So you’ve got a successful technology company, and now you’re poised to go public. What bank should carry out the deal? It turns out at least a few prominent venture capitalists and corporate executives in Silicon Valley are divided on the approach. Some prefer a big brand name and others believe in boutique. The question is not so much whether or not to go public, but how.

VCs like Bill Gurley, a partner at Benchmark Capitol, and Doug Leone, a partner at Sequoia Capitol, are among those who champion smaller firms in leading tech companies through the harrowing initial public offering process. “I’d rather have a much more engaged smaller firm than be the fifth deal of that week for Morgan and Goldman,” said Leone, speaking at an event last week in Menlo Park, Calif., and referring to the Wall Street juggernauts Morgan Stanley (MS) and Goldman Sachs (GS).

Indeed, the big name banks like Morgan Stanley and Goldman Sachs have been busy in Silicon Valley. They’ve steered through just about all the high-profile tech IPOs of late, from those of social gaming outfit Zynga (ZNGA) to local business review aggregator Yelp (YELP). But the Wall Street giants hit the mother lode as underwriters for Facebook’s forthcoming deal and its expected multi-billion dollar offering, one of the highest tech IPOs in history.

MORE: How HTC can fight back

The difference in size is the difference between a bank that may have become complacent and one that is still hungry, the VCs said. “I think some of the non-Goldman and Morgan guys will jump higher, work harder, go faster and be more responsive,” said Bill Gurley, speaking at the same event, hosted by the advisory firm Wealthfront. Speakers were reluctant to name whom these lesser-known banks could be.

But more than anything, the VCs stressed trust as a key factor in the “bookbuilding” process that leads to a company’s market debut. “You need to make sure that whoever is your banker has your back,” said Gurley. That’s been one of the common knocks against Google’s (GOOG) milestone IPO in 2004, which was considered to be modestly successful. The company had boutique firm WR Hambrecht administrate a “Dutch” Internet auction, in which the company determined price based on online bids. But brand names Morgan Stanley and Credit Suisse (CS) were the main underwriters, and some believe those banks were weary of a blockbuster debut, in fear of hurting themselves in the long run.

Still, for some executives at the event, the image of stability and recognition is a major selling point in the decision to choose a big name bank. “It’s hard to do a small IPO and get any interest by people,” said Ken Goldman, CFO of the network security company Fortinet (FTNT). “Investors do look at the quality of some of the larger banks and that does help you go public. That’s just the way the world is. Branding matters.”

MORE: Why Path is holding out on ads for now

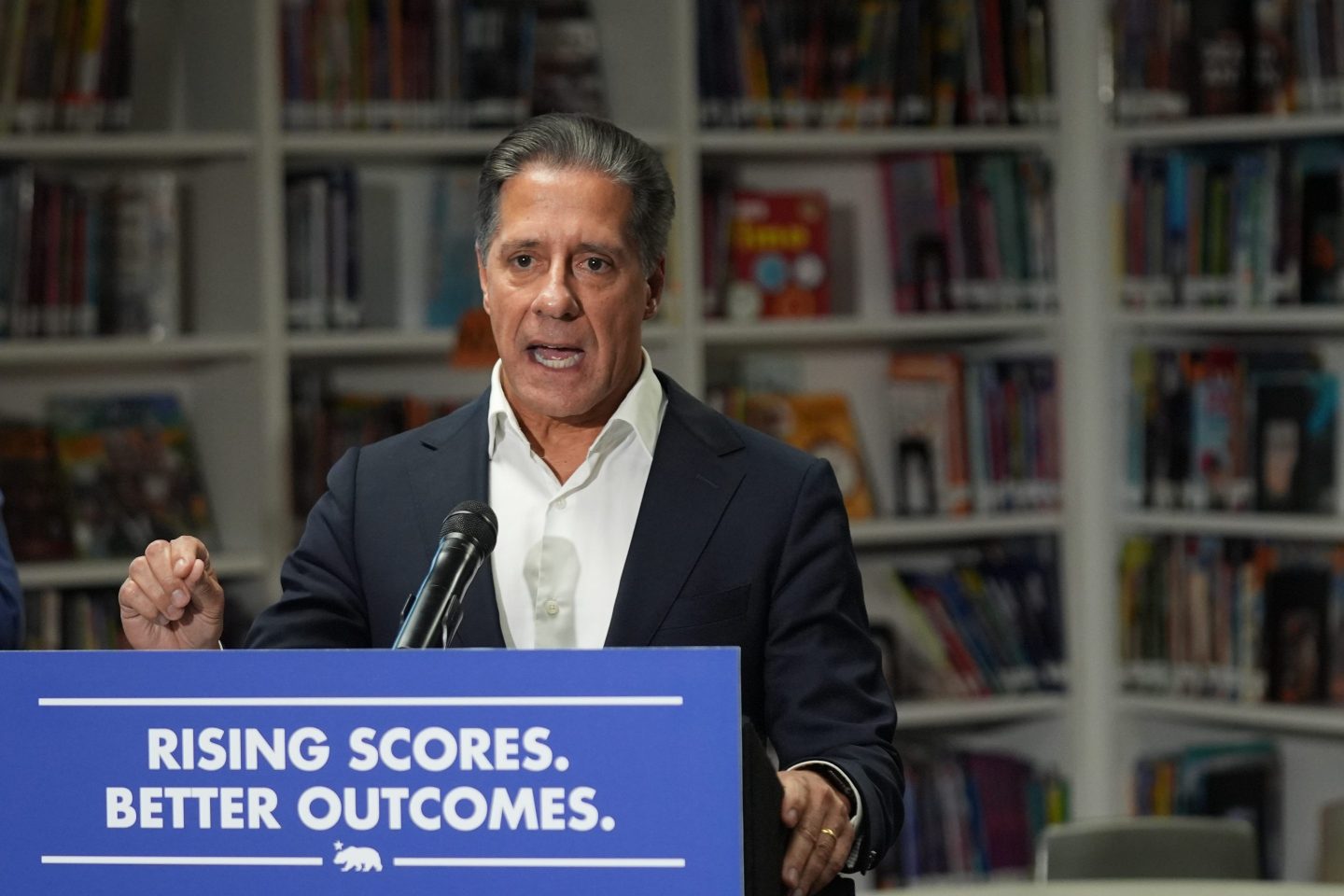

Tony Zingale — whose enterprise social networking company Jive (JIVE) went public in December with a successful debut — agreed. “Little known secret: the big brands are working up and down Sand Hill Road all day long as well because they know this discussion is going to come up in the boardroom,” said Zingale.

Letting the boutique banks drive would be a return to the Valley’s roots. In the 1980s and 1990s the smaller banks got their pick in part because the Wall Street heavyweights just weren’t paying attention yet, but also in part due to preference. “It was an environment where small firms that don’t exist anymore dominated,” said legendary banking veteran Frank Quattrone, co-founder of corporate advising firm Qatalyst Group. “They were the ones that the VCs and CEOs trusted to get deals done,” said Quattrone during the event, mentioning now defunct firms like Robertson Coleman and Stephens and L.F. Rothschild.

But regardless of big or small bank, Facebook’s (and they chose big banks) IPO will be the one deal that will have a profound influence on the tech IPO climate for the next several years because of the billions Facebook will horde from the IPO market. Said Quattrone: “It is so important that this deal does well.”