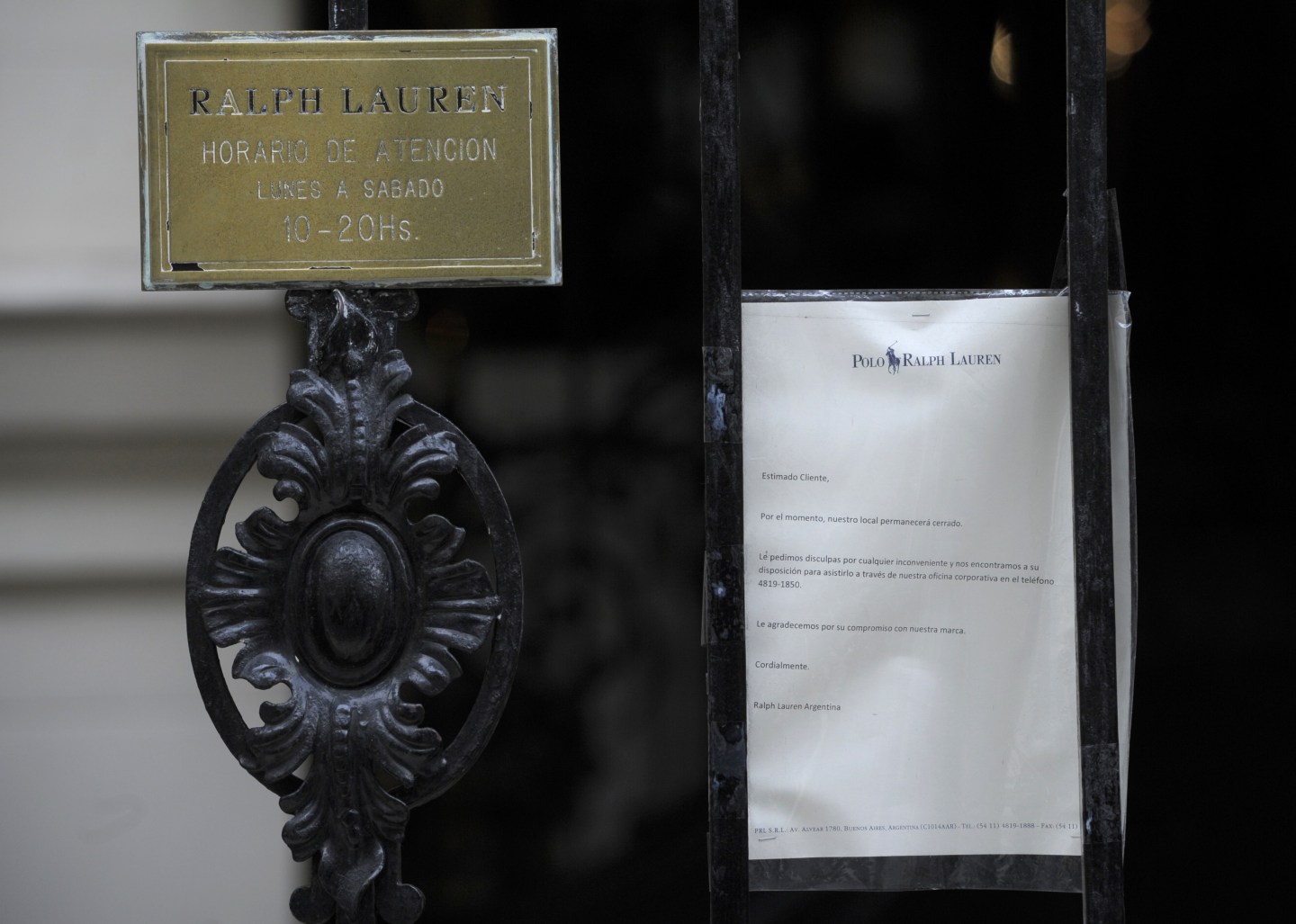

7 Ralph Lauren exits Argentina (2012)

Ralph Lauren (RL) exited Argentina in 2012 after 13 years, closing a Buenos Aires flagship and two other stores as the retailer founded itself encumbered by import barriers, restrictive red tape, currency troubles and a big drop in tourism to that country. Ralph Lauren's move came as other luxury brands headed for the Argentinean exits—Yves Saint-Laurent left that year too after 30 years in the South American country.

But there may have been other considerations. A year later, in 2013, Ralph Lauren agreed to pay about $1.6 million to resolve charges under the U.S. Foreign Corrupt Practices Act that the fashion company had made payments and gave gifts to foreign officials—including perfume, dresses and handbags—between 2005 and 2009 that amounted to bribes.

8 Borders bookstores says ta-ta to Britain (2007)

The now-defunct U.S. bookstore chain Borders had made a foray into Britain in a vain attempt to build a trans-Atlantic empire. But by 2007, as sales were starting to weaken at home, it decided to exit its biggest major international market, where it had come in 1998 and bought a local chain, eventually operating 42 Borders superstores there. Borders soon after got out of other international markets, including Australia, and ultimately went out of business in the U.S. in 2011.

9 New Look says 'Do svidaniya' to Russia

British fashion retailer New Look said in November it had exited Russia and Ukraine because of political uncertainty there, months after saying it would put a planned expansion in the once-promising Russian market on hold. “All retailers are having an extremely tough time in Russia, not just in clothing,” Anders Kristiansen, chief executive of New Look, told the Financial Times.

10 Out of Venezuela for Clorox

Consumer brands have also exited some countries. Clorox (CLX) said in September it was leaving Venezuela because inflation and government-mandated price freezes prevented it from making a profit. Struggling beauty company Avon Products (AVP) has in recent years left markets such as South Korea and Ireland to shore up its business in more promising markets.